- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S) Partners With Schwarz Digits For AI Cybersecurity In Europe

Reviewed by Simply Wall St

SentinelOne (S) announced a partnership with Schwarz Digits, aiming to provide an AI-powered cybersecurity platform for the European market. Despite a 5% share price increase over the past month, multiple factors played a role. This strategic alliance could have bolstered investor sentiment, aligning with the overall upward trend observed in major indexes recently. Furthermore, the tech sector's general rise, amidst expectations of a Federal Reserve rate cut, could also have supported the company's stock performance. While these developments may have aided the price movement, they were in line with broader market behaviors, suggesting a general market influence.

The recent partnership between SentinelOne and Schwarz Digits is poised to impact the company's growth narrative positively. This collaboration is expected to bolster SentinelOne's AI-driven cybersecurity platform in Europe, potentially expanding its market reach and enhancing revenue prospects. The new alliance aligns with the company's ongoing strategy to leverage international growth and strategic partnerships to drive higher operating leverage and diversified revenue streams, despite potential risks from regulatory complexities and industry consolidation.

Over the past year, SentinelOne's total shareholder return was a decline of 20.53%. This performance contrasts with the broader market trends, as the company's stock underperformed both the US Software industry and the US market, which returned 28% and 19.5%, respectively. This lag in performance highlights challenges in maintaining competitive positioning amidst favorable broader industry and economic conditions.

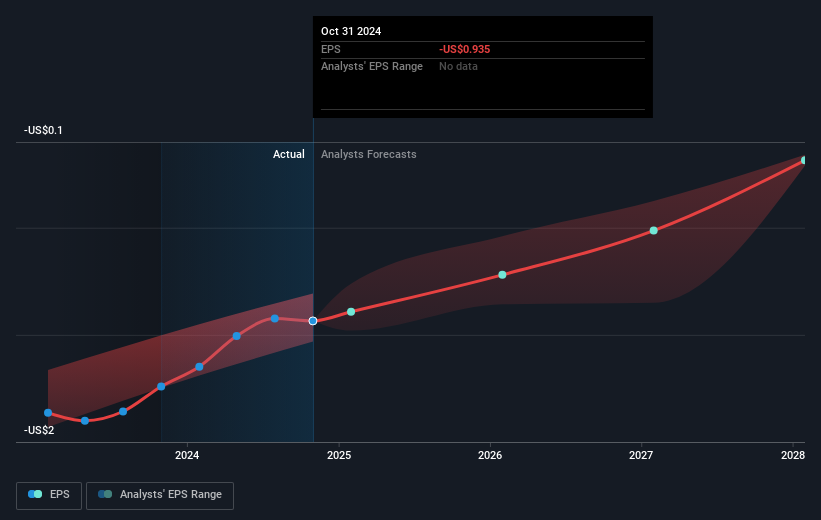

The recent announcement could influence revenue and earnings forecasts by enhancing SentinelOne's competitive edge through innovative AI and cybersecurity solutions. Analysts forecast revenue growth of 15.6% per year, although the company is expected to remain unprofitable in the near term. With the current share price at US$18.15 and a consensus analyst price target of US$23.5, there's an implied upside potential of approximately 29.48%. However, achieving these targets will hinge on the successful integration and expansion into new markets, as well as effective partnerships and innovations.

Understand SentinelOne's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and undervalued.

Similar Companies

Market Insights

Community Narratives