- United States

- /

- Semiconductors

- /

- NasdaqGS:MRVL

Marvell Technology (MRVL) Unveils Structera Product Line for CXL Memory Solutions

Reviewed by Simply Wall St

Marvell Technology (MRVL) recently announced the successful interoperability of its Structera portfolio, setting a milestone in data-centric applications with compatibility across key memory solutions and CPU platforms. Despite this positive news, the company's stock experienced a 2.6% decline over the last quarter. In contrast, market trends demonstrated mixed outcomes with slight rises in major indexes, as tech stocks, including Alphabet and Apple, performed well. The broader market's enthusiasm was partially dampened by trade uncertainties and labor market concerns, and while Marvell’s advancements offer long-term benefits, they may have been insufficient to offset sector-wide apprehensions.

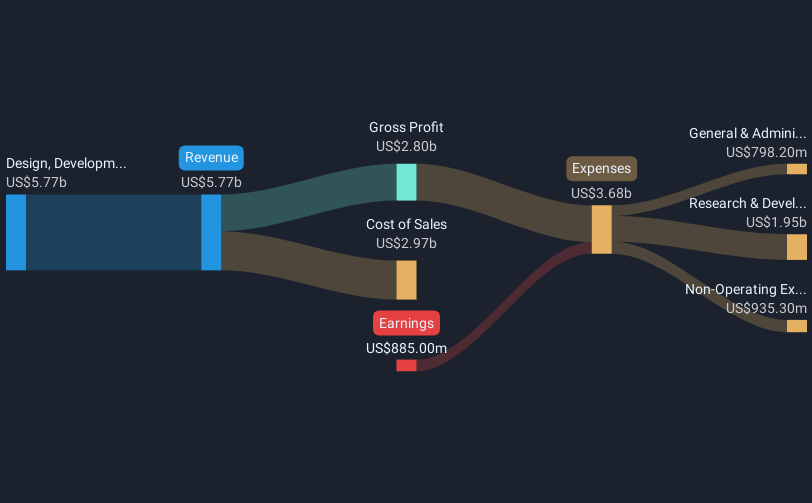

Marvell Technology's recent advancement in the Structera portfolio marks a significant milestone in enhancing data-centric applications, with potential long-term benefits for its data center operations. This development aligns with the company's focus on leveraging AI demand and advancing semiconductor technology. Over the past five years, Marvell's total shareholder return, including share price appreciation and dividends, was 75.75%. This historical performance provides a context for understanding its recent short-term share price decline of 2.6% last quarter. In comparison, Marvell underperformed the broader US Semiconductor industry, which returned 46.1% over the past year.

The interoperability achievement could positively influence revenue and earnings forecasts. Analysts anticipate Marvell's revenue growth to accelerate in conjunction with the deployment of AI-driven custom silicon programs and new technologies, such as the 3-nanometer 1.6T DSP. Currently, Marvell's share price sits at US$64.60, presenting potential upside relative to the analysts' consensus price target of US$86.09, representing a discount of approximately 33.27%. The price movement indicates an opportunity for catching up to the analysts’ anticipated valuations, contingent on realizing the projected advancements and overcoming industry apprehensions.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:MRVL

Marvell Technology

Provides data infrastructure semiconductor solutions, spanning the data center core to network edge.

Reasonable growth potential with adequate balance sheet.

Similar Companies

Market Insights

Community Narratives