Middle Eastern Penny Stocks Under US$4B Market Cap To Consider

Reviewed by Simply Wall St

As Gulf stock markets navigate mixed performances, influenced by fluctuating oil prices and cautious investor sentiment ahead of key U.S. Federal Reserve discussions, the Middle Eastern financial landscape remains a focal point for investors. Penny stocks, though an older term, continue to offer intriguing opportunities within this market context, particularly among smaller or newer companies that may be undervalued. By focusing on those with strong balance sheets and solid fundamentals, these stocks can present potential growth prospects without the heightened risks often associated with this investment area.

Top 10 Penny Stocks In The Middle East

| Name | Share Price | Market Cap | Rewards & Risks |

| Maharah for Human Resources (SASE:1831) | SAR4.79 | SAR2.16B | ✅ 2 ⚠️ 3 View Analysis > |

| Thob Al Aseel (SASE:4012) | SAR3.70 | SAR1.48B | ✅ 2 ⚠️ 1 View Analysis > |

| E7 Group PJSC (ADX:E7) | AED1.55 | AED3.1B | ✅ 2 ⚠️ 3 View Analysis > |

| Katmerciler Arac Üstü Ekipman Sanayi ve Ticaret (IBSE:KATMR) | TRY3.21 | TRY3.46B | ✅ 2 ⚠️ 2 View Analysis > |

| Al Wathba National Insurance Company PJSC (ADX:AWNIC) | AED3.74 | AED776.25M | ✅ 2 ⚠️ 3 View Analysis > |

| Dubai National Insurance & Reinsurance (P.S.C.) (DFM:DNIR) | AED3.30 | AED381.15M | ✅ 2 ⚠️ 4 View Analysis > |

| Dubai Investments PJSC (DFM:DIC) | AED2.88 | AED12.29B | ✅ 3 ⚠️ 3 View Analysis > |

| Union Properties (DFM:UPP) | AED0.849 | AED3.64B | ✅ 1 ⚠️ 3 View Analysis > |

| Sharjah Cement and Industrial Development (PJSC) (ADX:SCIDC) | AED0.919 | AED557.16M | ✅ 2 ⚠️ 2 View Analysis > |

| Tgi Infrastructures (TASE:TGI) | ₪2.98 | ₪221.54M | ✅ 2 ⚠️ 3 View Analysis > |

Click here to see the full list of 80 stocks from our Middle Eastern Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

Dubai Investments PJSC (DFM:DIC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Dubai Investments PJSC operates in property, investment, manufacturing, contracting, and services sectors both in the United Arab Emirates and internationally, with a market cap of AED12.29 billion.

Operations: The company generates revenue from three main segments: Property (AED1.87 billion), Manufacturing, Contracting and Services (AED1.46 billion), and Investments (AED214.32 million).

Market Cap: AED12.29B

Dubai Investments PJSC, with a market cap of AED12.29 billion, operates across multiple sectors and has shown a mixed financial performance recently. While the company's earnings grew significantly by 35.3% in the past year, surpassing industry averages, its revenue declined slightly over the same period. The firm maintains a satisfactory net debt to equity ratio of 17.3% and experienced management and board teams with average tenures exceeding five years contribute to its stability. However, interest coverage is low at 2x EBIT, indicating potential challenges in managing debt obligations effectively despite strong short-term asset coverage of liabilities.

- Dive into the specifics of Dubai Investments PJSC here with our thorough balance sheet health report.

- Examine Dubai Investments PJSC's earnings growth report to understand how analysts expect it to perform.

Ihlas Gazetecilik (IBSE:IHGZT)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: Ihlas Gazetecilik A.S. is involved in publishing, selling, distributing, and marketing newspapers, books, encyclopedias, brochures, and magazines both in Turkey and internationally with a market cap of TRY1.62 billion.

Operations: The company generates revenue primarily from its publishing segment, specifically newspapers, with a total of TRY1.76 billion.

Market Cap: TRY1.62B

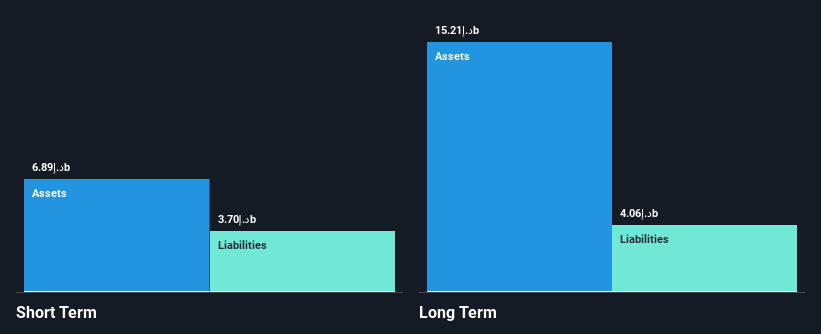

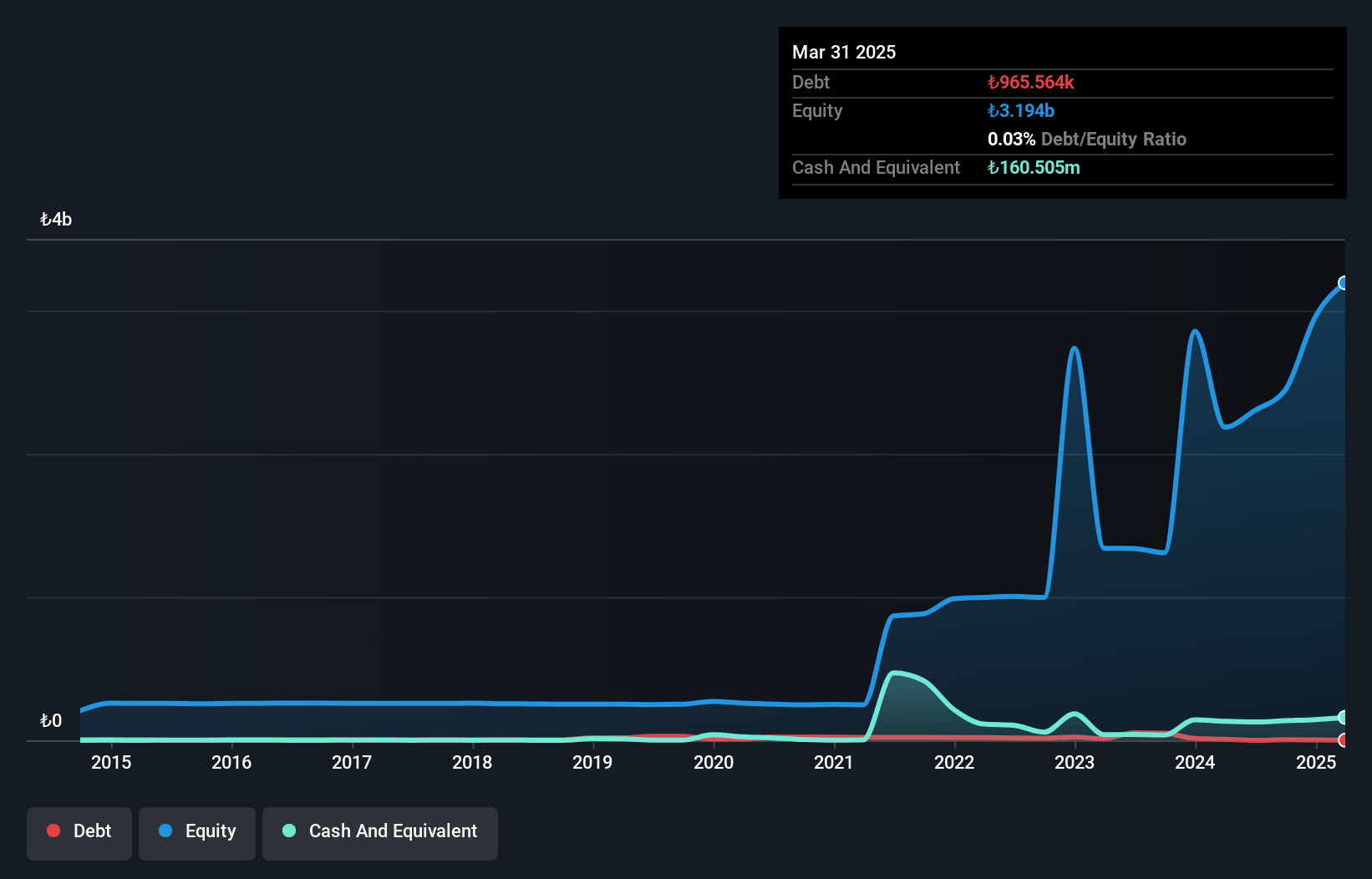

Ihlas Gazetecilik A.S., with a market cap of TRY1.62 billion, has recently turned profitable, though its Return on Equity remains low at 5.1%. The company's short-term assets of TRY1 billion comfortably cover both its short-term and long-term liabilities. Despite negative operating cash flow indicating that debt is not well covered by cash flow, the company holds more cash than total debt and has significantly reduced its debt-to-equity ratio over the past five years. However, a large one-off loss of TRY129.9 million impacted recent financial results, highlighting potential volatility in earnings quality.

- Take a closer look at Ihlas Gazetecilik's potential here in our financial health report.

- Understand Ihlas Gazetecilik's track record by examining our performance history report.

Tgi Infrastructures (TASE:TGI)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Tgi Infrastructures Ltd, along with its subsidiary, specializes in producing, processing, assembling, and marketing magnesium-based mechanical assemblies for the automotive industry in Israel, with a market cap of ₪221.54 million.

Operations: TASE:TGI generates revenue primarily through its Infrastructure and Energy segment, contributing ₪82.70 million, and the Metal and Electrical Industries segment, which adds ₪81.87 million.

Market Cap: ₪221.54M

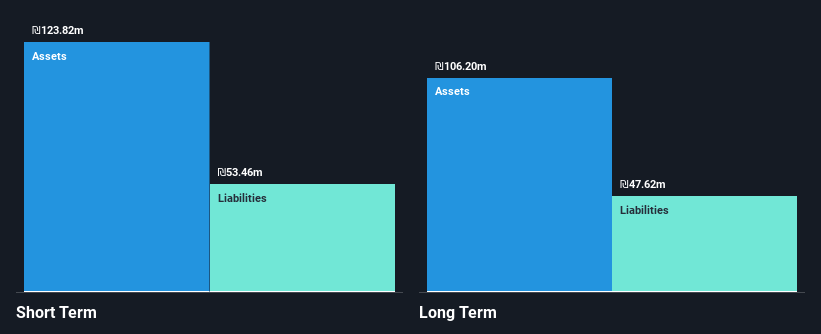

Tgi Infrastructures Ltd, with a market cap of ₪221.54 million, has shown solid financial performance, reporting first-quarter sales of ₪43.04 million and net income of ₪5.49 million. The company's earnings growth over the past year was notable at 37.7%, although it lags behind its five-year average growth rate of 59.8% annually. Tgi's short-term assets exceed both its short-term and long-term liabilities, and its debt is well covered by operating cash flow at 54.9%. However, despite offering a dividend yield of 7.25%, it's not well supported by earnings or free cash flows, indicating potential sustainability concerns.

- Click to explore a detailed breakdown of our findings in Tgi Infrastructures' financial health report.

- Gain insights into Tgi Infrastructures' past trends and performance with our report on the company's historical track record.

Make It Happen

- Embark on your investment journey to our 80 Middle Eastern Penny Stocks selection here.

- Want To Explore Some Alternatives? Rare earth metals are an input to most high-tech devices, military and defence systems and electric vehicles. The global race is on to secure supply of these critical minerals. Beat the pack to uncover the 27 best rare earth metal stocks of the very few that mine this essential strategic resource.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About IBSE:IHGZT

Ihlas Gazetecilik

Ihlas Gazetecilik A.S. publishes, sells, distributes, and markets newspapers, books, encyclopedias, brochures, and magazines in Turkey and internationally.

Adequate balance sheet and slightly overvalued.

Market Insights

Community Narratives