- Canada

- /

- Metals and Mining

- /

- TSX:NGD

New Gold (TSX:NGD) Reports Strong Q2 Earnings With Sales Surging To US$308 Million

Reviewed by Simply Wall St

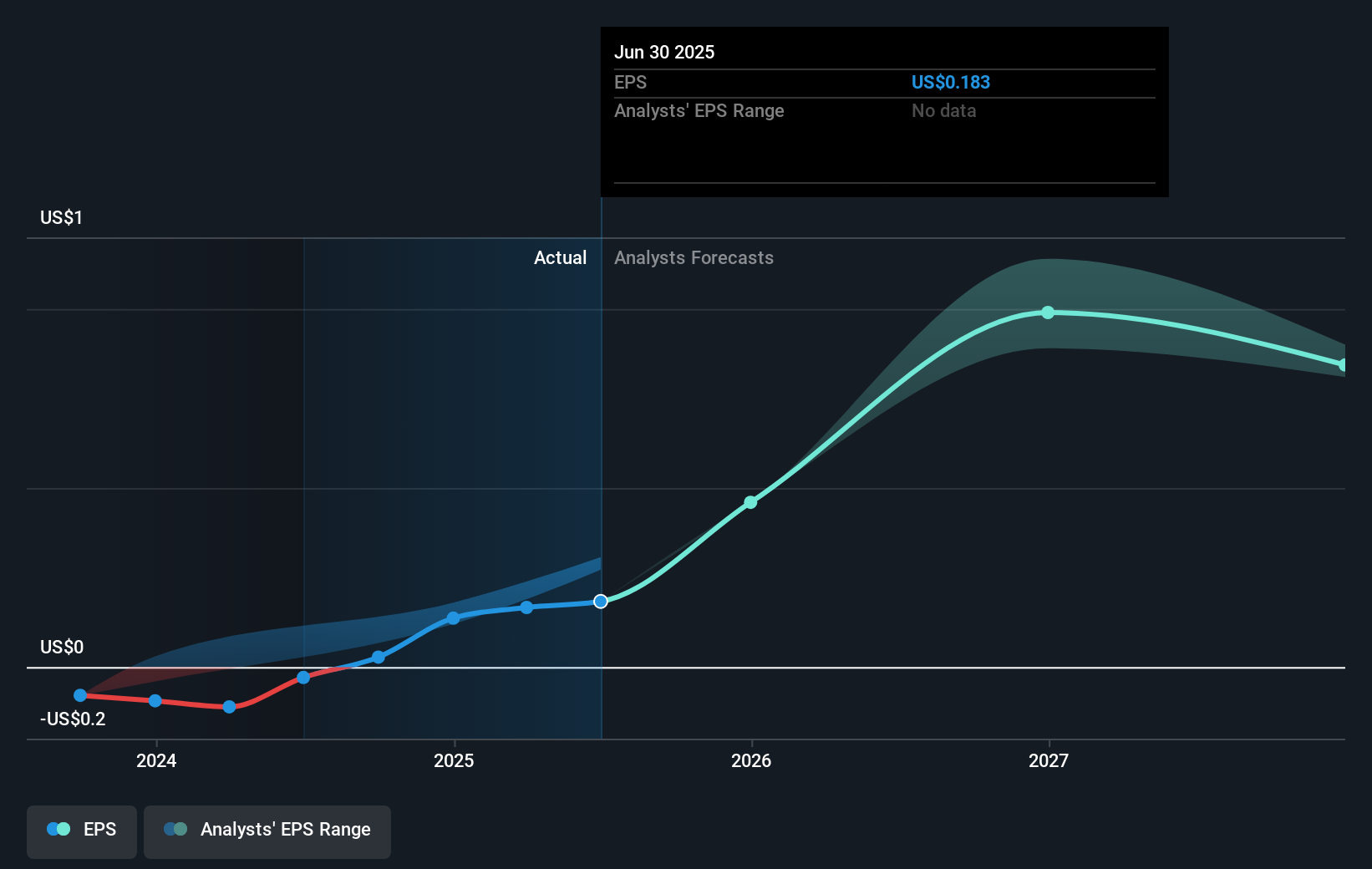

New Gold (TSX:NGD) recently announced its Q2 2025 results with significant sales and net income growth, alongside a basic EPS increase to USD 0.09. These strong financial results, coupled with strategic moves like acquiring full interest in the New Afton Mine, played a role in the company's remarkable 32% price surge last quarter. This movement aligned with a broadly positive market sentiment, highlighted by major indices like the S&P 500 and Nasdaq reaching record highs. New Gold's robust performance added to the momentum in the market, despite the backdrop of trade discussions and economic announcements.

We've identified 1 warning sign for New Gold that you should be aware of.

Find companies with promising cash flow potential yet trading below their fair value.

The recent news of New Gold's substantial sales and earnings growth, heightened by its acquisition of full interest in the New Afton Mine, aligns with its efforts to boost future production and enhance shareholder value. Over the past three years, the company's total shareholder return, incorporating both share price appreciation and dividends, was a very large 476.19%. This long-term performance underscores the company's ability to generate value, surpassing the Canadian Market's one-year return of 17.6% and outpacing the Canadian Metals and Mining industry, which saw a return of 33.7% over the past year.

New Gold's recent operational milestones, such as achieving commercial production in the C-Zone at New Afton, are anticipated to elevate future revenue and earnings forecasts. The expected 30% increase in gold production and 90% increase in copper production, alongside cost reductions, should further support these upward trends. However, New Gold's current share price of CA$6.05 remains at a 38.4% discount to the analysts' consensus price target of CA$8.3, suggesting potential upward movement. This price alignment with the predicted earnings and revenue growth highlights analysts' confidence in New Gold's future prospects.

Our valuation report unveils the possibility New Gold's shares may be trading at a discount.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if New Gold might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSX:NGD

New Gold

An intermediate gold mining company, engages in the development and operation of mineral properties in Canada.

High growth potential with excellent balance sheet.

Similar Companies

Market Insights

Community Narratives