- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (PLTR) Expands Collaboration With Lumen And Lear For AI-Driven Transformation

Reviewed by Simply Wall St

Palantir Technologies (PLTR) has recently made headlines with its strategic collaborations, notably partnering with Lumen Technologies and expanding its alliance with Lear Corporation. These initiatives aim to enhance business operations using advanced AI technologies. Over the last quarter, PLTR experienced a 29% price increase, likely bolstered by these influential partnerships. Despite the broader tech market seeing a modest rise, driven by favorable developments like potential Fed rate cuts, Palantir's focused efforts in strengthening market positioning and innovative approaches through client engagements could have added weight to its stock performance, countering any broader market trends.

Rare earth metals are the new gold rush. Find out which 29 stocks are leading the charge.

Over the last three years, Palantir Technologies has delivered a substantial total return of nearly 2000%, showcasing its strong performance in the market. This growth far outpaces the broader US market's annual return of 18.1% during the past year. For comparison, the US Software industry's one-year performance was 28%, indicating that Palantir's recent progress aligns well with industry trends.

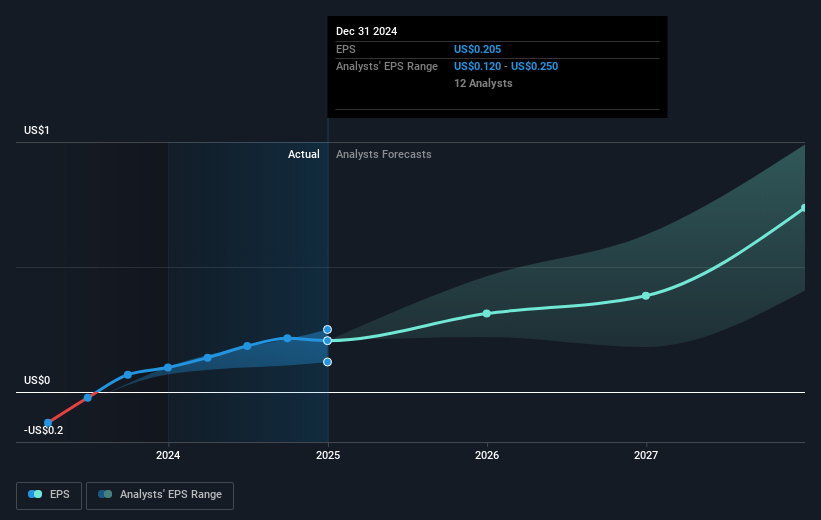

Palantir's recent collaborations and Q2 2025 earnings report, reflecting significant revenue ($1 billion) and net income ($326.73 million), signal positive impacts on revenue and earnings forecasts. The expanded partnerships with firms like Lear Corporation and Lumen Technologies suggest robust future prospects. Despite the company's current share price of $154.90 exceeding the consensus price target of $151.74, the upward movement reflects bullish sentiment amid its advancements and strengthened ties. This context underscores potential revenue growth and enhanced earnings capacity, driven by ongoing corporate initiatives and market alignment.

Assess Palantir Technologies' previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives