- United States

- /

- Software

- /

- NasdaqGS:PLTR

Palantir Technologies (NasdaqGS:PLTR) Partners For On-Demand Manufacturing Solutions With Divergent Technologies

Reviewed by Simply Wall St

Palantir Technologies (NasdaqGS:PLTR) shares surged 35% over the past month, as recent announcements highlight the company's active engagement in technology partnerships and strategic expansions. The partnership with Divergent Technologies aims to enhance manufacturing capabilities by integrating advanced technologies such as AI-driven design and industrial-rate additive manufacturing into Palantir’s software platform, potentially boosting client operations. Additionally, collaborations with Legion Intelligence, xAI, and TWG Global, alongside a robust Q1 earnings report, may have reinforced investor confidence. While mega-cap tech stocks showed mixed performances, Palantir's upward move aligned with the broader market's overall positive trend amidst easing trade tensions.

We've identified 1 possible red flag for Palantir Technologies that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

Over the past three years, Palantir Technologies (NasdaqGS:PLTR) has experienced a very large total return of 1477.15%, showcasing significant appreciation in its share value. This exceptional long-term performance underscores the company's growth trajectory, even as its one-year return surpasses the broader US market return of 11.7% and the US Software industry return of 16.4% for the same period. These metrics highlight Palantir’s robust standing against both the market and industry peers.

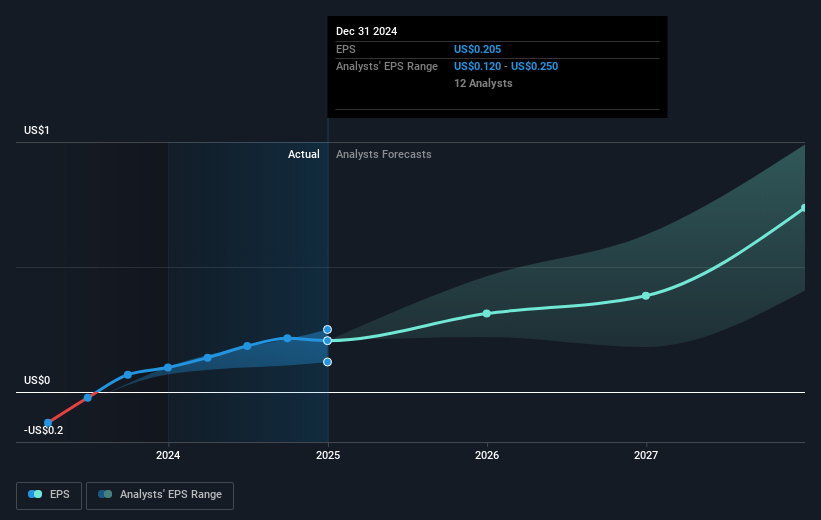

The recent positive developments, including new partnerships and impressive earnings growth, could bolster future revenue and earnings forecasts. These advancements have likely contributed to the boosted investor confidence seen in the recent price surge. However, with the current share price trading at a discount of 23.52% compared to consensus analyst price targets, investors might be evaluating the company's fair value and potential upside. The increased financial guidance and partnerships augment Palantir's capabilities in AI and other cutting-edge technologies, potentially enhancing its market position and operational outcomes moving forward.

Jump into the full analysis health report here for a deeper understanding of Palantir Technologies.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:PLTR

Palantir Technologies

Palantir Technologies Inc. builds and deploys software platforms for the intelligence community to assist in counterterrorism investigations and operations in the United States, the United Kingdom, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives