Rusta (OM:RUSTA) Q1 Earnings Show Modest Sales Increase But Lower Net Income

Reviewed by Simply Wall St

Rusta (OM:RUSTA) experienced a price move of 8% over the last week, coinciding with its first-quarter earnings announcement. Despite a 3% rise in sales to SEK 3,174 million, the company's net income and earnings per share decreased, reflecting potential profitability challenges. This earnings release comes at a time when major U.S. stock indexes, including the Dow Jones and S&P 500, have reached record highs, bolstered by investor optimism over potential near-term interest rate cuts by the Federal Reserve. Rusta's price movement, therefore, likely reflects both its financial results and the broader market's positive sentiment.

Buy, Hold or Sell Rusta? View our complete analysis and fair value estimate and you decide.

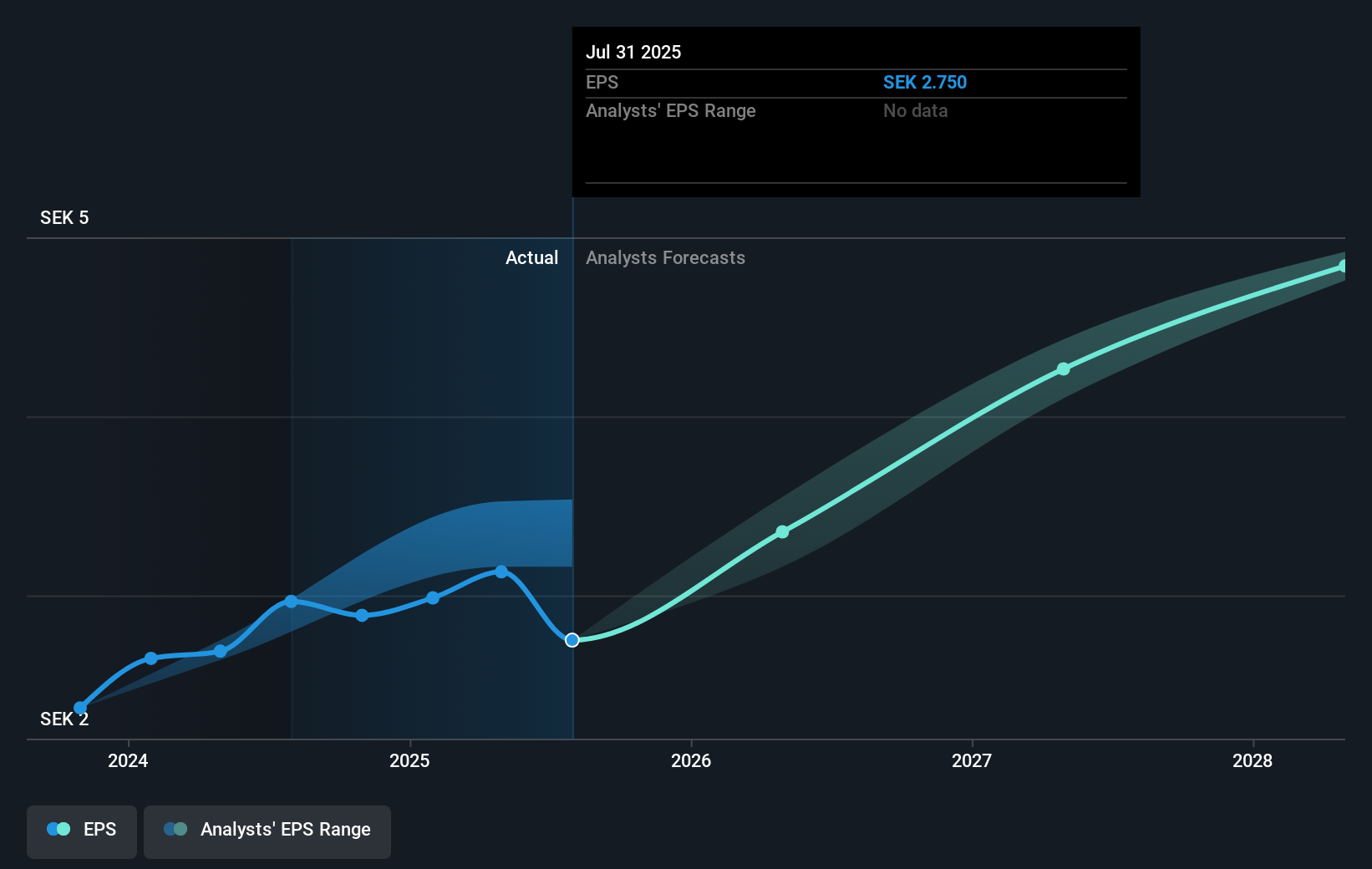

The recent price movement for Rusta, following its earnings announcement, highlights the company's ongoing profitability challenges amid a backdrop of broader market optimism. The net income decline amid a modest sales increase points to issues that could impact future earnings projections, particularly as analysts forecast revenue growth of 9.2% annually over the next three years. This recent earnings release suggests that the company’s future expansion plans and supply chain investments are crucial for meeting these forecasts.

Over the longer term, Rusta's total return, including share price and dividends, was 8.97% over the past year. This compares favorably to the Swedish market return of 0.2% over the same period, indicating strong relative performance. Additionally, Rusta outperformed the Swedish Multiline Retail industry, which experienced a 2.9% decline over the past year, positioning the company well within its sector.

Rusta's current share price of SEK74.00 reflects a 14.86% discount to the consensus analyst price target of SEK85.00. This discount suggests that there is existing market skepticism regarding the company's ability to achieve its projected profitability improvements. The anticipated expansion into new markets, especially Germany, and efforts to optimize store formats and supply chains are expected to enhance net margins and support these projections. However, market conditions such as currency fluctuations and competitive pressures could influence these outcomes.

Get an in-depth perspective on Rusta's performance by reading our balance sheet health report here.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About OM:RUSTA

Rusta

Rusta AB (publ) retails products in home decoration, consumables, seasonal products, leisure, and Do It Yourself (DIY) categories in Sweden, Norway, Finland, and Germany.

Undervalued with solid track record.

Similar Companies

Market Insights

Community Narratives