- United States

- /

- Interactive Media and Services

- /

- NasdaqGS:META

Meta Platforms (NasdaqGS:META) Announces US$0.53 Dividend for Shareholders

Reviewed by Simply Wall St

Meta Platforms (NasdaqGS:META) recently declared a quarterly cash dividend of $0.53 per share, reflecting its continued commitment to shareholder value. Over the last month, the company's stock saw a notable price increase of 16%, possibly influenced by this announcement. Despite broader market uncertainties, Meta’s robust earnings growth and positive quarterly revenue guidance likely added weight to this upward trend. Additionally, the company's collaboration with Red Hat on generative AI technology might have positively influenced investor sentiment. While the market, including the Nasdaq, experienced gains, Meta’s stronger rise indicates specific investor confidence in its strategic moves.

We've discovered 1 risk for Meta Platforms that you should be aware of before investing here.

The recent announcement of a quarterly cash dividend by Meta Platforms may reinforce investor confidence in the company's ongoing commitment to shareholder value. This confidence coincides with the 16% increase in Meta's share price over the past month, which may also reflect positive sentiment surrounding its collaboration with Red Hat on generative AI technology. Undoubtedly, the focus on AI and improved ad targeting holds the potential to bolster revenue by enhancing digital engagement, a sentiment echoed by the narrative that AI and business messaging could significantly impact Meta's growth prospects.

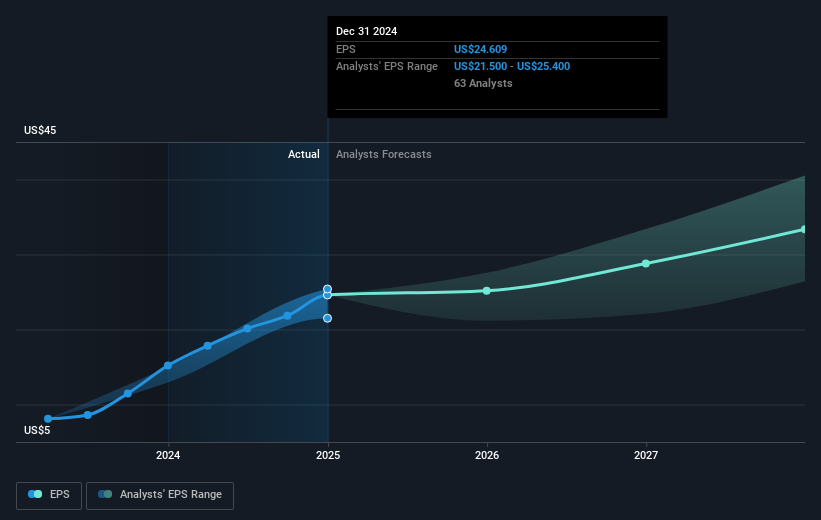

Reflecting on the longer-term performance, Meta's total return of over 225.9% in the past three years exemplifies its significant growth trajectory, far outpacing the US market and industry, both of which saw lower returns over the past year. As Meta strives to expand its commerce capabilities through WhatsApp and Messenger, these developments might catalyze further revenue expansion, aligning with analysts' forecasts of revenue growth at an annual rate of 12.7% over the next few years. However, increased AI investments and operational challenges in Europe pose potential risks to maintaining current profit margins.

With Meta trading at US$587.31, the share price is currently positioned below the consensus analyst price target of US$703.89, suggesting further upside potential. Nevertheless, this valuation hinges on achieving the projected earnings of US$86 billion by 2028. Investors should weigh these factors critically, considering the persistent challenges faced by the Reality Labs and potential impacts of regulatory adjustments in Europe. As these elements unfold, they will determine the accuracy of future earnings forecasts and the alignment with the consensus price target.

Explore historical data to track Meta Platforms' performance over time in our past results report.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

The New Payments ETF Is Live on NASDAQ:

Money is moving to real-time rails, and a newly listed ETF now gives investors direct exposure. Fast settlement. Institutional custody. Simple access.

Explore how this launch could reshape portfolios

Sponsored ContentNew: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:META

Meta Platforms

Engages in the development of products that enable people to connect and share with friends and family through mobile devices, personal computers, virtual reality and mixed reality headsets, augmented reality, and wearables worldwide.

Undervalued with excellent balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)