- United States

- /

- Capital Markets

- /

- NYSE:MS

Morgan Stanley (NYSE:MS) Chosen as Joint Bookrunner in Volvo Cars Fixed Income Initiative

Reviewed by Simply Wall St

Morgan Stanley (NYSE:MS) recently acted as a joint bookrunner for Volvo Cars' fixed income investor calls scheduled on June 2, 2025. The involvement indicates the company's active engagement in financial partnerships. Meanwhile, the market has seen a 2% climb over the past week and a 12% rise over the last year, with earnings forecast to grow by 14% annually. Morgan Stanley's 6.8% share price movement over the past month aligns with these broader market trends, with the announcement of preferred dividends across various series perhaps adding weight to its positive market trajectory.

Uncover the next big thing with financially sound penny stocks that balance risk and reward.

Morgan Stanley's involvement as a joint bookrunner for Volvo Cars' fixed income investor calls highlights its strong market position in facilitating significant financial partnerships. This engagement could bolster both client trust and market reputation, potentially driving future revenue growth and enhancing shareholder returns. Over the past five years, Morgan Stanley's total return, incorporating share price and dividends, was 200.73%. This substantial increase highlights the company's resilience and growth in delivering value to shareholders over a longer time frame.

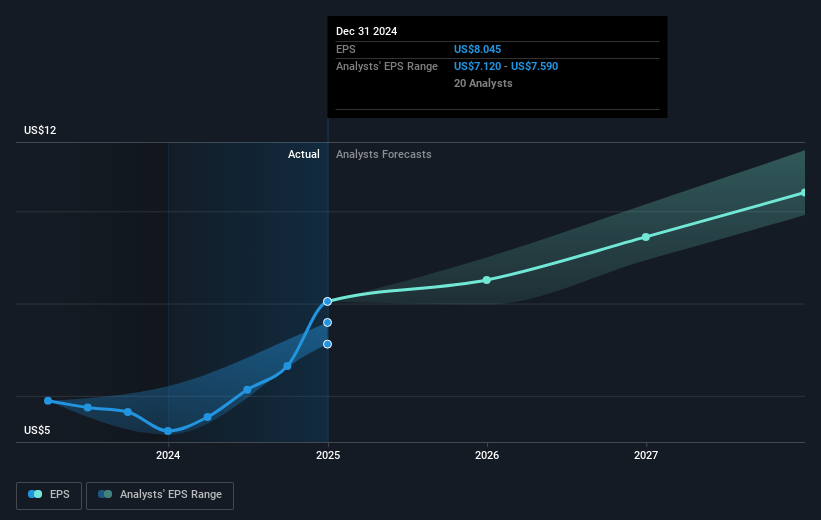

In comparison to the broader market, Morgan Stanley's performance is noteworthy as the company's earnings growth over the past year, at 52.8%, exceeded the Capital Markets industry's 16%. As analysts forecast a 3.6% annual revenue growth over the next three years, this joint bookrunner role may positively impact future earnings prospects and revenue streams, particularly through increased advisory and underwriting activities in M&A and IPO sectors.

With the current share price at US$118.33 and the consensus price target at US$124.13, there is a 4.7% potential upside as per analysts' consensus. This small discrepancy suggests expectations of stable market penetration and revenue generation, though the company's future price-to-earnings ratio of 16.2x remains below the industry average of 25.0x. Investors should consider these elements when assessing future potential alongside the company's proven track record of significant total shareholder returns.

Assess Morgan Stanley's previous results with our detailed historical performance reports.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:MS

Morgan Stanley

A financial holding company, provides various financial products and services to governments, financial institutions, and individuals in the Americas, Asia, Europe, Middle East, and Africa.

Solid track record, good value and pays a dividend.

Similar Companies

Market Insights

Community Narratives