- United States

- /

- Software

- /

- NYSE:S

SentinelOne (S) and Portnox Combine Forces for Enhanced Security Integration

Reviewed by Simply Wall St

SentinelOne (S) saw a price increase of 8% last week, influenced by key developments and broader market trends. A major factor was the announcement of a new integration with Portnox, which aims to enhance cybersecurity with real-time threat detection and dynamic access policies. This move is a significant step in the company's strategy to strengthen zero trust enforcement, and it likely aided the positive sentiment around the stock. This comes amidst generally strong market performance with tech stocks buoying major indices, although job market data and expectations of Federal Reserve rate cuts have presented some economic uncertainty.

SentinelOne has 2 possible red flags we think you should know about.

The recent announcement of SentinelOne's integration with Portnox aims to enhance cybersecurity offerings, potentially accelerating both revenue and earnings forecasts. By strengthening its position in zero trust enforcement, SentinelOne is likely to attract more enterprise customers seeking integrated AI-native security solutions. This move could contribute to improved net margins by reducing operational costs and boosting revenue through channel partnerships with players like Lenovo and managed service providers.

Over the last year, SentinelOne's total shareholder return was a decline of 22.64%. This longer-term perspective suggests that while the company's recent price increase is encouraging, challenges remain. In comparison, over the same period, the company underperformed relative to the US Software industry, which had a 27.3% increase, and the broader US market, which returned 17.5%. Investors may find this context crucial as they evaluate the stock's comeback potentials and reliability in future earnings.

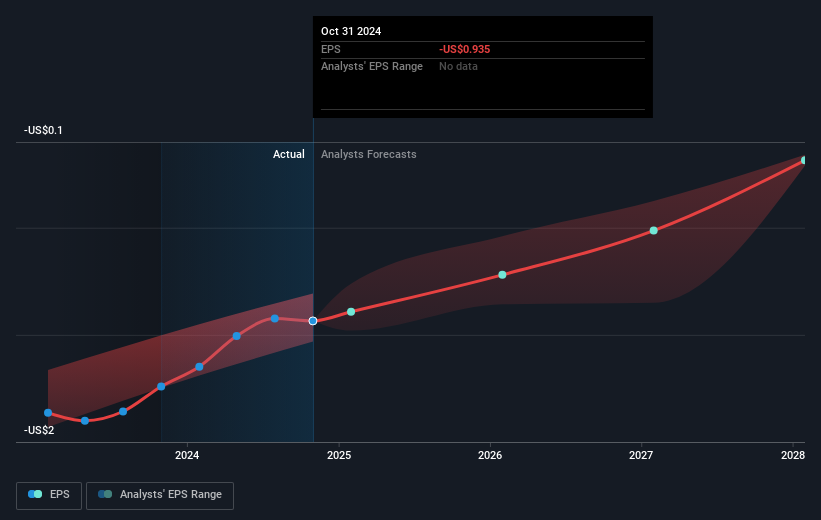

The recent share price movement, pushing the stock to $17.70, places it at a discount to the consensus analyst price target of $23.50, suggesting room for upward movement should the integration deliver as expected. However, caution is advised given economic uncertainties. As the company continues its transition to an AI-native platform and phases out legacy products, its ability to stabilize earnings remains a point of interest for analysts projecting revenue growth. With analysts forecasting significant revenue increase and expecting the stock to rise by 32.8%, ongoing scrutiny will be key for investors engaging with SentinelOne's investment profile.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:S

SentinelOne

Operates as a cybersecurity provider in the United States and internationally.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Community Narratives