Should DiGiSPICE Technologies Limited (NSE:DIGISPICE) Be Part Of Your Dividend Portfolio?

Is DiGiSPICE Technologies Limited (NSE:DIGISPICE) a good dividend stock? How can we tell? Dividend paying companies with growing earnings can be highly rewarding in the long term. If you are hoping to live on your dividends, it's important to be more stringent with your investments than the average punter. Regular readers know we like to apply the same approach to each dividend stock, and we hope you'll find our analysis useful.

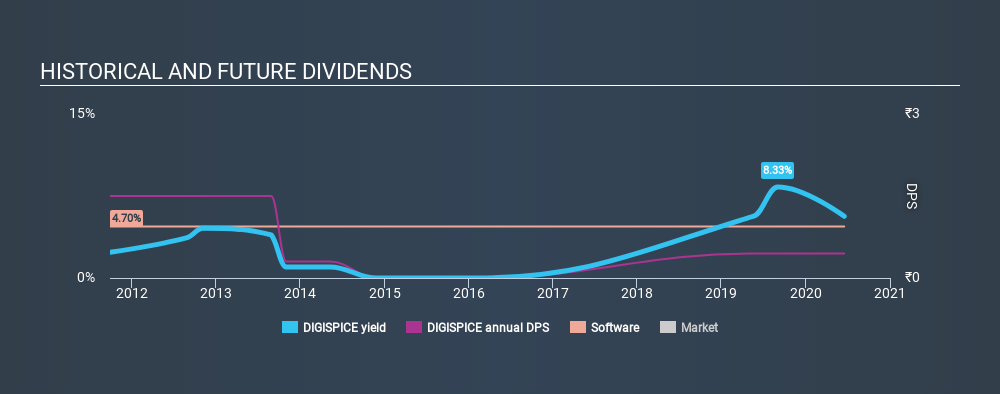

With a goodly-sized dividend yield despite a relatively short payment history, investors might be wondering if DiGiSPICE Technologies is a new dividend aristocrat in the making. We'd agree the yield does look enticing. Remember though, due to the recent spike in its share price, DiGiSPICE Technologies's yield will look lower, even though the market may now be factoring in an improvement in its long-term prospects. There are a few simple ways to reduce the risks of buying DiGiSPICE Technologies for its dividend, and we'll go through these below.

Click the interactive chart for our full dividend analysis

Payout ratios

Dividends are usually paid out of company earnings. If a company is paying more than it earns, then the dividend might become unsustainable - hardly an ideal situation. So we need to form a view on if a company's dividend is sustainable, relative to its net profit after tax. While DiGiSPICE Technologies pays a dividend, it reported a loss over the last year. When a company is loss-making, we next need to check to see if its cash flows can support the dividend.

DiGiSPICE Technologies paid out a conservative 28% of its free cash flow as dividends last year.

With a strong net cash balance, DiGiSPICE Technologies investors may not have much to worry about in the near term from a dividend perspective.

Consider getting our latest analysis on DiGiSPICE Technologies's financial position here.

Dividend Volatility

Before buying a stock for its income, we want to see if the dividends have been stable in the past, and if the company has a track record of maintaining its dividend. The first recorded dividend for DiGiSPICE Technologies, in the last decade, was nine years ago. Although it has been paying a dividend for several years now, the dividend has been cut at least once, and we're cautious about the consistency of its dividend across a full economic cycle. During the past nine-year period, the first annual payment was ₹1.50 in 2011, compared to ₹0.45 last year. Dividend payments have fallen sharply, down 70% over that time.

When a company's per-share dividend falls we question if this reflects poorly on either external business conditions, or the company's capital allocation decisions. Either way, we find it hard to get excited about a company with a declining dividend.

Dividend Growth Potential

With a relatively unstable dividend, and a poor history of shrinking dividends, it's even more important to see if EPS are growing. It's good to see DiGiSPICE Technologies has been growing its earnings per share at 64% a year over the past five years.

Conclusion

To summarise, shareholders should always check that DiGiSPICE Technologies's dividends are affordable, that its dividend payments are relatively stable, and that it has decent prospects for growing its earnings and dividend. We're not keen on the fact that DiGiSPICE Technologies paid dividends despite reporting a loss over the past year, although fortunately its dividend was covered by cash flow. Next, earnings growth has been good, but unfortunately the dividend has been cut at least once in the past. Ultimately, DiGiSPICE Technologies comes up short on our dividend analysis. It's not that we think it is a bad company - just that there are likely more appealing dividend prospects out there on this analysis.

Investors generally tend to favour companies with a consistent, stable dividend policy as opposed to those operating an irregular one. At the same time, there are other factors our readers should be conscious of before pouring capital into a stock. As an example, we've identified 3 warning signs for DiGiSPICE Technologies that you should be aware of before investing.

If you are a dividend investor, you might also want to look at our curated list of dividend stocks yielding above 3%.

If you’re looking to trade DiGiSPICE Technologies, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account.Promoted

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:DIGISPICE

DiGiSPICE Technologies

Engages in the provision of tech-enabled local payments network services in India and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)