- Australia

- /

- Real Estate

- /

- ASX:CWP

Need To Know: Analysts Just Made A Substantial Cut To Their Cedar Woods Properties Limited (ASX:CWP) Estimates

One thing we could say about the analysts on Cedar Woods Properties Limited (ASX:CWP) - they aren't optimistic, having just made a major negative revision to their near-term (statutory) forecasts for the organization. Revenue and earnings per share (EPS) forecasts were both revised downwards, with analysts seeing grey clouds on the horizon. The stock price has risen 6.4% to AU$5.31 over the past week. We'd be curious to see if the downgrade is enough to reverse investor sentiment on the business.

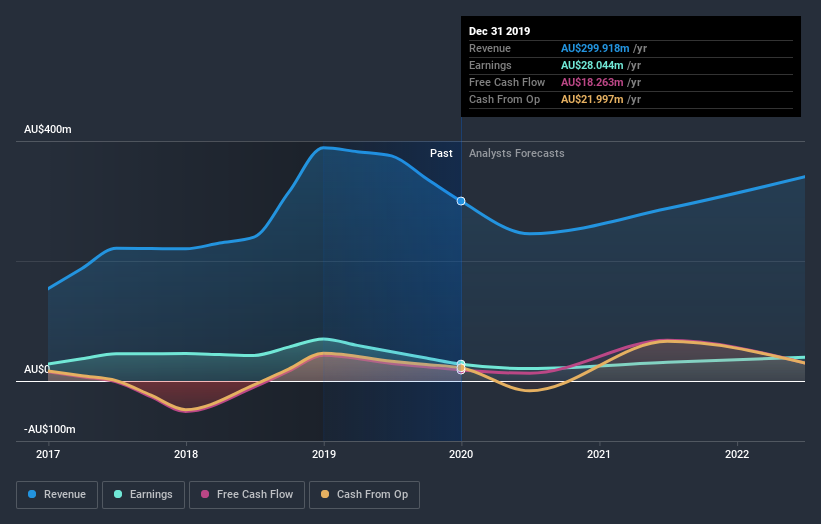

Following the latest downgrade, the current consensus, from the two analysts covering Cedar Woods Properties, is for revenues of AU$245m in 2020, which would reflect a considerable 18% reduction in Cedar Woods Properties' sales over the past 12 months. Statutory earnings per share are supposed to plunge 26% to AU$0.26 in the same period. Previously, the analysts had been modelling revenues of AU$275m and earnings per share (EPS) of AU$0.36 in 2020. Indeed, we can see that the analysts are a lot more bearish about Cedar Woods Properties' prospects, administering a substantial drop in revenue estimates and slashing their EPS estimates to boot.

View our latest analysis for Cedar Woods Properties

Despite the cuts to forecast earnings, there was no real change to the AU$5.67 price target, showing that the analysts don't think the changes have a meaningful impact on its intrinsic value. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values Cedar Woods Properties at AU$6.00 per share, while the most bearish prices it at AU$5.34. This is a very narrow spread of estimates, implying either that Cedar Woods Properties is an easy company to value, or - more likely - the analysts are relying heavily on some key assumptions.

Of course, another way to look at these forecasts is to place them into context against the industry itself. These estimates imply that sales are expected to slow, with a forecast revenue decline of 18%, a significant reduction from annual growth of 18% over the last five years. By contrast, our data suggests that other companies (with analyst coverage) in the same industry are forecast to see their revenue grow 4.8% annually for the foreseeable future. It's pretty clear that Cedar Woods Properties' revenues are expected to perform substantially worse than the wider industry.

The Bottom Line

The most important thing to take away is that analysts cut their earnings per share estimates, expecting a clear decline in business conditions. Unfortunately analysts also downgraded their revenue estimates, and industry data suggests that Cedar Woods Properties' revenues are expected to grow slower than the wider market. The lack of change in the price target is puzzling in light of the downgrade but, with a serious decline expected this year, we wouldn't be surprised if investors were a bit wary of Cedar Woods Properties.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. At least one analyst has provided forecasts out to 2022, which can be seen for free on our platform here.

Of course, seeing company management invest large sums of money in a stock can be just as useful as knowing whether analysts are downgrading their estimates. So you may also wish to search this free list of stocks that insiders are buying.

When trading Cedar Woods Properties or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About ASX:CWP

Cedar Woods Properties

Engages in property investment and development activities in Australia.

Very undervalued with proven track record.

Market Insights

Community Narratives