Should You Be Tempted To Sell Skandinaviska Enskilda Banken AB (publ.) (STO:SEB A) Because Of Its P/E Ratio?

Today, we'll introduce the concept of the P/E ratio for those who are learning about investing. We'll apply a basic P/E ratio analysis to Skandinaviska Enskilda Banken AB (publ.)'s (STO:SEB A), to help you decide if the stock is worth further research. Skandinaviska Enskilda Banken AB (publ.) has a P/E ratio of 9.55, based on the last twelve months. In other words, at today's prices, investors are paying SEK9.55 for every SEK1 in prior year profit.

Check out our latest analysis for Skandinaviska Enskilda Banken AB (publ.)

How Do I Calculate Skandinaviska Enskilda Banken AB (publ.)'s Price To Earnings Ratio?

The formula for P/E is:

Price to Earnings Ratio = Price per Share ÷ Earnings per Share (EPS)

Or for Skandinaviska Enskilda Banken AB (publ.):

P/E of 9.55 = SEK78.820 ÷ SEK8.256 (Based on the trailing twelve months to March 2020.)

(Note: the above calculation results may not be precise due to rounding.)

Is A High P/E Ratio Good?

A higher P/E ratio means that buyers have to pay a higher price for each SEK1 the company has earned over the last year. That isn't a good or a bad thing on its own, but a high P/E means that buyers have a higher opinion of the business's prospects, relative to stocks with a lower P/E.

Does Skandinaviska Enskilda Banken AB (publ.) Have A Relatively High Or Low P/E For Its Industry?

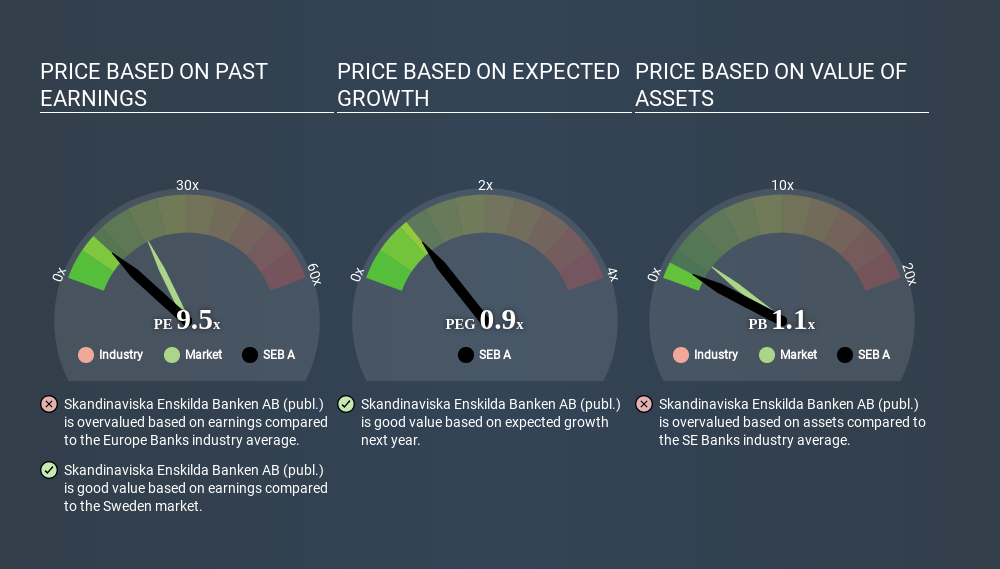

The P/E ratio essentially measures market expectations of a company. You can see in the image below that the average P/E (8.9) for companies in the banks industry is lower than Skandinaviska Enskilda Banken AB (publ.)'s P/E.

That means that the market expects Skandinaviska Enskilda Banken AB (publ.) will outperform other companies in its industry. Shareholders are clearly optimistic, but the future is always uncertain. So further research is always essential. I often monitor director buying and selling.

How Growth Rates Impact P/E Ratios

P/E ratios primarily reflect market expectations around earnings growth rates. When earnings grow, the 'E' increases, over time. That means even if the current P/E is high, it will reduce over time if the share price stays flat. So while a stock may look expensive based on past earnings, it could be cheap based on future earnings.

Skandinaviska Enskilda Banken AB (publ.) saw earnings per share decrease by 25% last year. But it has grown its earnings per share by 1.4% per year over the last three years. And EPS is down 2.0% a year, over the last 5 years. This might lead to muted expectations.

Don't Forget: The P/E Does Not Account For Debt or Bank Deposits

Don't forget that the P/E ratio considers market capitalization. Thus, the metric does not reflect cash or debt held by the company. The exact same company would hypothetically deserve a higher P/E ratio if it had a strong balance sheet, than if it had a weak one with lots of debt, because a cashed up company can spend on growth.

Such expenditure might be good or bad, in the long term, but the point here is that the balance sheet is not reflected by this ratio.

So What Does Skandinaviska Enskilda Banken AB (publ.)'s Balance Sheet Tell Us?

Net debt totals a substantial 234% of Skandinaviska Enskilda Banken AB (publ.)'s market cap. This is a relatively high level of debt, so the stock probably deserves a relatively low P/E ratio. Keep that in mind when comparing it to other companies.

The Verdict On Skandinaviska Enskilda Banken AB (publ.)'s P/E Ratio

Skandinaviska Enskilda Banken AB (publ.) trades on a P/E ratio of 9.5, which is below the SE market average of 18.5. When you consider that the company has significant debt, and didn't grow EPS last year, it isn't surprising that the market has muted expectations.

Investors have an opportunity when market expectations about a stock are wrong. As value investor Benjamin Graham famously said, 'In the short run, the market is a voting machine but in the long run, it is a weighing machine. So this free report on the analyst consensus forecasts could help you make a master move on this stock.

You might be able to find a better buy than Skandinaviska Enskilda Banken AB (publ.). If you want a selection of possible winners, check out this free list of interesting companies that trade on a P/E below 20 (but have proven they can grow earnings).

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About OM:SEB A

Skandinaviska Enskilda Banken

Provides corporate, retail, investment, and private banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)