- United Kingdom

- /

- Machinery

- /

- LSE:TRI

Promising UK Penny Stocks To Consider In July 2025

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 index slipping due to weak trade data from China, highlighting ongoing global economic uncertainties. In such times, investors might consider exploring opportunities beyond the major indices. Penny stocks, though sometimes seen as a relic of past market eras, continue to offer potential value and growth when backed by strong financials.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.21 | £300.14M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.25 | £343.35M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.41 | £44.36M | ✅ 5 ⚠️ 2 View Analysis > |

| System1 Group (AIM:SYS1) | £4.05 | £51.39M | ✅ 3 ⚠️ 2 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.06 | £315.07M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.56 | £128.03M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.24 | £197.82M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.815 | £11.22M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.11 | £65.19M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.155 | £813.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 294 stocks from our UK Penny Stocks screener.

Let's dive into some prime choices out of the screener.

everplay group (AIM:EVPL)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Everplay Group PLC, along with its subsidiaries, develops and publishes independent video games for both digital and physical markets in the United Kingdom and internationally, with a market cap of £528.78 million.

Operations: The company generates revenue of £166.62 million from its segment dedicated to the development and publication of games and apps.

Market Cap: £528.78M

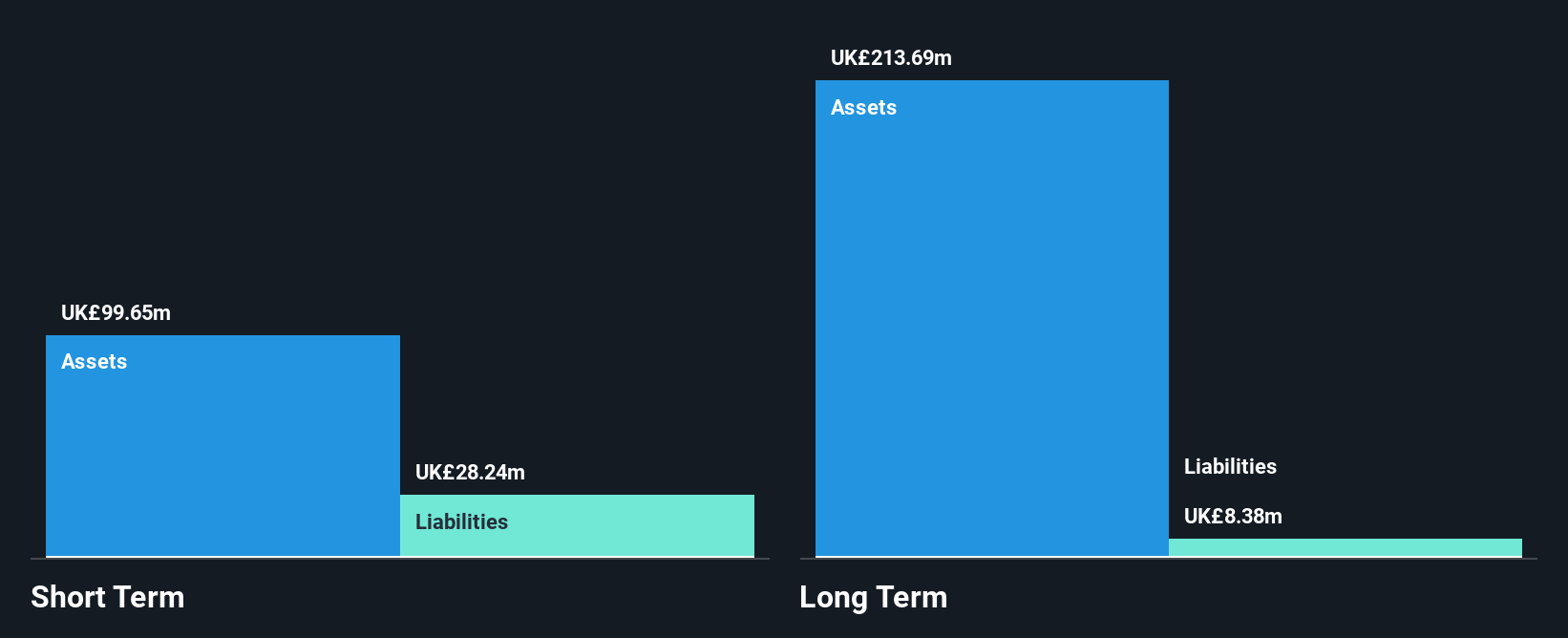

Everplay Group PLC has recently expanded its portfolio by acquiring the Hammerwatch franchise, enhancing its first-party IP footprint and creating potential new revenue streams. Despite a past decline in earnings by 17.4% annually over five years, Everplay became profitable last year, with short-term assets significantly exceeding liabilities. The company is debt-free and maintains stable weekly volatility at 7%. However, Everplay's board lacks experience with an average tenure of 1.9 years. Its return on equity is low at 7.7%, but it trades below estimated fair value, indicating potential for future growth as earnings are forecast to increase annually by 11.21%.

- Dive into the specifics of everplay group here with our thorough balance sheet health report.

- Explore everplay group's analyst forecasts in our growth report.

M&C Saatchi (AIM:SAA)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: M&C Saatchi plc offers advertising and marketing communications services across the UK, Europe, the Middle East, Asia Pacific, and the Americas with a market cap of £235.45 million.

Operations: The company generates revenue from various regions, with £191.4 million from the United Kingdom, £77.7 million from Asia Pacific, £73.3 million from the Americas, £25.9 million from the Middle East, and £24.2 million from Europe.

Market Cap: £235.45M

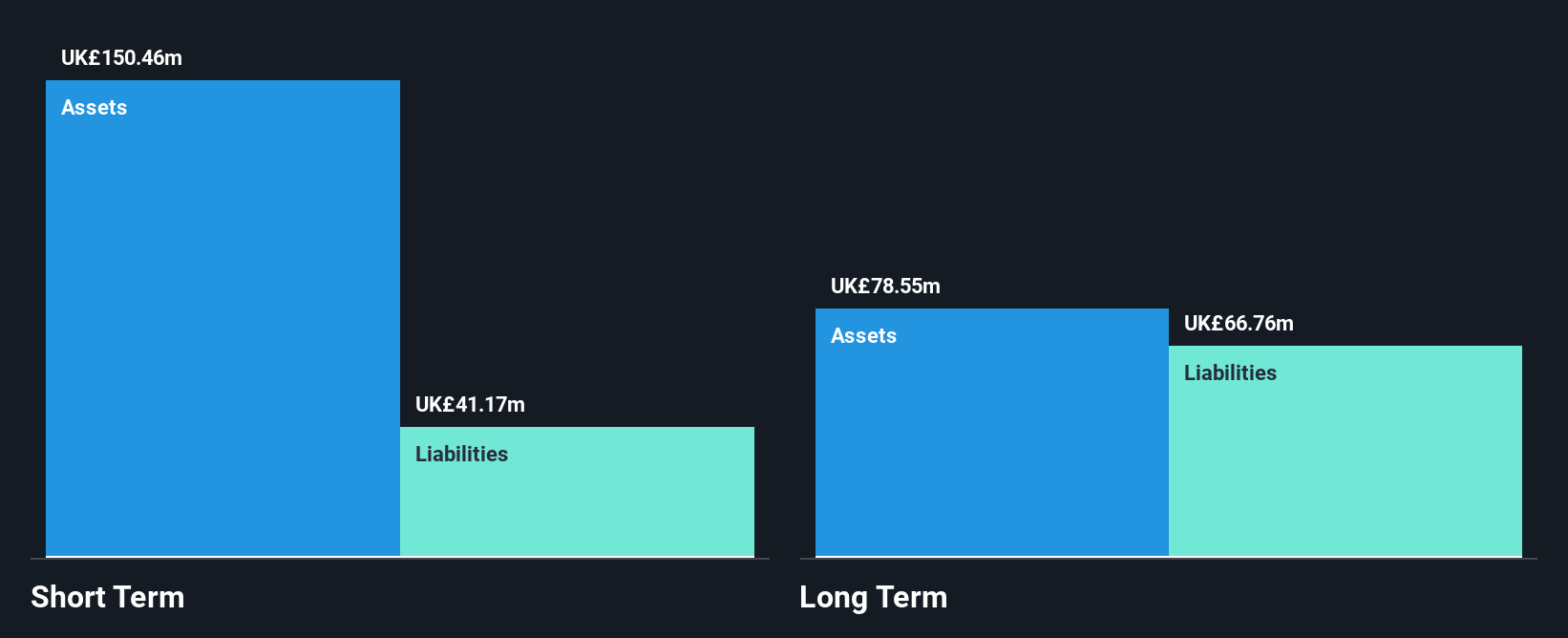

M&C Saatchi plc has demonstrated financial resilience with operating cash flow well covering its debt, and short-term assets surpassing both short- and long-term liabilities. The company's recent profitability marks a significant turnaround, supported by a reduced debt-to-equity ratio from 105.6% to 33.5% over five years. Despite large one-off losses impacting past earnings, the company maintains high return on equity at 29.3%. Board changes include Dame Heather Rabbatts' appointment as Non-Executive Chair, while dividend increases signal confidence in future performance. M&C Saatchi trades below estimated fair value with analysts forecasting earnings growth of 25.2% annually.

- Take a closer look at M&C Saatchi's potential here in our financial health report.

- Assess M&C Saatchi's future earnings estimates with our detailed growth reports.

Trifast (LSE:TRI)

Simply Wall St Financial Health Rating: ★★★★★☆

Overview: Trifast plc, with a market cap of £97.72 million, designs, engineers, manufactures, and supplies industrial fasteners and category C components across the United Kingdom, Ireland, Europe, North America, and Asia.

Operations: Revenue Segments: No specific revenue segments are reported for the company.

Market Cap: £97.72M

Trifast plc has shown financial improvement with its transition to profitability, reporting a net income of £1.04 million for the year ending March 2025. The company trades at a significant discount to its estimated fair value and has reduced its debt-to-equity ratio over five years. Although earnings growth is forecasted at 51.73% annually, recent results were impacted by large one-off losses of £2.7 million. Trifast's strategic shift towards bolt-on acquisitions aims to strengthen market share in North America and smart infrastructure, though any investments must meet strict price discipline and margin criteria.

- Get an in-depth perspective on Trifast's performance by reading our balance sheet health report here.

- Learn about Trifast's future growth trajectory here.

Turning Ideas Into Actions

- Click here to access our complete index of 294 UK Penny Stocks.

- Interested In Other Possibilities? The latest GPUs need a type of rare earth metal called Neodymium and there are only 26 companies in the world exploring or producing it. Find the list for free.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Trifast might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:TRI

Trifast

Designs, engineers, manufactures, and supplies industrial fasteners and category C components in the United Kingdom, Ireland, Europe, North America, and Asia.

Excellent balance sheet with moderate growth potential.

Market Insights

Community Narratives