- India

- /

- Auto Components

- /

- NSEI:LUMAXIND

Lumax Industries (NSE:LUMAXIND) Has Gifted Shareholders With A Fantastic 234% Total Return On Their Investment

Lumax Industries Limited (NSE:LUMAXIND) shareholders might be concerned after seeing the share price drop 13% in the last quarter. But in stark contrast, the returns over the last half decade have impressed. It's fair to say most would be happy with 201% the gain in that time. So while it's never fun to see a share price fall, it's important to look at a longer time horizon. Ultimately business performance will determine whether the stock price continues the positive long term trend. Unfortunately not all shareholders will have held it for five years, so spare a thought for those caught in the 35% decline over the last three years: that's a long time to wait for profits.

View our latest analysis for Lumax Industries

While the efficient markets hypothesis continues to be taught by some, it has been proven that markets are over-reactive dynamic systems, and investors are not always rational. One flawed but reasonable way to assess how sentiment around a company has changed is to compare the earnings per share (EPS) with the share price.

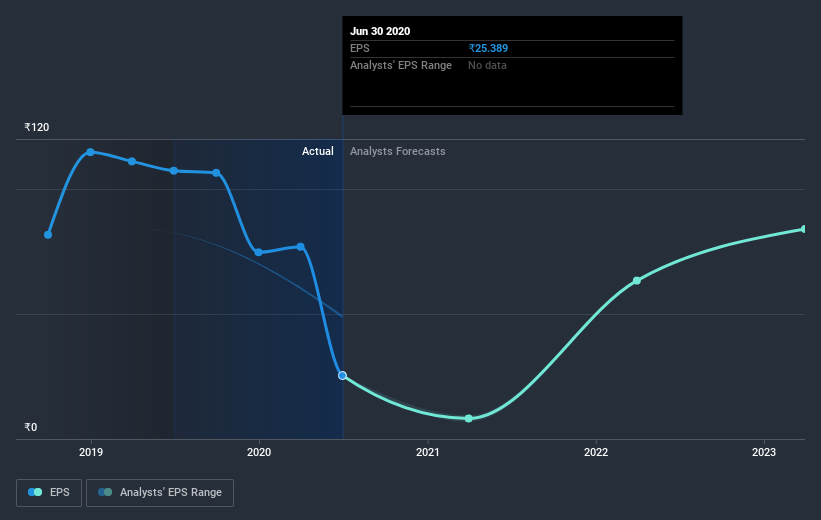

Over half a decade, Lumax Industries managed to grow its earnings per share at 0.7% a year. This EPS growth is slower than the share price growth of 25% per year, over the same period. This suggests that market participants hold the company in higher regard, these days. That's not necessarily surprising considering the five-year track record of earnings growth. This optimism is visible in its fairly high P/E ratio of 50.53.

You can see how EPS has changed over time in the image below (click on the chart to see the exact values).

Before buying or selling a stock, we always recommend a close examination of historic growth trends, available here.

What About Dividends?

When looking at investment returns, it is important to consider the difference between total shareholder return (TSR) and share price return. Whereas the share price return only reflects the change in the share price, the TSR includes the value of dividends (assuming they were reinvested) and the benefit of any discounted capital raising or spin-off. So for companies that pay a generous dividend, the TSR is often a lot higher than the share price return. We note that for Lumax Industries the TSR over the last 5 years was 234%, which is better than the share price return mentioned above. And there's no prize for guessing that the dividend payments largely explain the divergence!

A Different Perspective

We're pleased to report that Lumax Industries shareholders have received a total shareholder return of 6.2% over one year. That's including the dividend. However, that falls short of the 27% TSR per annum it has made for shareholders, each year, over five years. Potential buyers might understandably feel they've missed the opportunity, but it's always possible business is still firing on all cylinders. I find it very interesting to look at share price over the long term as a proxy for business performance. But to truly gain insight, we need to consider other information, too. Take risks, for example - Lumax Industries has 4 warning signs (and 2 which don't sit too well with us) we think you should know about.

Of course Lumax Industries may not be the best stock to buy. So you may wish to see this free collection of growth stocks.

Please note, the market returns quoted in this article reflect the market weighted average returns of stocks that currently trade on IN exchanges.

When trading Lumax Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

If you're looking to trade Lumax Industries, open an account with the lowest-cost platform trusted by professionals, Interactive Brokers.

With clients in over 200 countries and territories, and access to 160 markets, IBKR lets you trade stocks, options, futures, forex, bonds and funds from a single integrated account.

Enjoy no hidden fees, no account minimums, and FX conversion rates as low as 0.03%, far better than what most brokers offer.

Sponsored ContentNew: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:LUMAXIND

Lumax Industries

Manufactures and sells automotive components for in India.

Undervalued with high growth potential and pays a dividend.

Market Insights

Community Narratives