- United States

- /

- Semiconductors

- /

- NasdaqGS:NVDA

NVIDIA (NVDA) Gains Momentum With New Robotics Partnerships & Increased GPU Deployments

Reviewed by Simply Wall St

NVIDIA (NVDA) recently announced a series of partnerships and product launches that enhance its AI and robotics technology, including the release of the Jetson AGX Thor, which boosts AI computation capabilities. Additionally, collaborations with companies like Infineon Technologies and RealSense are focusing on advancing humanoid robotics and AI depth cameras. Although the stock's 33% rise this past quarter might align with broader tech sector movements and market trends, particularly as the market trends upward, these developments could have supported overall positive sentiment toward NVIDIA's position in the tech industry, contributing to its notable price move.

NVIDIA has 1 risk we think you should know about.

NVIDIA's recent partnerships and product launches, particularly aimed at advancing AI and robotics technology, could considerably influence its position within the broader tech industry. The introduction of the Jetson AGX Thor and collaborations with firms like Infineon Technologies and RealSense show a clear intent to deepen its footprint in AI-enhanced robotics. These developments may contribute to boosting NVIDIA's revenue as its AI and data center solutions continue to gain traction.

Over the last five years, NVIDIA's total shareholder return, encompassing both share price appreciation and dividends, has been extremely large at over 1,200%. This tremendous growth showcases its robust market position and increasing investor confidence. However, recent performance comparisons show NVIDIA surpassing the US Semiconductor industry with its return of over 33.4% in just the past year, which is above the industry average.

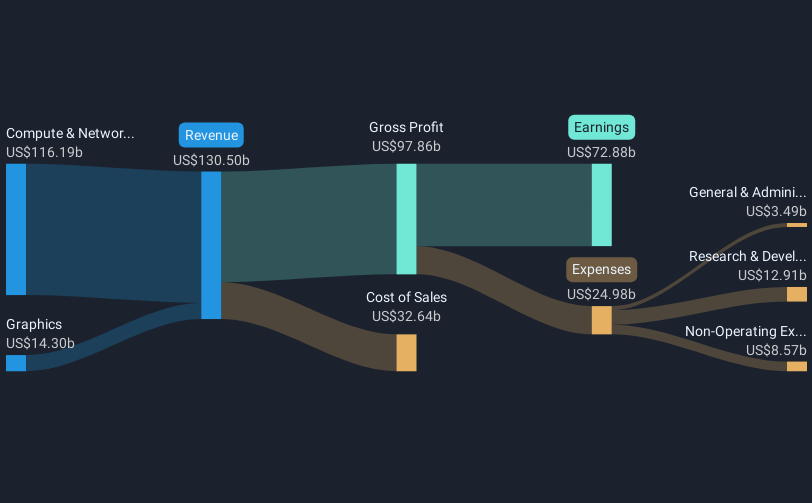

As NVIDIA forges deeper into AI and automotive sectors, revenue and earnings projections are likely to see positive adjustments. Analysts forecast approximately 20% annual revenue growth, alongside substantial earnings growth, driven partly by innovations in AI technology. Despite these optimistic forecasts, NVIDIA's current share price of US$179.81 is close to the analyst consensus price target of US$192.72, suggesting limited near-term upside according to analysts. This narrow gap may imply that market participants have already accounted for much of the expected growth in its valuation. Nonetheless, continued execution on its strategic initiatives may provide opportunities for further appreciation.

Click to explore a detailed breakdown of our findings in NVIDIA's financial health report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NVIDIA might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:NVDA

NVIDIA

A computing infrastructure company, provides graphics and compute and networking solutions in the United States, Singapore, Taiwan, China, Hong Kong, and internationally.

Exceptional growth potential with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives