- United States

- /

- Banks

- /

- NYSE:NU

Nu Holdings (NYSE:NU) Removed From Russell Midcap And Growth Indexes

Reviewed by Simply Wall St

Nu Holdings (NYSE:NU) experienced a 29% price move in the last quarter, a period marked by its removal from the Russell Midcap and Midcap Growth indexes. Despite the challenges of reduced visibility post-removal, Nu Holdings showed considerable financial growth, with increased earnings and the appointment of Roberto Campos Neto to a significant role. These factors, alongside its addition to the Russell Top 200 indexes, bolster its presence as the broader markets rose, driven by favorable conditions such as economic optimism and easing trade concerns in June. The company's actions and market conditions seemed aligned during this period.

We've discovered 1 risk for Nu Holdings that you should be aware of before investing here.

The recent shifts in Nu Holdings' index inclusion have potentially influenced market perceptions and investor interest, as indicated by the short-term price volatility. This volatility may moderately impact revenue and earnings forecasts, considering the company's expansion into secured lending and new services. However, Nu Holdings' longer-term performance has been robust, with a total shareholder return of 238.87% over the past three years, highlighting significant growth despite recent challenges. This performance places the company in a favorable light compared to the broader US market and the US Banks industry, where it underperformed over the past year with market returns at 13.7% and industry returns at 27.3%.

The company's current share price of US$12.44 reflects a slight discount from the consensus price target of US$14.55. This suggests that analysts see potential for appreciation based on growth forecasts, assuming successful execution of their strategic initiatives such as international expansion and investment in technology. Despite some execution risks and competitive pressures, the company's diversification efforts could bolster its financial resilience. As the company integrates its strategic changes, these developments could lead to adjustments in future revenue and earnings forecasts. Investors should consider these factors in line with their insights and expectations for Nu Holdings.

Explore Nu Holdings' analyst forecasts in our growth report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Nu Holdings might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:NU

Nu Holdings

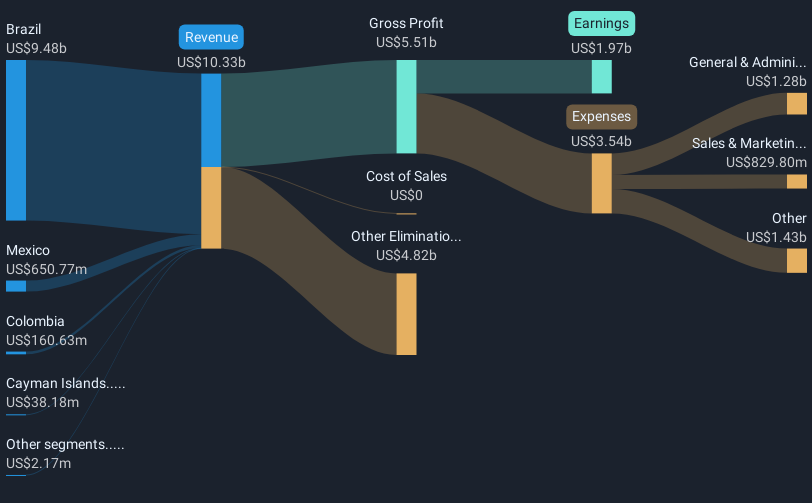

Provides digital banking platform in Brazil, Mexico, Colombia, the Cayman Islands, and the United States.

Exceptional growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives