- United States

- /

- Banks

- /

- NasdaqGS:PFBC

Preferred Bank Just Reported And Analysts Have Been Lifting Their Price Targets

It's been a good week for Preferred Bank (NASDAQ:PFBC) shareholders, because the company has just released its latest full-year results, and the shares gained 3.8% to US$63.10. Results look mixed - while revenue fell marginally short of analyst estimates at US$169m, statutory earnings were in line with expectations, at US$5.16 per share. Earnings are an important time for investors, as they can track a company's performance, look at what top analysts are forecasting for next year, and see if there's been a change in sentiment towards the company. We thought readers would find it interesting to see analysts' latest (statutory) post-earnings forecasts for next year.

See our latest analysis for Preferred Bank

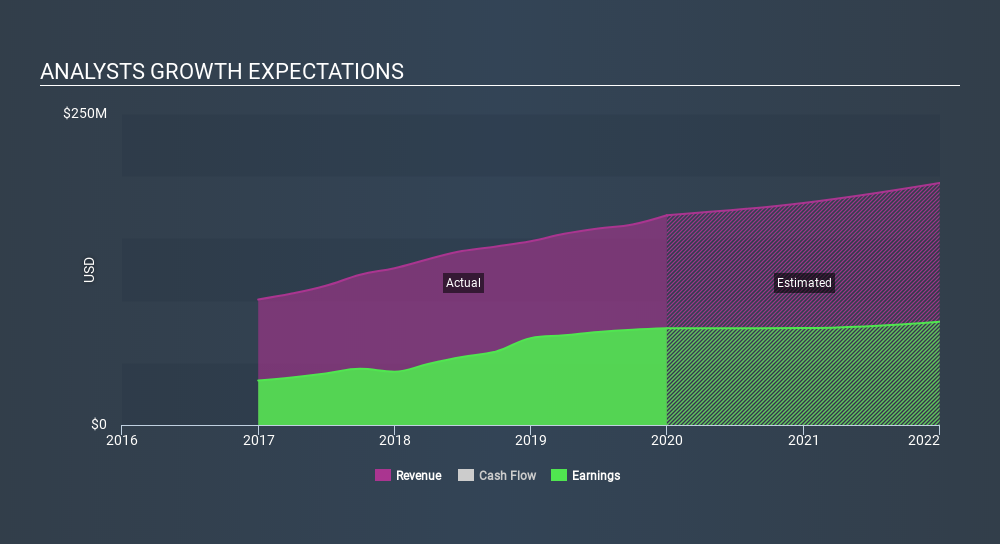

Taking into account the latest results, the most recent consensus for Preferred Bank from five analysts is for revenues of US$178.6m in 2020, which is a satisfactory 5.9% increase on its sales over the past 12 months. Statutory per share are forecast to be US$5.23, approximately in line with the last 12 months. Before this earnings report, analysts had been forecasting revenues of US$177.0m and earnings per share (EPS) of US$5.13 in 2020. So the consensus seems to have become somewhat more optimistic on Preferred Bank's earnings potential following these results.

The consensus price target rose 5.4% to US$63.00, suggesting that higher earnings estimates flow through to the stock's valuation as well. Fixating on a single price target can be unwise though, since the consensus target is effectively the average of analyst price targets. As a result, some investors like to look at the range of estimates to see if there are any diverging opinions on the company's valuation. There are some variant perceptions on Preferred Bank, with the most bullish analyst valuing it at US$65.00 and the most bearish at US$59.00 per share. The narrow spread of estimates could suggest that the business' future is relatively easy to value, or that analysts have a clear view on its prospects.

It can be useful to take a broader overview by seeing how analyst forecasts compare, both to the Preferred Bank's past performance and to peers in the same market. It's pretty clear that analysts expect Preferred Bank's revenue growth will slow down substantially, with revenues next year expected to grow 5.9%, compared to a historical growth rate of 18% over the past five years. Juxtapose this against the other companies in the market with analyst coverage, which are forecast to grow their revenues (in aggregate) 4.9% next year. So it's pretty clear that, while Preferred Bank's revenue growth is expected to slow, it's expected to grow roughly in line with the industry.

The Bottom Line

The biggest takeaway for us from these new estimates is that the consensus upgraded its earnings per share estimates, showing a clear improvement in sentiment around Preferred Bank's earnings potential next year. They also reconfirmed their revenue estimates, with the company predicted to grow at about the same rate as the wider market. Analysts also upgraded their price target, suggesting that analysts believe the intrinsic value of the business is likely to improve over time.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple Preferred Bank analysts - going out to 2021, and you can see them free on our platform here.

You can also see our analysis of Preferred Bank's Board and CEO remuneration and experience, and whether company insiders have been buying stock.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NasdaqGS:PFBC

Preferred Bank

Provides various banking products and services to small and mid-sized businesses, entrepreneurs, real estate developers, professionals, and high net worth individuals.

Flawless balance sheet, undervalued and pays a dividend.

Similar Companies

Market Insights

Weekly Picks

Early mover in a fast growing industry. Likely to experience share price volatility as they scale

A case for CA$31.80 (undiluted), aka 8,616% upside from CA$0.37 (an 86 bagger!).

Moderation and Stabilisation: HOLD: Fair Price based on a 4-year Cycle is $12.08

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)