- United States

- /

- Hospitality

- /

- NYSE:RCL

Royal Caribbean Cruises (RCL) Reports Strong Earnings Growth With US$1,210 Million Net Income

Reviewed by Simply Wall St

Royal Caribbean Cruises (RCL) showcased a robust second quarter, with revenue rising to $4.5 billion from $4.1 billion year-on-year, and net income climbing to $1.2 billion from $854 million. During the last quarter, RCL's share price surged 63%, driven by strong earnings results that highlighted significant recovery in the cruise industry post-pandemic, as well as dividend affirmations. These positive developments occurred even as broader markets like the S&P 500 and Nasdaq experienced minor retreats amid general earnings announcements and economic speculations. Overall, Royal Caribbean's performance reinforced investor optimism against the backdrop of broader market movements.

Find companies with promising cash flow potential yet trading below their fair value.

The recent surge in Royal Caribbean Cruises' share price by 63% during the last quarter, driven by robust earnings and dividend affirmations, highlights a strong recovery in the cruise industry. Over the longer term, the company's total return of a very large percentage over three years underscores a period of significant growth as it capitalized on enhanced experiences and fleet expansion. In the last year, Royal Caribbean outperformed both the US Market's 17.7% return and the US Hospitality industry's 32.4% return, reflecting investor confidence and robust operational performance.

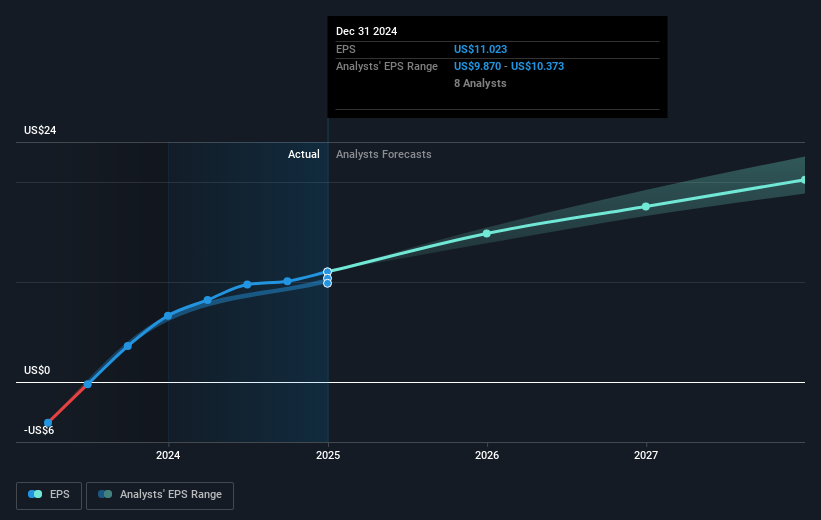

The company's strong revenue and earnings growth in the second quarter, boosted by the introduction of new ships and enhanced onboard experiences, is likely to positively impact future forecasts. Analysts predict revenue growth of 9.3% annually and an increase in profit margins, with earnings expected to reach US$5.7 billion by May 2028. However, the current share price of US$352.00 is above the analyst consensus price target of US$328.42, suggesting potential expectations of future revenue stream adjustments or market reassessments. The discrepancy between the share price and the price target indicates market optimism may need recalibration if fiscal projections aren't met.

Explore Royal Caribbean Cruises' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:RCL

Good value with proven track record.

Similar Companies

Market Insights

Community Narratives