- United States

- /

- Software

- /

- NYSE:CRM

Salesforce (CRM) Declares US$0.42 Dividend; Smarsh Enhances AI Services With Agentforce

Reviewed by Simply Wall St

Salesforce (CRM) recently announced the deployment of its Agentforce to enhance AI-driven customer service for Smarsh, alongside affirming a quarterly dividend of $0.416 per share. Over the past month, Salesforce's stock experienced a slight 1.41% decline amidst a backdrop of broader market fluctuations, including a slight dip in major indices like the Dow Jones and Nasdaq following mixed job market data and anticipation of potential interest rate cuts by the Federal Reserve. Salesforce's positive earnings report and strategic collaborations likely contributed positively but were counterbalanced by the prevailing market concerns and trends.

Buy, Hold or Sell Salesforce? View our complete analysis and fair value estimate and you decide.

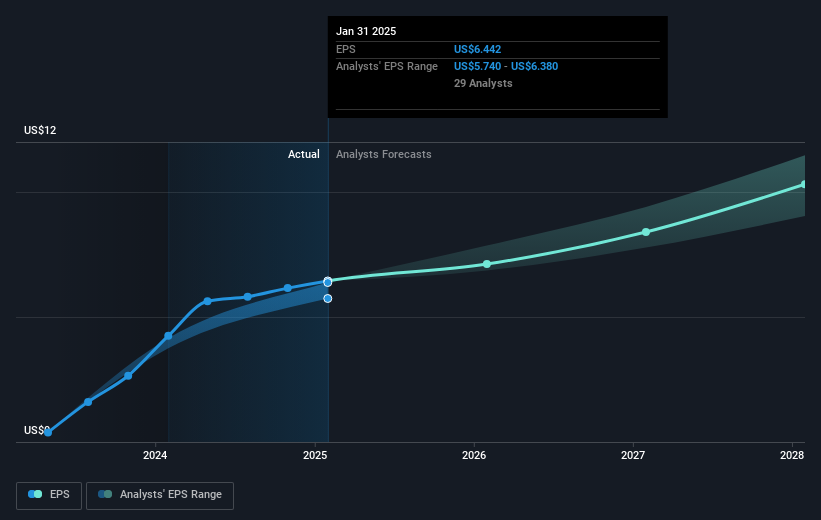

The recent announcement from Salesforce regarding its partnership with Smarsh to deploy Agentforce AI-driven customer service, coupled with the quarterly dividend affirmation, aligns with the ongoing AI and automation narrative propelling the company forward. While the share price experienced a 1.41% decline recently, it’s essential to consider the broader context of Salesforce's performance. Over the last three years, Salesforce's total return, including dividends, was 56.88%, highlighting substantial growth despite recent fluctuations. Over the past year, however, Salesforce has underperformed the US Software industry, which returned 28% compared to Salesforce's lesser performance.

The implementation of AI technologies is expected to bolster Salesforce's future revenue and earnings projections by enhancing customer retention and sales productivity, particularly within mid-market and SMB segments. Such innovations could drive revenue and earnings beyond the current figures of US$39.50 billion and US$6.66 billion respectively, offering a path for potential growth. Despite the recent share price standing at US$244.01, analysts maintain a consensus price target of US$336.19, signaling potential upside. However, it's significant to weigh these projections against existing challenges, such as increased competition and regulatory pressures, which could impact these forecasts.

Understand Salesforce's earnings outlook by examining our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CRM

Salesforce

Provides customer relationship management (CRM) technology that connects companies and customers together worldwide.

Excellent balance sheet and good value.

Similar Companies

Market Insights

Community Narratives