- United States

- /

- Semiconductors

- /

- NasdaqGS:NXPI

NXP Semiconductors (NXPI) Updates Buyback Program with 1.1 Million Shares Repurchased

Reviewed by Simply Wall St

NXP Semiconductors (NXPI) witnessed a price movement of 12% over the past week, a period marked by significant corporate communications. The company updated its buyback program, having repurchased nearly 1.1 million shares, adding structural support to its stock value. Furthermore, NXP's third-quarter guidance detailing expected revenue and operating income ranges may have impacted investor sentiment positively, especially amid a broader market context where sectors are gaining ground. While the Producer Price Index news could have added an inflationary concern to the market, the company’s activities likely helped buoy investor confidence against these broader market conditions.

The recent activities at NXP Semiconductors, including the buyback program and updated revenue guidance, have the potential to bolster the company’s narrative of overcoming previous growth headwinds. These moves could enhance investor sentiment by suggesting stronger financial health and confidence from management. Over a five-year period, the company's total return, including share price and dividends, was 102.52%, illustrating a strong longer-term performance. However, over the past year, NXP Semiconductors underperformed compared to the US Semiconductor industry, which saw a 40.6% gain, highlighting variance in shorter-term industry-wide performance.

The introduction of the updated buyback program and revenue projections might positively influence analysts' forecasts for revenue and earnings, despite current challenges. The company's current share price of $230.52, when compared with the consensus price target of $258.06, suggests a potential upward movement, being 11.95% below the target. This could imply room for appreciation if the company successfully executes its outlined strategies and market conditions remain favorable. Investors will be particularly attentive to how these elements translate into the anticipated earnings growth and margin improvements in the coming quarters.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NXP Semiconductors might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NXPI

NXP Semiconductors

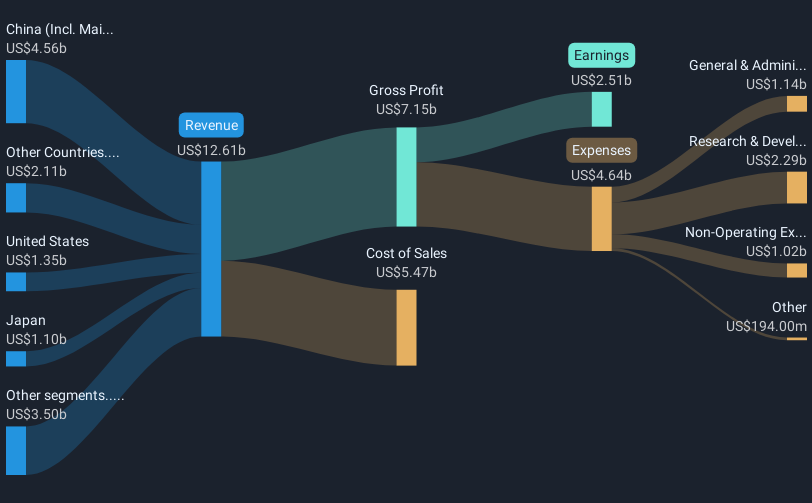

Provides semiconductor products in China, the United States, Germany, Japan, Singapore, South Korea, Mexico, the Netherlands, Taiwan, and internationally.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Community Narratives