- United States

- /

- Real Estate

- /

- NasdaqGS:ZG

October 2025 Value Picks: 3 Stocks That May Offer Attractive Valuations

Reviewed by Simply Wall St

As the U.S. stock market navigates through a period of volatility, highlighted by impressive bank earnings and ongoing trade tensions with China, investors are keenly observing economic indicators for signs of stability. In this environment, identifying stocks that may be undervalued could offer potential opportunities for those looking to capitalize on attractive valuations amidst fluctuating market conditions.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Wix.com (WIX) | $135.66 | $259.94 | 47.8% |

| Peapack-Gladstone Financial (PGC) | $28.75 | $56.16 | 48.8% |

| Metropolitan Bank Holding (MCB) | $78.61 | $152.30 | 48.4% |

| Investar Holding (ISTR) | $22.725 | $45.32 | 49.9% |

| First Busey (BUSE) | $23.32 | $45.91 | 49.2% |

| Dime Community Bancshares (DCOM) | $29.87 | $57.26 | 47.8% |

| Corpay (CPAY) | $287.78 | $550.54 | 47.7% |

| Constellium (CSTM) | $15.91 | $31.09 | 48.8% |

| AGNC Investment (AGNC) | $10.02 | $19.46 | 48.5% |

| AbbVie (ABBV) | $226.22 | $431.17 | 47.5% |

Let's take a closer look at a couple of our picks from the screened companies.

Atour Lifestyle Holdings (ATAT)

Overview: Atour Lifestyle Holdings Limited, with a market cap of approximately $4.87 billion, operates through its subsidiaries to develop lifestyle brands centered around hotel offerings in the People’s Republic of China.

Operations: The company's revenue primarily comes from its Atour Group segment, which generated CN¥8.36 billion.

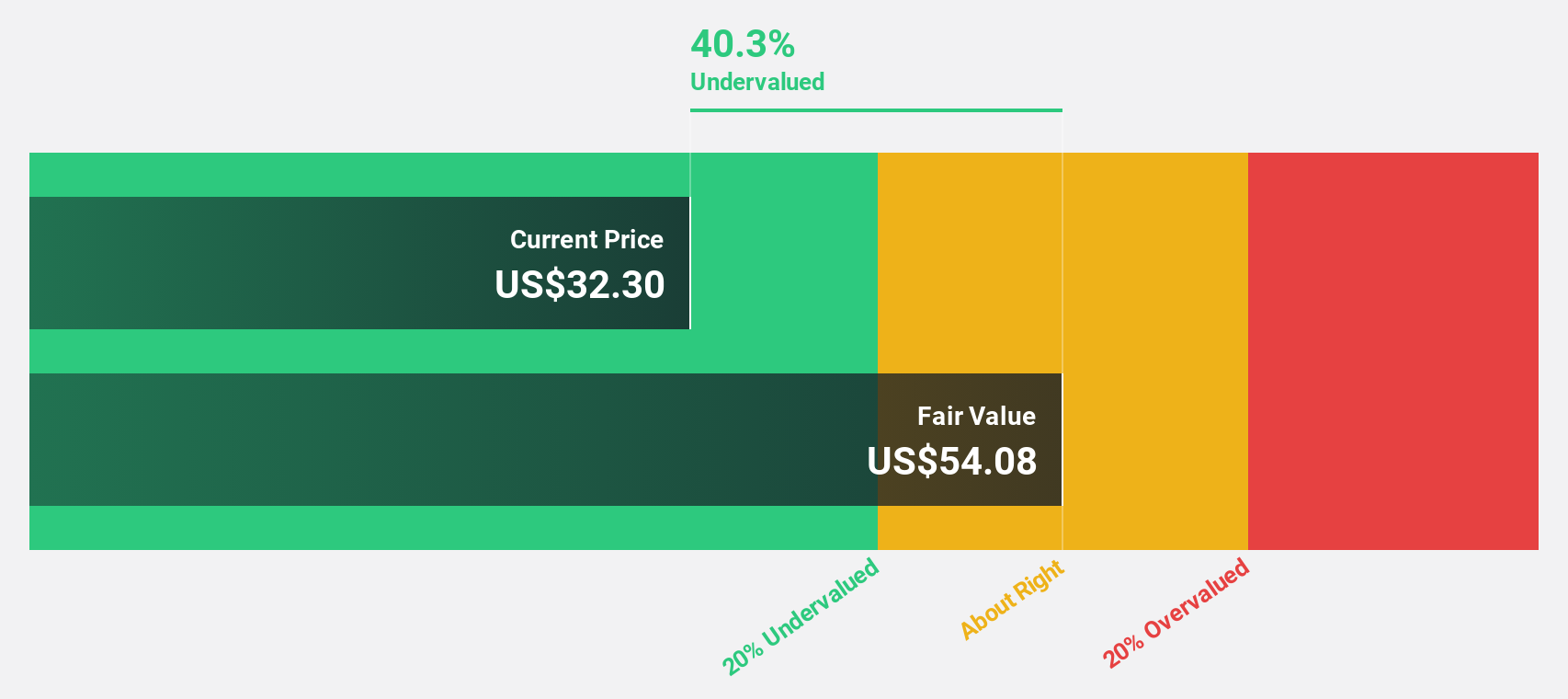

Estimated Discount To Fair Value: 35.7%

Atour Lifestyle Holdings is trading significantly below its estimated fair value of US$56.83, with a current price of US$36.56, highlighting its potential as an undervalued stock based on cash flows. The company's earnings have shown robust growth, increasing by 32.6% over the past year, and are expected to grow at 23.7% annually, outpacing the broader US market forecast of 15.6%. Additionally, Atour's revenue is projected to rise by over 21% per year.

- Our growth report here indicates Atour Lifestyle Holdings may be poised for an improving outlook.

- Dive into the specifics of Atour Lifestyle Holdings here with our thorough financial health report.

First Solar (FSLR)

Overview: First Solar, Inc. is a solar technology company that offers photovoltaic (PV) solar energy solutions across the United States, France, India, Chile, and internationally with a market cap of approximately $24.07 billion.

Operations: The company's revenue primarily comes from the design, manufacture, and sale of CdTe solar modules, totaling approximately $4.34 billion.

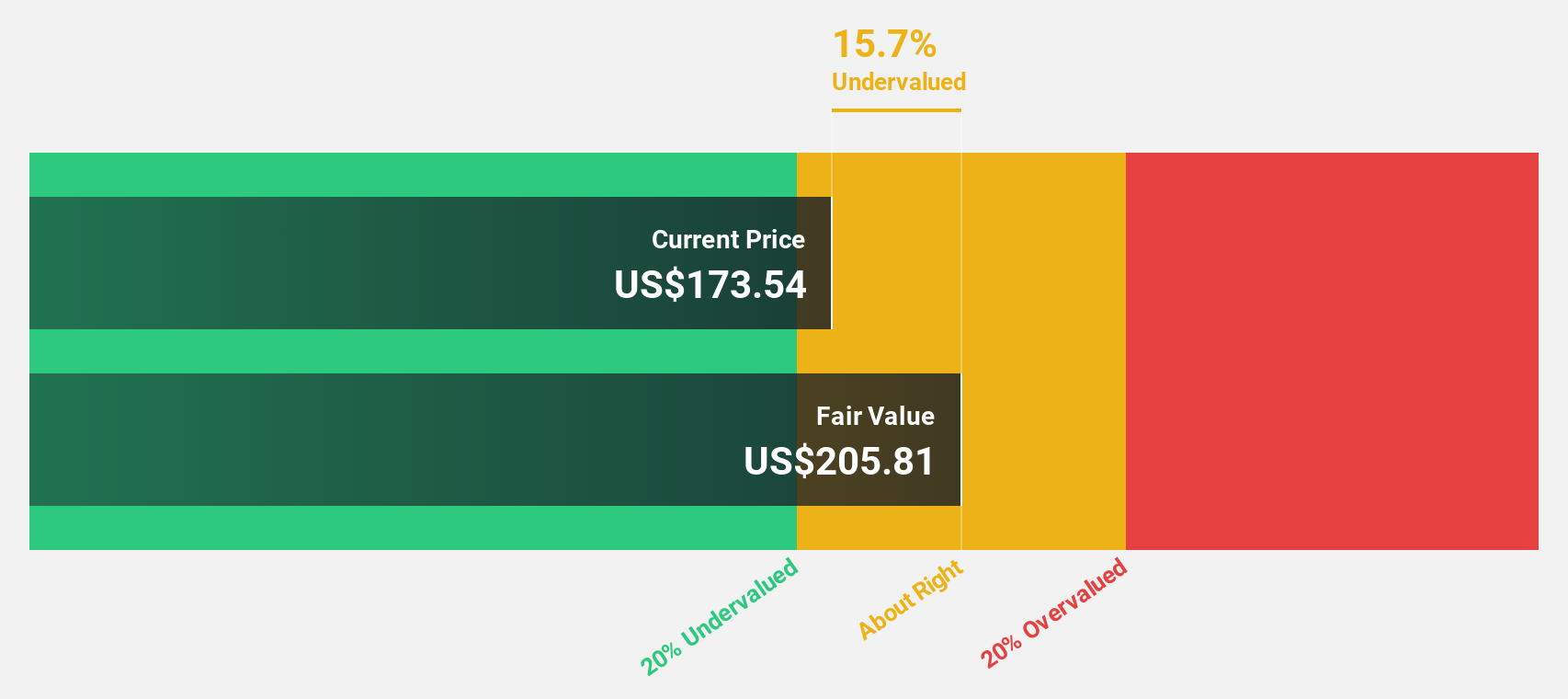

Estimated Discount To Fair Value: 37%

First Solar is trading at US$244.4, significantly below its estimated fair value of US$387.8, suggesting it may be undervalued based on cash flows. The company's earnings are expected to grow significantly over the next three years, surpassing the broader US market's growth rate. Recent supply agreements and expanded semiconductor commitments with 5N Plus Inc., alongside increased domestic production capacity, bolster First Solar's strategic position in the solar industry.

- According our earnings growth report, there's an indication that First Solar might be ready to expand.

- Delve into the full analysis health report here for a deeper understanding of First Solar.

Zillow Group (ZG)

Overview: Zillow Group, Inc. operates real estate brands through mobile applications and websites in the United States with a market cap of approximately $17.36 billion.

Operations: The company generates revenue of $2.39 billion from its Internet Information Providers segment.

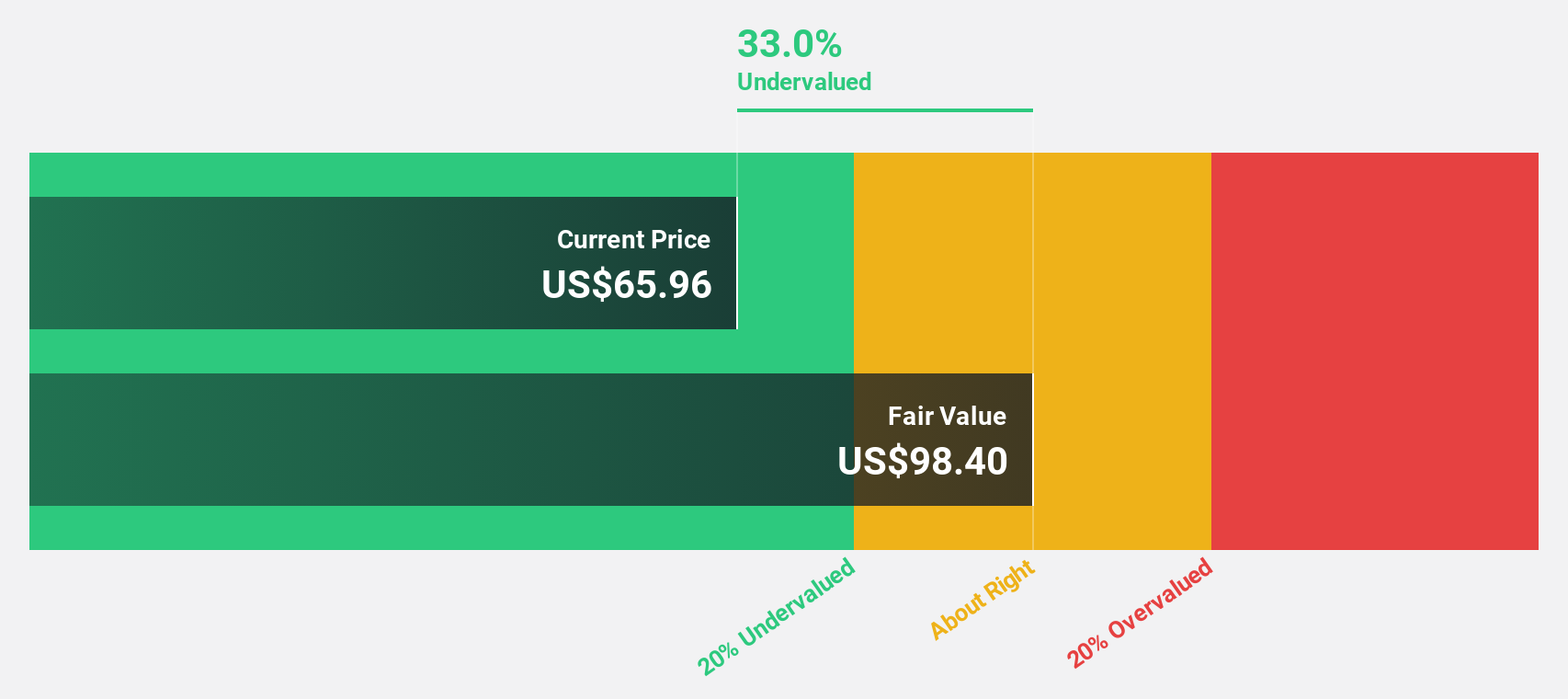

Estimated Discount To Fair Value: 23.9%

Zillow Group, priced at US$69.96, is trading substantially below its estimated fair value of US$91.93, highlighting potential undervaluation based on cash flows. The company anticipates significant earnings growth over the next three years and is expected to achieve profitability within that period. Recent initiatives like Zillow Pro and partnerships for rent reporting enhance its technological edge and consumer reach, although ongoing legal challenges may pose risks to its strategic advancements in the real estate sector.

- Insights from our recent growth report point to a promising forecast for Zillow Group's business outlook.

- Unlock comprehensive insights into our analysis of Zillow Group stock in this financial health report.

Summing It All Up

- Click through to start exploring the rest of the 172 Undervalued US Stocks Based On Cash Flows now.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Take control of your financial future using Simply Wall St, offering free, in-depth knowledge of international markets to every investor.

Contemplating Other Strategies?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Zillow Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ZG

Zillow Group

Operates real estate brands in mobile applications and Websites in the United States.

Flawless balance sheet with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives