- United States

- /

- Transportation

- /

- NYSE:XPO

Should XPO Logistics (NYSE:XPO) Be Disappointed With Their 64% Profit?

When we invest, we're generally looking for stocks that outperform the market average. Buying under-rated businesses is one path to excess returns. To wit, the XPO Logistics share price has climbed 64% in five years, easily topping the market return of 35% (ignoring dividends).

See our latest analysis for XPO Logistics

To paraphrase Benjamin Graham: Over the short term the market is a voting machine, but over the long term it's a weighing machine. One imperfect but simple way to consider how the market perception of a company has shifted is to compare the change in the earnings per share (EPS) with the share price movement.

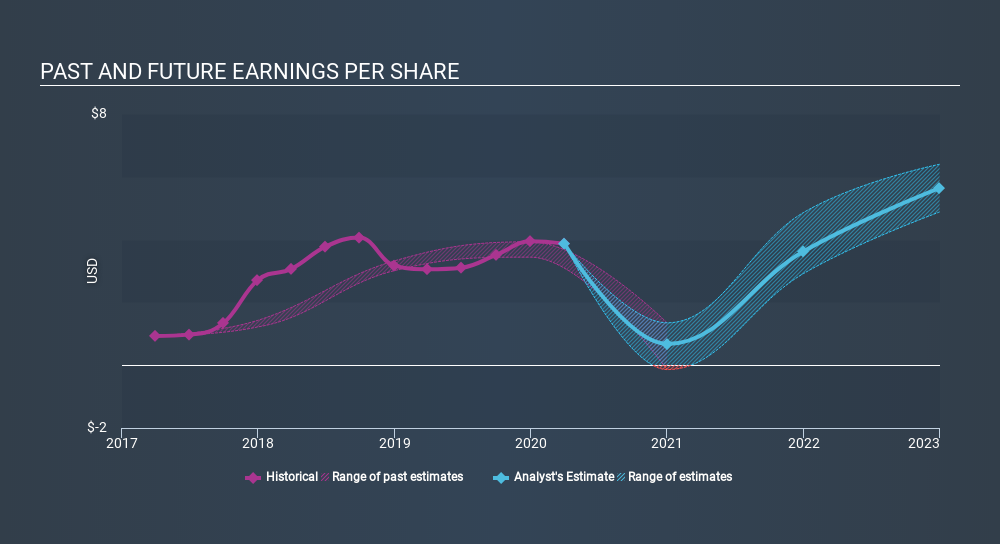

During the five years of share price growth, XPO Logistics moved from a loss to profitability. That's generally thought to be a genuine positive, so we would expect to see an increasing share price. Given that the company made a profit three years ago, but not five years ago, it is worth looking at the share price returns over the last three years, too. Indeed, the XPO Logistics share price has gained 54% in three years. Meanwhile, EPS is up 61% per year. This EPS growth is higher than the 15% average annual increase in the share price over the same three years. Therefore, it seems the market has moderated its expectations for growth, somewhat.

You can see below how EPS has changed over time (discover the exact values by clicking on the image).

It's good to see that there was some significant insider buying in the last three months. That's a positive. On the other hand, we think the revenue and earnings trends are much more meaningful measures of the business. It might be well worthwhile taking a look at our free report on XPO Logistics's earnings, revenue and cash flow.

A Different Perspective

We're pleased to report that XPO Logistics shareholders have received a total shareholder return of 53% over one year. That's better than the annualised return of 10% over half a decade, implying that the company is doing better recently. In the best case scenario, this may hint at some real business momentum, implying that now could be a great time to delve deeper. While it is well worth considering the different impacts that market conditions can have on the share price, there are other factors that are even more important. Consider for instance, the ever-present spectre of investment risk. We've identified 2 warning signs with XPO Logistics (at least 1 which shouldn't be ignored) , and understanding them should be part of your investment process.

If you like to buy stocks alongside management, then you might just love this free list of companies. (Hint: insiders have been buying them).

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on US exchanges.

Love or hate this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned. Thank you for reading.

About NYSE:XPO

XPO

Provides freight transportation services in the United States, North America, France, the United Kingdom, and rest of Europe.

Solid track record with adequate balance sheet.

Market Insights

Community Narratives