Only 4 Days Left To Cash In On Regional Express Holdings Limited (ASX:REX) Dividend

Regional Express Holdings Limited (ASX:REX) stock is about to trade ex-dividend in 4 days time. This means that investors who purchase shares on or after the 24th of September will not receive the dividend, which will be paid on the 16th of October.

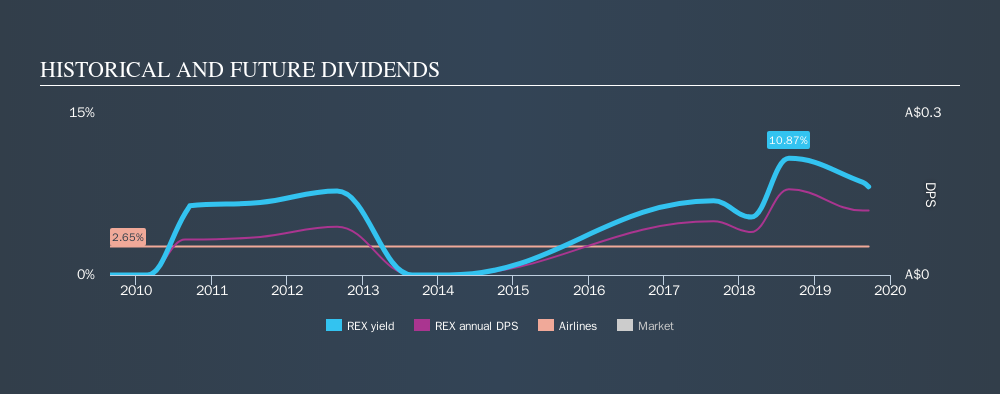

Regional Express Holdings's next dividend payment will be AU$0.08 per share. Last year, in total, the company distributed AU$0.1 to shareholders. Based on the last year's worth of payments, Regional Express Holdings has a trailing yield of 8.2% on the current stock price of A$1.46. Dividends are an important source of income to many shareholders, but the health of the business is crucial to maintaining those dividends. As a result, readers should always check whether Regional Express Holdings has been able to grow its dividends, or if the dividend might be cut.

Check out our latest analysis for Regional Express Holdings

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Regional Express Holdings paid out 75% of its earnings to investors last year, a normal payout level for most businesses. A useful secondary check can be to evaluate whether Regional Express Holdings generated enough free cash flow to afford its dividend. Over the last year, it paid out more than three-quarters (87%) of its free cash flow generated, which is fairly high and may be starting to limit reinvestment in the business.

It's positive to see that Regional Express Holdings's dividend is covered by both profits and cash flow, since this is generally a sign that the dividend is sustainable, and a lower payout ratio usually suggests a greater margin of safety before the dividend gets cut.

Click here to see how much of its profit Regional Express Holdings paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with strong growth prospects usually make the best dividend payers, because it's easier to grow dividends when earnings per share are improving. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Fortunately for readers, Regional Express Holdings's earnings per share have been growing at 18% a year for the past five years. It paid out more than three-quarters of its earnings in the last year, even though earnings per share are growing rapidly. We're surprised that management has not elected to reinvest more in the business to accelerate growth further.

Many investors will assess a company's dividend performance by evaluating how much the dividend payments have changed over time. In the last nine years, Regional Express Holdings has lifted its dividend by approximately 6.9% a year on average. We're glad to see dividends rising alongside earnings over a number of years, which may be a sign the company intends to share the growth with shareholders.

To Sum It Up

Is Regional Express Holdings worth buying for its dividend? Higher earnings per share generally lead to higher dividends from dividend-paying stocks over the long run. However, we'd also note that Regional Express Holdings is paying out more than half of its earnings and cash flow as profits, which could limit the dividend growth if earnings growth slows. While it does have some good things going for it, we're a bit ambivalent and it would take more to convince us of Regional Express Holdings's dividend merits.

Curious about whether Regional Express Holdings has been able to consistently generate growth? Here's a chart of its historical revenue and earnings growth.

We wouldn't recommend just buying the first dividend stock you see, though. Here's a list of interesting dividend stocks with a greater than 2% yield and an upcoming dividend.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:REX

Regional Express Holdings

Engages in the air transportation of passengers and freight.

Moderate and slightly overvalued.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)