- United States

- /

- Software

- /

- NasdaqCM:RIOT

Riot Platforms (NasdaqCM:RIOT) Expands Credit Facility With Coinbase

Reviewed by Simply Wall St

Riot Platforms (NasdaqCM: RIOT) recently faced a significant shift with its removal from several major indices as of June 28, which could have impacted market perception. However, the company announced a notable increase in bitcoin production in May 2025 and expanded its credit facility with Coinbase, possibly boosting investor confidence. The appointment of Jonathan Gibbs to strengthen their data center capabilities also reflects a firm commitment to growth. Despite being dropped from indices, Riot's 39% price rise over the last quarter aligns relatively well with broader market rallies, suggesting these moves might have supported the upward trend.

Riot Platforms has 3 weaknesses (and 1 which can't be ignored) we think you should know about.

The recent shifts in Riot Platforms' operational focus, marked by the expansion of their Bitcoin production and enhanced data center capabilities under Jonathan Gibbs, could bolster their strategic pivot towards AI and high-performance computing (HPC). This shift may positively impact revenue predictability and net margins, driving a long-term stable revenue stream stemming from AI/HPC contracts. The 39% price rise in the last quarter suggests positive investor sentiment around these developments, despite its removal from key indices. Additionally, the company's expansion of the credit facility with Coinbase might help in mitigating liquidity risks, which could prove crucial amid the high capital expenditures linked to increasing hash rate capacity.

Over the past five years, Riot's shares have achieved a very large total return of 343.28%, revealing substantial long-term growth. However, within the last year, the company's performance was below both the broader US market and the US Software industry, which saw returns of 13.7% and 19.2%, respectively. This indicates a disparity between short-term market response and long-term shareholder gains.

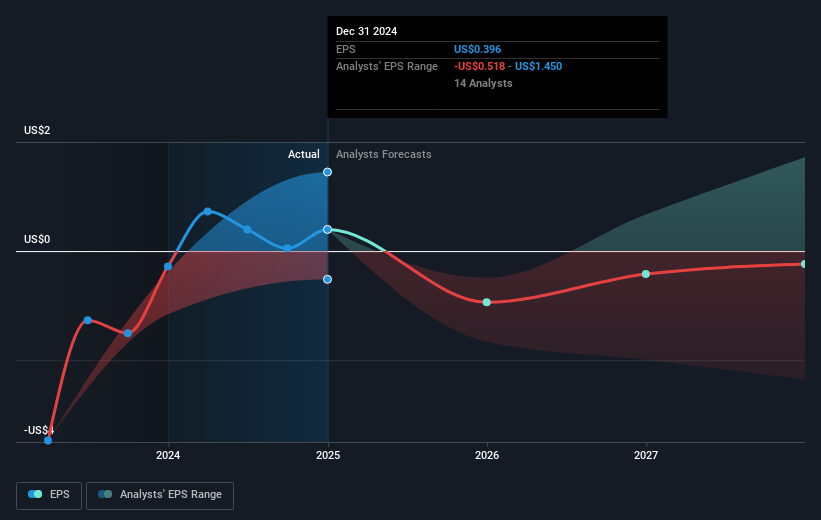

The announcements discussed earlier may spark positive investor sentiment regarding future revenue and earnings forecasts. With a focus on expanding Bitcoin holdings as prices increase, Riot's asset value and earnings could see enhancement. However, it should be noted that analysts forecast continued unprofitability over the next three years, which may dampen expectations. The current share price of $7.42 represents a significant discount of nearly 54% from the analyst consensus price target of $16.1, indicating market skepticism compared to analyst optimism. It's essential to consider these factors when assessing Riot Platforms' potential trajectory.

The valuation report we've compiled suggests that Riot Platforms' current price could be inflated.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:RIOT

Riot Platforms

Operates as a Bitcoin mining company in the United States.

Low with imperfect balance sheet.

Similar Companies

Market Insights

Community Narratives