- United States

- /

- Semiconductors

- /

- NasdaqGS:QCOM

QUALCOMM (QCOM) Appoints New Chief Accounting Officer as Executive Roles Shift

Reviewed by Simply Wall St

QUALCOMM (QCOM) recently experienced a 5% price increase over the last quarter, following significant executive and board changes. These changes included Neil Martin transitioning to lead the company's M&A efforts and Patricia Grech's appointment as Chief Accounting Officer. These leadership shifts, aimed at refining strategic direction, align with the company's robust Q3 earnings report showcasing revenue and net income growth. During this period, broader market dynamics remained flat. While overall market conditions were neutral, QUALCOMM's activities, such as share buybacks and index changes, might have added momentum to its stock performance.

Buy, Hold or Sell QUALCOMM? View our complete analysis and fair value estimate and you decide.

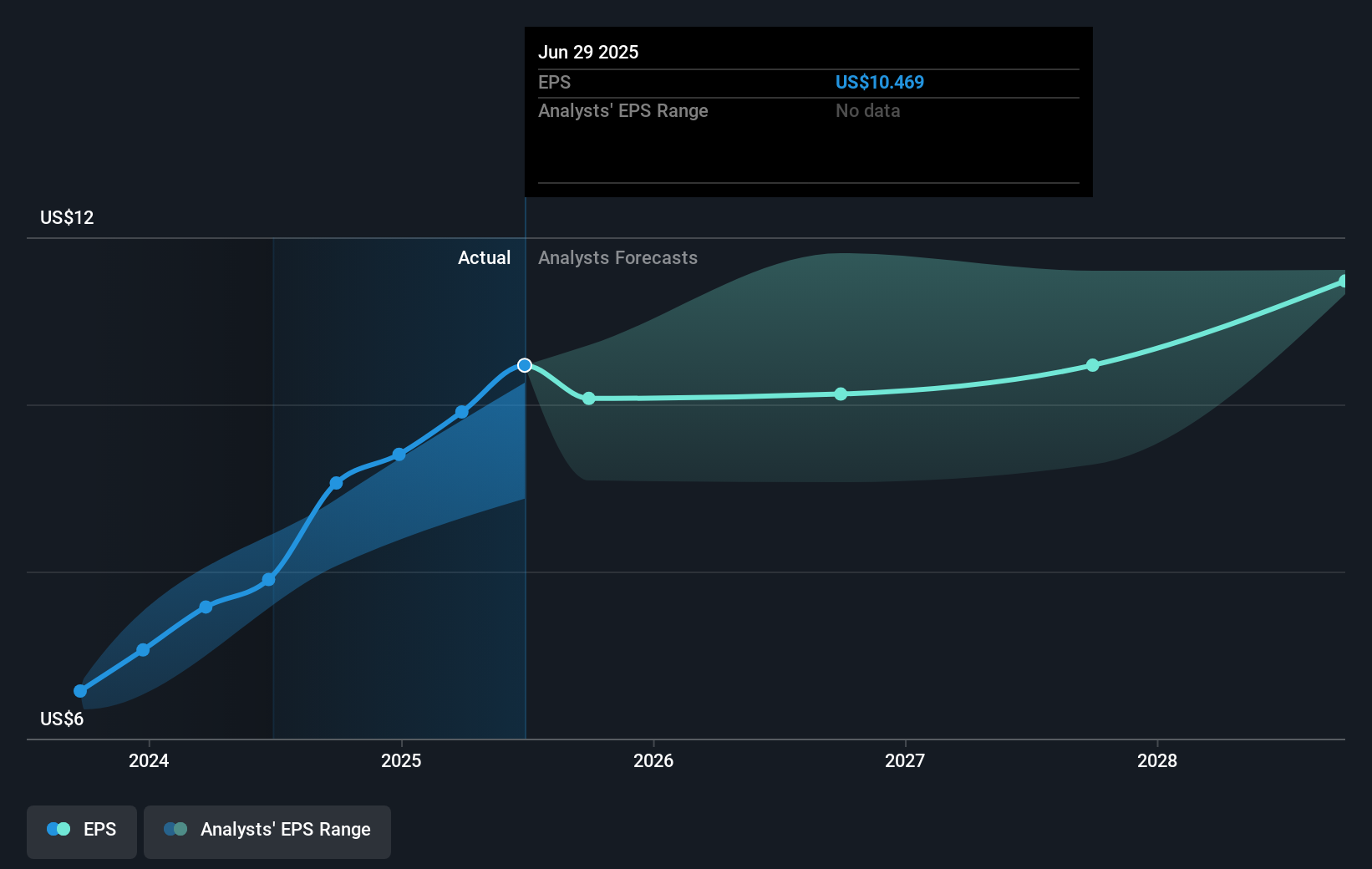

The recent executive changes at QUALCOMM, featuring Neil Martin and Patricia Grech in key roles, may prompt shifts in strategic focus towards mergers and acquisitions and enhanced financial management. These organizational adjustments could further support QUALCOMM’s diversification into AI, automotive, and IoT markets, as mentioned in the narrative. These moves may help stabilize and potentially enhance revenue and earnings forecasts by reducing dependence on the volatile smartphone segment and opening new high-growth avenues in data centers and next-gen connectivity.

Over the past five years, QUALCOMM's total shareholder return, including dividends and stock appreciation, was 46.11%. This long-term performance provides a context of sustained growth despite current economic conditions. However, compared to the past year, QUALCOMM underperformed both the US Semiconductor industry and the broader US market, which saw returns of 33.4% and 15.5% respectively.

The current share price of US$156.42 reflects a discount to the analysts' consensus price target of US$176.68. This 11.6% discount suggests the market may still hold some reservations regarding the pace of diversification and the impact of potential obstacles like geopolitical tensions and increased competition. The company's ROE remains exceptional, forecasted to increase from 42.5% to 49.5% over three years, indicating effective use of equity in generating profits. If the newly appointed leadership effectively harnesses these strategic initiatives, the potential remains for revenue growth and valuation improvements aligned with analyst expectations.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if QUALCOMM might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:QCOM

QUALCOMM

Engages in the development and commercialization of foundational technologies for the wireless industry worldwide.

Outstanding track record with flawless balance sheet and pays a dividend.

Similar Companies

Market Insights

Community Narratives