- United States

- /

- Software

- /

- NasdaqCM:PGY

Pagaya Technologies (PGY) Reports Upcoming Revenue Guidance of US$290M to US$310M

Reviewed by Simply Wall St

Pagaya Technologies (PGY) experienced a considerable share price increase of 247% over the last quarter, coinciding with its addition to multiple Russell growth indices, which likely played a role in elevating investor confidence. The recent announcement of revenue guidance for the upcoming quarter ranging between $290 and $310 million, alongside expectations for a modest net income, further aligns with Pagaya's growing financial stature. The inclusion in key growth indices could have amplified the company's visibility, while the flat market in the last week did not notably influence these movements, although the broader market's 15% annual climb indicates general optimism.

We've spotted 2 warning signs for Pagaya Technologies you should be aware of.

The significant share price increase over the last quarter, attributed to Pagaya Technologies' addition to various Russell growth indices, reflects growing investor confidence and enhanced visibility. This aligns with the company's ongoing efforts in digital transformation and AI deployment, which are expected to broaden lending channels and drive sustainable revenue growth.

Over the past year, Pagaya's shares saw a total return of 112.28%, showcasing a remarkable performance compared to the US Software industry, which returned 26.3%. This strong return was fueled by strategic advances in AI-powered solutions and expanding partnerships, despite the broader market's annual climb of 15% over the same timeframe. The company's growth, however, is juxtaposed with challenges like regulatory scrutiny and reliance on the asset-backed securities market.

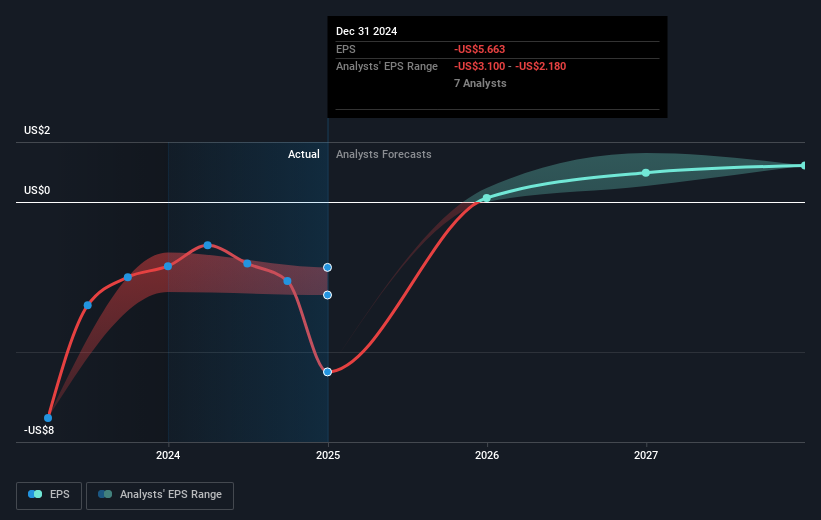

The recent revenue guidance between US$290 and US$310 million and the modest net income projection indicate positive momentum in both current operations and future prospects. Analyst forecasts expect Pagaya's earnings to grow significantly, supported by increasing adoption of AI models designed for fair lending. However, with the current share price slightly above the consensus price target of US$30.97, the market appears to be pricing in this optimism, suggesting a fully valued stock unless future earnings outperform current expectations.

Review our growth performance report to gain insights into Pagaya Technologies' future.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqCM:PGY

Pagaya Technologies

A product-focused technology company, deploys data science and proprietary artificial intelligence-powered technology for financial services and other service providers, their customers, and asset investors in the United States, Israel, and the Cayman Islands.

High growth potential and fair value.

Market Insights

Community Narratives