- United Arab Emirates

- /

- Banks

- /

- DFM:AJMANBANK

Middle Eastern Penny Stocks With Market Caps Over US$7M

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently faced downward pressure due to weak oil prices, impacting fiscal balances in oil-reliant economies. Despite these challenges, the region still offers intriguing investment opportunities, particularly in the form of penny stocks. Although often seen as a relic of past market trends, penny stocks can present significant growth potential when supported by robust financial health and solid fundamentals.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.82 | SAR2.17B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.64 | SAR1.46B | ✅ 2 ⚠️ 1 View Analysis > |

| Alarum Technologies (TASE:ALAR) | ₪4.611 | ₪326.71M | ✅ 3 ⚠️ 2 View Analysis > |

| Mega Polietilen Köpük Sanayi ve Ticaret Anonim Sirketi (IBSE:MEGAP) | TRY4.80 | TRY1.32B | ✅ 2 ⚠️ 3 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.13 | AED2.26B | ✅ 5 ⚠️ 3 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.30 | AED683.1M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED2.97 | AED392.7M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.88 | AED12.29B | ✅ 2 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.84 | AED524.31M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.833 | ₪210.61M | ✅ 2 ⚠️ 2 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Ajman Bank PJSC (DFM:AJMANBANK)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ajman Bank PJSC offers a range of banking products and services to individuals, businesses, and government institutions in the United Arab Emirates, with a market capitalization of AED3.90 billion.

Operations: Ajman Bank PJSC generates revenue through its Treasury (AED139.57 million), Consumer Banking (AED302.69 million), and Wholesale Banking (AED395.46 million) segments.

Market Cap: AED3.9B

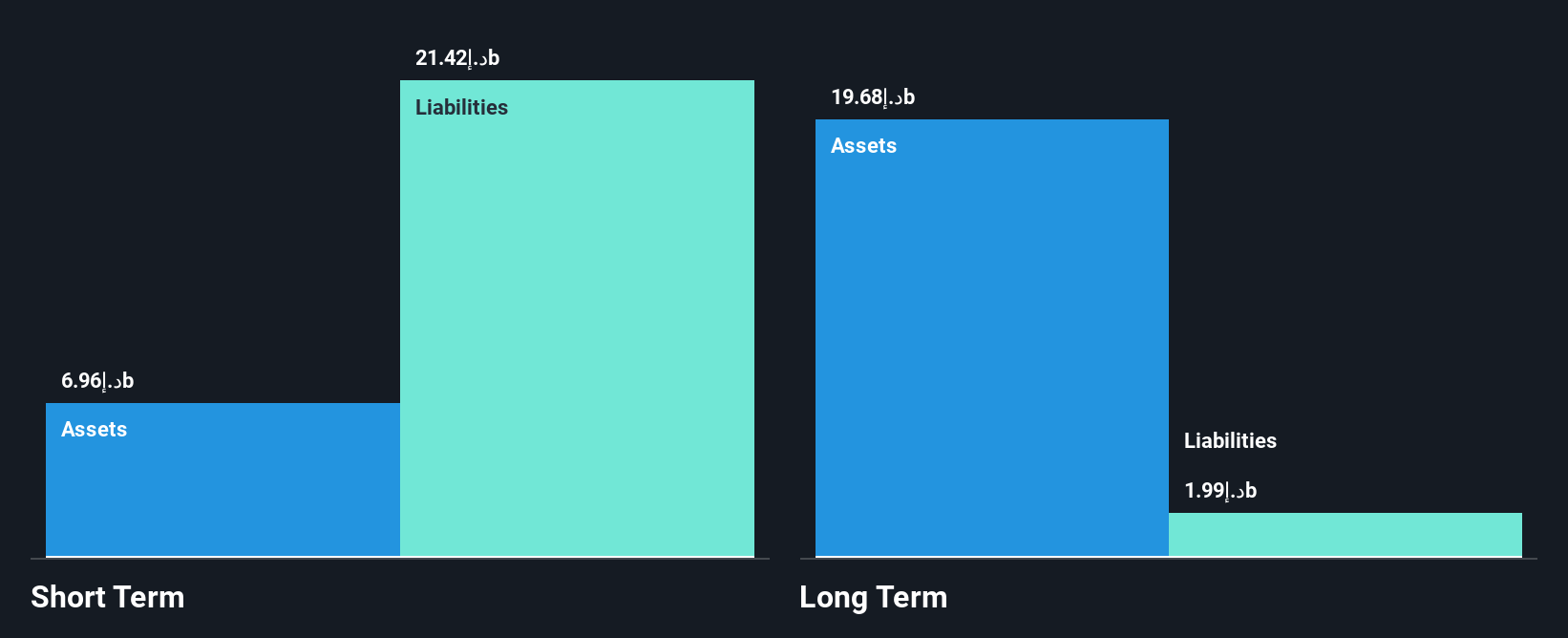

Ajman Bank PJSC, with a market cap of AED3.90 billion, has shown financial resilience despite challenges. Recent earnings reveal net income growth to AED 110.42 million for Q2 2025, up from AED 108.14 million a year ago, indicating profitability improvement. The bank maintains stable funding through customer deposits and an appropriate Loans to Deposits ratio of 71%. However, high bad loans at 9.8% and low Return on Equity at 13.3% present concerns. Its Price-To-Earnings ratio of 9.1x suggests good value compared to the local market average of 12.8x, while management's experience adds operational stability.

- Click here to discover the nuances of Ajman Bank PJSC with our detailed analytical financial health report.

- Gain insights into Ajman Bank PJSC's historical outcomes by reviewing our past performance report.

Airtouch Solar (TASE:ARTS)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Airtouch Solar Ltd, with a market cap of ₪24.26 million, offers autonomous water-free robotic cleaning solutions for solar panels.

Operations: No revenue segments have been reported for Airtouch Solar.

Market Cap: ₪24.26M

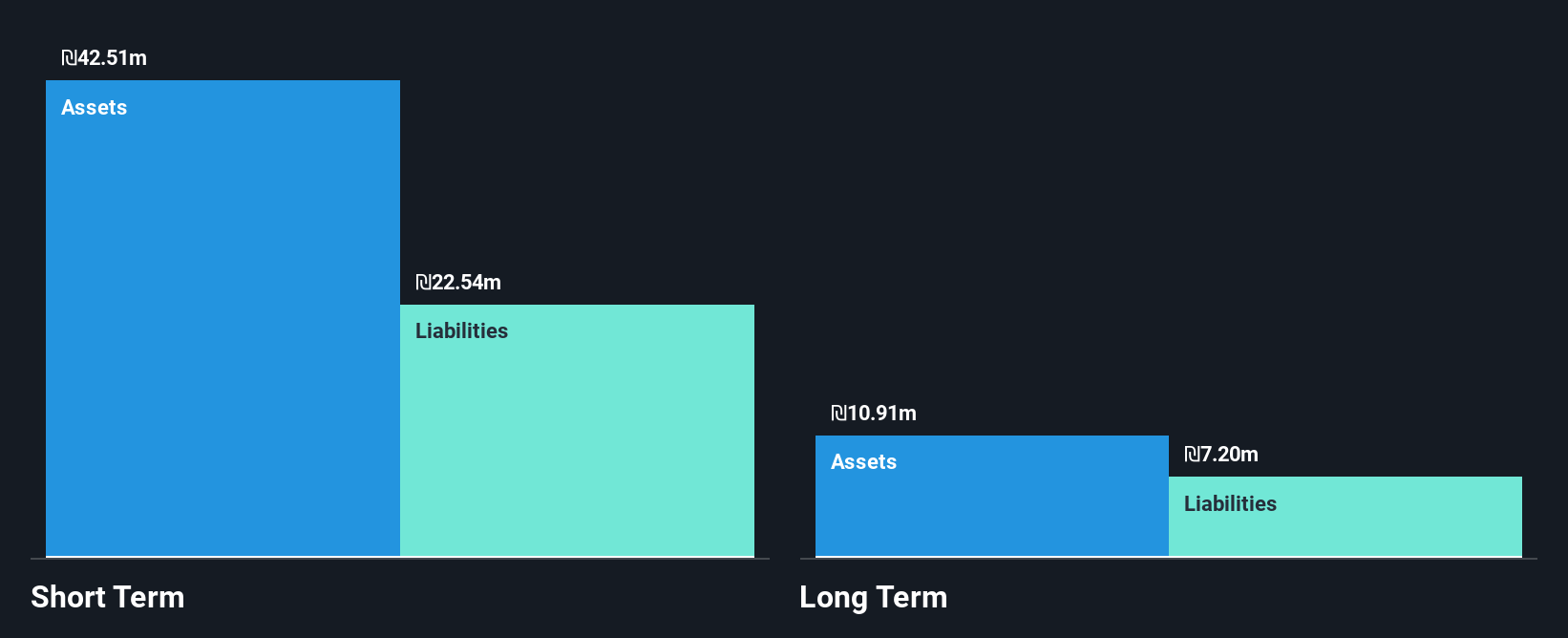

Airtouch Solar Ltd, with a market cap of ₪24.26 million, is navigating the challenges typical of penny stocks. The company reported sales of ₪16.36 million for the half year ended June 2025, but remains unprofitable with a net loss of ₪3.52 million. Despite this, Airtouch Solar has improved its financial health by turning negative shareholder equity positive over five years and maintaining more cash than total debt. Its short-term assets significantly exceed liabilities, providing some financial stability amid high volatility in share price and reduced weekly volatility from 15% to 10% over the past year.

- Click here and access our complete financial health analysis report to understand the dynamics of Airtouch Solar.

- Review our historical performance report to gain insights into Airtouch Solar's track record.

Avrot Industries (TASE:AVRT)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Avrot Industries Ltd specializes in the lining and coating of steel pipes in Israel, with a market cap of ₪183.85 million.

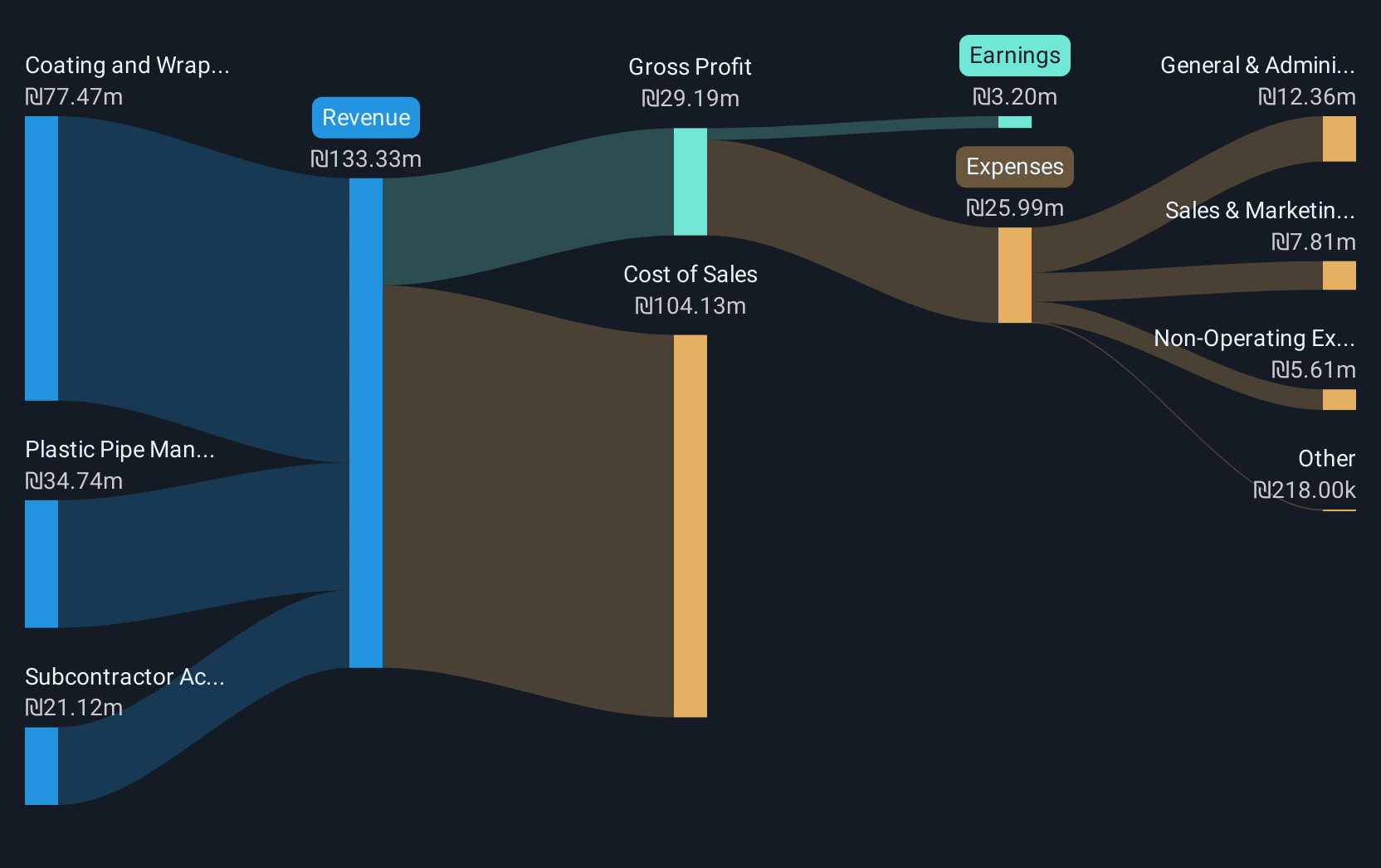

Operations: Avrot Industries generates revenue through three main segments: Plastic Pipe Manufacturing (₪34.74 million), Coating and Wrapping of Steel Pipe (₪77.47 million), and Subcontractor Activity in Water and Sewage Infrastructure (₪21.12 million).

Market Cap: ₪183.85M

Avrot Industries Ltd, with a market cap of ₪183.85 million, has recently reported half-year sales of ₪62.57 million and net income of ₪0.847 million, marking its transition to profitability over the past year. The company generates revenue from three main segments: Plastic Pipe Manufacturing (₪34.74 million), Coating and Wrapping of Steel Pipe (₪77.47 million), and Subcontractor Activity in Water and Sewage Infrastructure (₪21.12 million). Avrot's financial health is robust, with short-term assets exceeding both short- and long-term liabilities, a satisfactory net debt to equity ratio at 2.3%, and interest payments well covered by EBIT at 5.6x coverage.

- Take a closer look at Avrot Industries' potential here in our financial health report.

- Evaluate Avrot Industries' historical performance by accessing our past performance report.

Summing It All Up

- Dive into all 80 of the Middle Eastern Penny Stocks we have identified here.

- Curious About Other Options? Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:AJMANBANK

Ajman Bank PJSC

Provides various banking products and services for individuals, businesses, and government institutions in the United Arab Emirates.

Adequate balance sheet with acceptable track record.

Market Insights

Community Narratives