- Saudi Arabia

- /

- Luxury

- /

- SASE:4180

National Bank of Umm Al-Qaiwain (PSC) And 2 Other Middle Eastern Penny Stocks To Watch

Reviewed by Simply Wall St

Amidst a backdrop of cautious investor sentiment and fluctuating indices in the Middle East, many Gulf markets have recently retreated as investors await key policy decisions abroad. Despite these broader market movements, penny stocks remain an intriguing segment for investors seeking opportunities in smaller or newer companies. While the term "penny stocks" may seem outdated, these investments can still offer significant growth potential when backed by strong financials and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Menara Ventures Xl - Limited Partnership (TASE:MNRA) | ₪2.625 | ₪12.06M | ✅ 1 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR4.10 | SAR1.64B | ✅ 2 ⚠️ 1 View Analysis > |

| Amanat Holdings PJSC (DFM:AMANAT) | AED1.11 | AED2.71B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.51 | ₪316.54M | ✅ 3 ⚠️ 2 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.11 | AED2.22B | ✅ 3 ⚠️ 2 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY1.87 | TRY2.01B | ✅ 2 ⚠️ 2 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.14 | AED386.93M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.55 | AED10.76B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.826 | AED502.42M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.583 | ₪192.03M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 78 stocks from our Middle Eastern Penny Stocks screener.

Let's review some notable picks from our screened stocks.

National Bank of Umm Al-Qaiwain (PSC) (ADX:NBQ)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: National Bank of Umm Al-Qaiwain (PSC) provides retail and corporate banking services in the United Arab Emirates and has a market cap of AED4.54 billion.

Operations: The company's revenue is primarily derived from Treasury and Investments, contributing AED400.90 million, and Retail and Corporate Banking, which adds AED327.74 million.

Market Cap: AED4.54B

National Bank of Umm Al-Qaiwain (PSC) shows a mixed picture for investors interested in penny stocks. While the bank benefits from stable weekly volatility and a primarily low-risk funding structure, its recent earnings growth has been negative, contrasting with the broader industry trend. The Return on Equity stands at 8.8%, which is relatively low, and the net profit margin has decreased from last year. However, its Price-to-Earnings ratio of 8.8x suggests it might be undervalued compared to the market average. Despite some high-quality past earnings, concerns about high bad loans (3.7%) persist alongside an unstable dividend track record.

- Dive into the specifics of National Bank of Umm Al-Qaiwain (PSC) here with our thorough balance sheet health report.

- Learn about National Bank of Umm Al-Qaiwain (PSC)'s historical performance here.

GSD Holding (IBSE:GSDHO)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: GSD Holding A.S. operates in finance, shipping, energy, and education sectors through its subsidiaries and has a market cap of TRY3.91 billion.

Operations: The company's revenue is primarily derived from its Turkey-based operations in banking (TRY961.60 million), holding activities (TRY277.60 million), factoring (TRY1.68 billion), and marine services both domestically and internationally (TRY1.28 billion).

Market Cap: TRY3.91B

GSD Holding A.S. presents a complex profile for penny stock investors, with its recent transition to profitability being a key highlight. Despite this, the company reported a net loss of TRY218.28 million in Q1 2025, though an improvement from the previous year's loss. Its Price-to-Earnings ratio of 6.4x indicates potential undervaluation relative to the market average, while its debt levels remain satisfactory with short-term assets exceeding liabilities significantly. However, GSD's Return on Equity is low at 5.4%, and operating cash flow does not adequately cover its debt obligations, suggesting areas for cautious consideration amidst stable volatility and experienced board oversight.

- Jump into the full analysis health report here for a deeper understanding of GSD Holding.

- Gain insights into GSD Holding's historical outcomes by reviewing our past performance report.

Fitaihi Holding Group (SASE:4180)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Fitaihi Holding Group operates in Saudi Arabia, offering gold, jewelry, and luxury products with a market cap of SAR959.75 million.

Operations: The company's revenue is entirely derived from its operations in Saudi Arabia, amounting to SAR44.77 million.

Market Cap: SAR959.75M

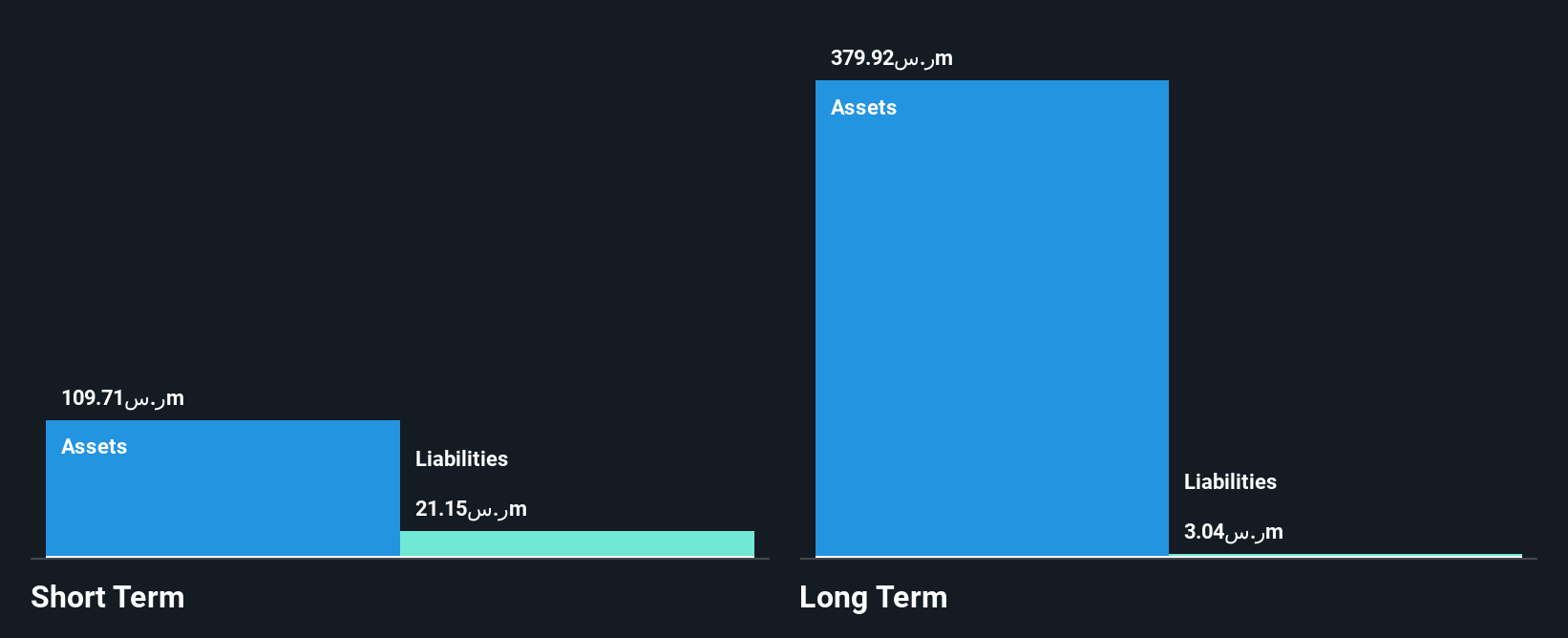

Fitaihi Holding Group offers an intriguing profile for penny stock investors in the Middle East, operating without debt and maintaining stable financial health with short-term assets of SAR109.7 million surpassing both long and short-term liabilities. Despite a recent net loss of SAR0.98 million for Q1 2025, Fitaihi's earnings growth over the past year has been substantial, significantly outpacing the luxury industry's average growth rate. The company's experienced board provides strategic oversight amidst these fluctuations. However, its Return on Equity remains low at 2.5%, suggesting potential areas needing improvement as it navigates market dynamics.

- Click to explore a detailed breakdown of our findings in Fitaihi Holding Group's financial health report.

- Understand Fitaihi Holding Group's track record by examining our performance history report.

Summing It All Up

- Click through to start exploring the rest of the 75 Middle Eastern Penny Stocks now.

- Contemplating Other Strategies? Explore 26 top quantum computing companies leading the revolution in next-gen technology and shaping the future with breakthroughs in quantum algorithms, superconducting qubits, and cutting-edge research.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:4180

Fitaihi Holding Group

Provides gold, jewelry, and luxury products primarily in Saudi Arabia.

Flawless balance sheet with solid track record.

Market Insights

Community Narratives