- United Arab Emirates

- /

- Banks

- /

- DFM:EMIRATESNBD

Middle Eastern Dividend Stocks To Consider For Your Portfolio

Reviewed by Simply Wall St

The Middle Eastern stock markets have recently experienced mixed performances, with the UAE showing gains driven by trade optimism and positive earnings expectations, while Saudi Arabia faced volatility due to mixed earnings results and several blue-chip stocks trading ex-dividend. In such a dynamic environment, dividend stocks can offer investors a measure of stability and income potential, making them an attractive consideration for those looking to navigate the current market landscape.

Top 10 Dividend Stocks In The Middle East

| Name | Dividend Yield | Dividend Rating |

| Saudi Telecom (SASE:7010) | 9.97% | ★★★★★☆ |

| Saudi National Bank (SASE:1180) | 5.48% | ★★★★★☆ |

| Saudi Awwal Bank (SASE:1060) | 6.17% | ★★★★★☆ |

| Riyad Bank (SASE:1010) | 6.53% | ★★★★★☆ |

| National Bank of Ras Al-Khaimah (P.S.C.) (ADX:RAKBANK) | 6.39% | ★★★★★☆ |

| Emirates NBD Bank PJSC (DFM:EMIRATESNBD) | 3.75% | ★★★★★☆ |

| Emaar Properties PJSC (DFM:EMAAR) | 6.47% | ★★★★★☆ |

| Commercial Bank of Dubai PSC (DFM:CBD) | 5.02% | ★★★★★☆ |

| Arab National Bank (SASE:1080) | 6.21% | ★★★★★☆ |

| Anadolu Hayat Emeklilik Anonim Sirketi (IBSE:ANHYT) | 6.84% | ★★★★★☆ |

Click here to see the full list of 74 stocks from our Top Middle Eastern Dividend Stocks screener.

Let's explore several standout options from the results in the screener.

Emirates NBD Bank PJSC (DFM:EMIRATESNBD)

Simply Wall St Dividend Rating: ★★★★★☆

Overview: Emirates NBD Bank PJSC, along with its subsidiaries, offers a range of corporate, institutional, retail, treasury, and Islamic banking services and has a market cap of AED168.65 billion.

Operations: Emirates NBD Bank PJSC generates revenue from several segments, including Deniz Bank with AED10.78 billion, Global Markets and Treasury with AED2.56 billion, Corporate and Institutional Banking with AED9.77 billion, and Retail Banking and Wealth Management contributing AED16.60 billion.

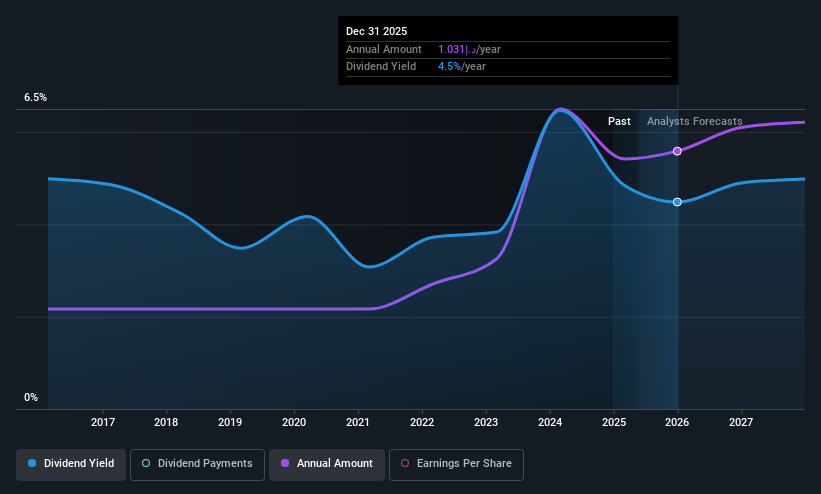

Dividend Yield: 3.7%

Emirates NBD Bank PJSC offers a stable dividend profile with a payout ratio of 29.8%, ensuring dividends are well covered by earnings. While its 3.75% yield is lower than top-tier dividend payers in the AE market, it has shown reliability and stability over the past decade. The bank's price-to-earnings ratio of 8x suggests good value relative to peers, though it faces challenges with a high non-performing loan ratio of 2.8%.

- Navigate through the intricacies of Emirates NBD Bank PJSC with our comprehensive dividend report here.

- Insights from our recent valuation report point to the potential undervaluation of Emirates NBD Bank PJSC shares in the market.

Al Rajhi REIT Fund (SASE:4340)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Al Rajhi REIT Fund is a Sharia-compliant investment fund listed on Tadawul, focused on generating periodic income by investing in income-generating real estate assets in Saudi Arabia, with a market cap of SAR2.30 billion.

Operations: The Al Rajhi REIT Fund's revenue primarily comes from its commercial real estate segment, generating approximately SAR260.26 million.

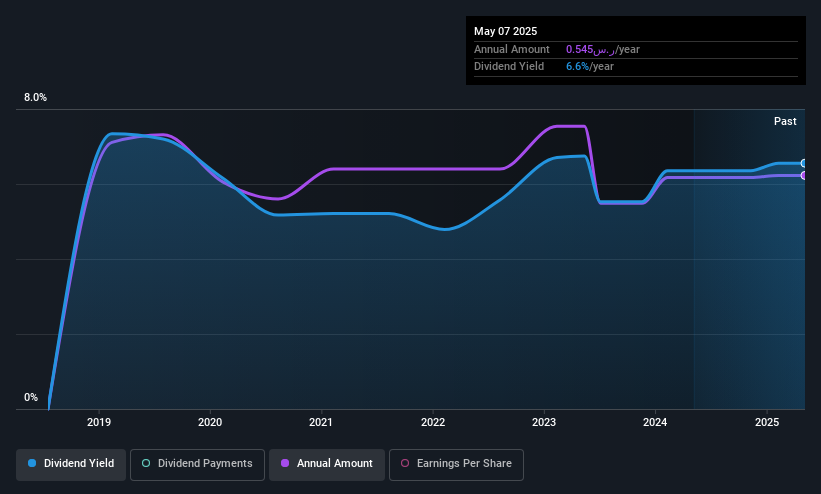

Dividend Yield: 6.5%

Al Rajhi REIT Fund's dividend yield of 6.5% ranks in the top 25% within the Saudi market, yet its payments have been unstable over six years, with recent reductions to SAR 0.1200 per share. The payout ratios—96.8% from earnings and 98.3% from cash flows—indicate dividends are covered but leave limited room for flexibility or growth. Recent board changes could impact future governance, though the fund trades at a significant discount to estimated fair value.

- Unlock comprehensive insights into our analysis of Al Rajhi REIT Fund stock in this dividend report.

- Our expertly prepared valuation report Al Rajhi REIT Fund implies its share price may be lower than expected.

Computer Direct Group (TASE:CMDR)

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Computer Direct Group Ltd. operates in the computing and software sector in Israel with a market capitalization of ₪1.60 billion.

Operations: Computer Direct Group Ltd.'s revenue is derived from three main segments: Infrastructure and Computing (₪1.28 billion), Outsourcing of Business Processes and Technology Support Centers (₪326.89 million), and Technological Solutions and Services, Management Consulting, and Value-Added Services (₪2.57 billion).

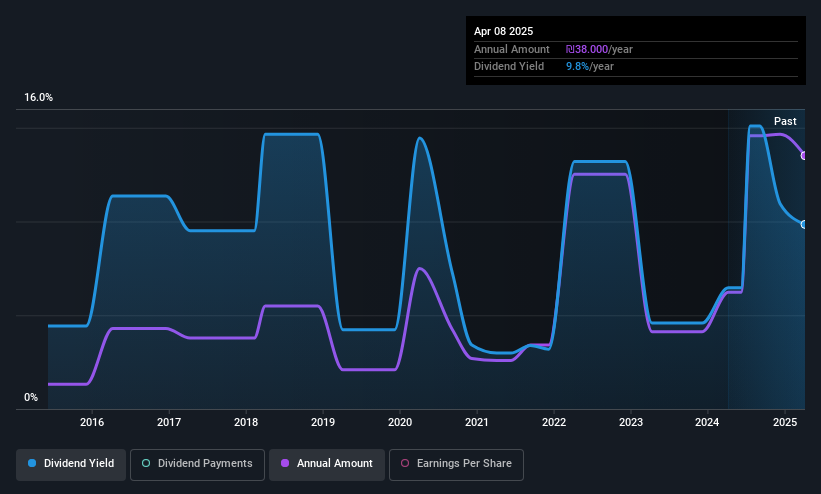

Dividend Yield: 8.1%

Computer Direct Group's dividend yield of 8.12% is among the top 25% in the IL market, despite a high payout ratio of 148.3%, indicating dividends are not well covered by earnings but are supported by a low cash payout ratio of 31.5%. While dividends have grown over the past decade, they remain volatile and unreliable. Recent earnings show growth with ILS 1.13 billion in sales and net income rising to ILS 22.17 million from last year.

- Click here and access our complete dividend analysis report to understand the dynamics of Computer Direct Group.

- The analysis detailed in our Computer Direct Group valuation report hints at an deflated share price compared to its estimated value.

Seize The Opportunity

- Delve into our full catalog of 74 Top Middle Eastern Dividend Stocks here.

- Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Ready For A Different Approach?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

- Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Emirates NBD Bank PJSC might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About DFM:EMIRATESNBD

Emirates NBD Bank PJSC

Provides corporate, institutional, retail, treasury, and Islamic banking services.

Excellent balance sheet established dividend payer.

Similar Companies

Market Insights

Community Narratives