- United States

- /

- Pharma

- /

- NasdaqGS:RPRX

Royalty Pharma (RPRX) Acquires US$885 Million Royalty Interest In Amgen's Imdelltra

Reviewed by Simply Wall St

Royalty Pharma (RPRX) recently acquired a royalty interest in Amgen's Imdelltra, a move that may have added confidence to investors, contributing to the company's 11% share price increase over the last quarter. This acquisition, along with its royalty sharing arrangements and the drug's anticipated market success, illustrates Royalty Pharma’s strategic business expansion. Concurrently, it saw enhancements in its board composition with new appointments, which might have played a beneficial role in investor perception. While broader market trends showed variability, with tech stocks leading gains and mixed performance in key indices, Royalty Pharma's activities aligned with positive moves in the market.

Be aware that Royalty Pharma is showing 1 possible red flag in our investment analysis.

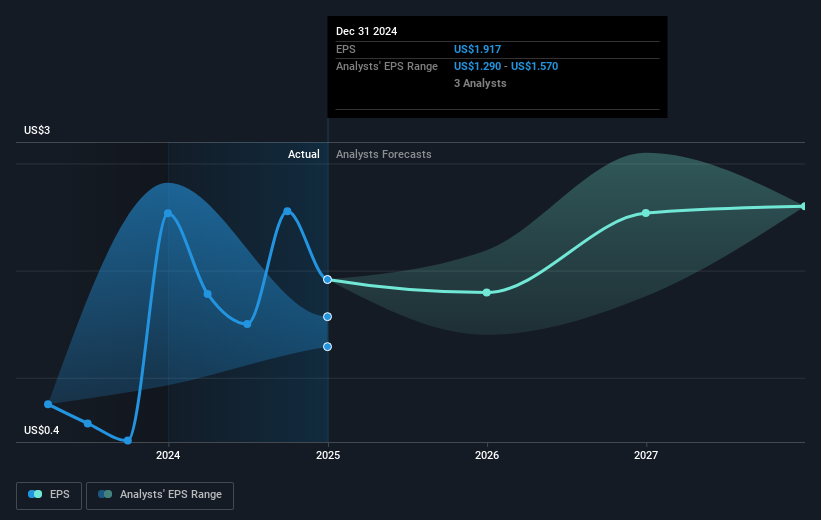

The recent acquisition of a royalty interest in Amgen's Imdelltra could further bolster Royalty Pharma's growth prospects. This move aligns with the narrative focusing on their strategic investments in the biopharmaceutical sector, potentially increasing future revenue streams and supporting long-term earnings forecasts. With the expected rise in demand for innovative therapies, this acquisition positions the company well to capitalize on the expanding market opportunities. Analysts foresee revenue reaching around US$4 billion by August 2028, underlining potential growth driven by such acquisitions and diversified revenue streams.

Over the past year, Royalty Pharma's total return, including share price and dividends, was 31.42%. This performance not only surpasses the broader US Pharmaceuticals industry, which saw a return of negative 12.9% over the same period, but also reflects favorably compared to the U.S. market return of 15.9%. Such robust returns highlight the company's competitive positioning and strategic maneuvers within the sector.

Despite recent positive price movements, shares trading at US$36.32 exhibit a discount to the analyst consensus price target of US$43.27, suggesting potential upside. If realized, ongoing strategic investments and efficient cash reinvestment policies could extend Royalty Pharma's favorable market performance, further aligning its market value with the consensus expectations. However, significant risks remain, and clarity on future earnings will depend on the resolution of legal disputes and management's ability to navigate industry headwinds effectively.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:RPRX

Royalty Pharma

Operates as a buyer of biopharmaceutical royalties and a funder of innovation in the biopharmaceutical industry in the United States.

Undervalued with proven track record.

Market Insights

Community Narratives