- United States

- /

- Chemicals

- /

- NYSE:SQM

June 2025's Top Stock Picks Possibly Priced Below Estimated Value

Reviewed by Simply Wall St

As the major U.S. stock indices, including the S&P 500 and Dow Jones, continue to post gains amid strong economic data and easing tariff concerns, investors are increasingly on the lookout for opportunities that may be undervalued in this buoyant market. Identifying stocks potentially priced below their estimated value can offer a strategic advantage, especially when supported by robust corporate earnings and favorable economic indicators.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Verra Mobility (VRRM) | $24.38 | $47.89 | 49.1% |

| Redwire (RDW) | $17.68 | $35.10 | 49.6% |

| Peoples Financial Services (PFIS) | $47.56 | $93.66 | 49.2% |

| Pagaya Technologies (PGY) | $16.75 | $33.36 | 49.8% |

| MetroCity Bankshares (MCBS) | $27.31 | $53.06 | 48.5% |

| Lyft (LYFT) | $15.53 | $30.52 | 49.1% |

| Lincoln Educational Services (LINC) | $22.57 | $44.02 | 48.7% |

| First Internet Bancorp (INBK) | $22.58 | $43.85 | 48.5% |

| Central Pacific Financial (CPF) | $26.30 | $51.99 | 49.4% |

| Arrow Financial (AROW) | $25.41 | $49.74 | 48.9% |

Here's a peek at a few of the choices from the screener.

Wix.com (WIX)

Overview: Wix.com Ltd. operates a cloud-based web development platform serving registered users and creators globally, with a market cap of $8.57 billion.

Operations: The company's revenue primarily stems from its Internet Software & Services segment, which generated $1.81 billion.

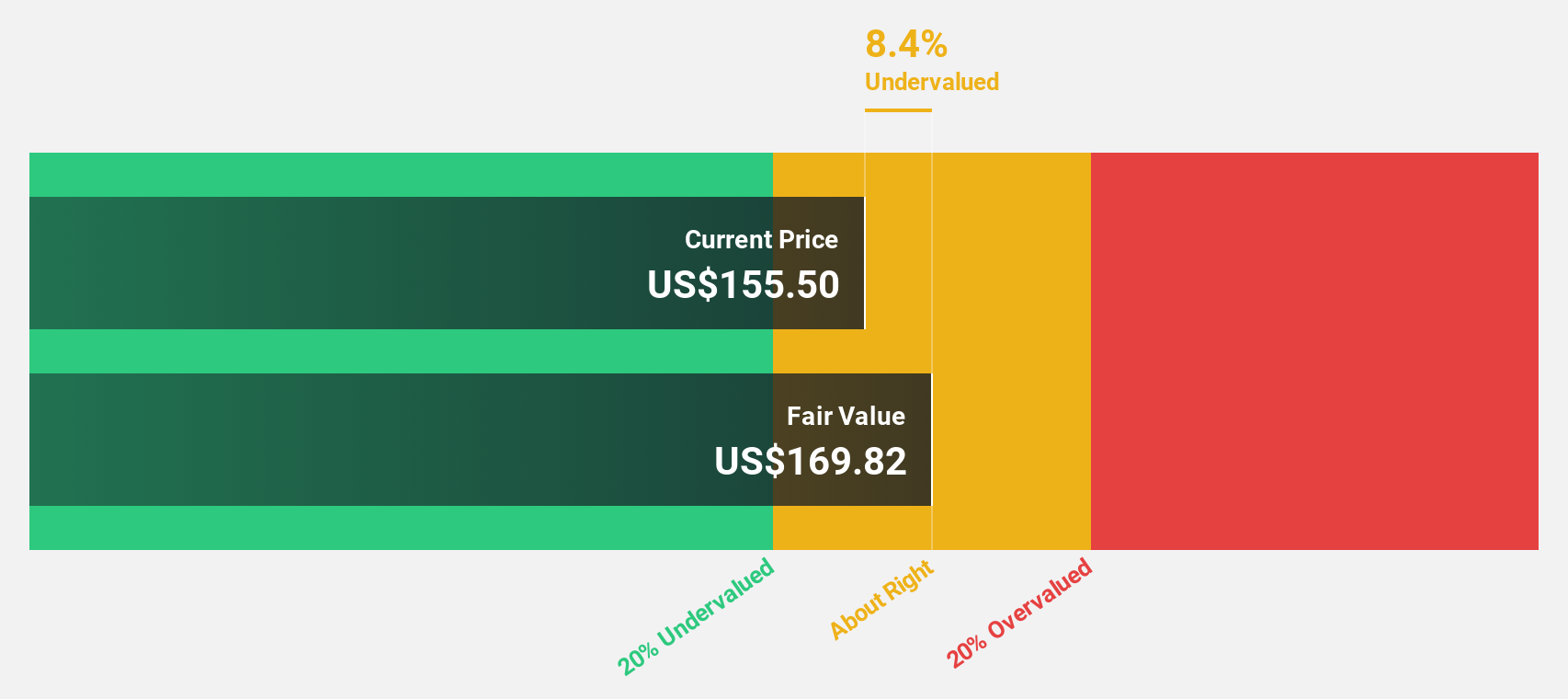

Estimated Discount To Fair Value: 10.1%

Wix.com is trading at US$153.25, slightly below its estimated fair value of US$170.37, indicating it may be undervalued based on cash flows. The company reported strong earnings growth with Q1 2025 revenue at US$473.65 million and net income of US$33.77 million, reflecting robust financial performance despite a high level of debt. Its innovative product launches like Wixel and strategic partnerships further support its growth potential in the evolving tech landscape.

- In light of our recent growth report, it seems possible that Wix.com's financial performance will exceed current levels.

- Unlock comprehensive insights into our analysis of Wix.com stock in this financial health report.

Albemarle (ALB)

Overview: Albemarle Corporation offers energy storage solutions globally and has a market cap of approximately $7.02 billion.

Operations: The company's revenue is derived from three main segments: Ketjen ($1.02 billion), Specialties ($1.33 billion), and Energy Storage ($2.74 billion).

Estimated Discount To Fair Value: 17.7%

Albemarle, trading at US$58.64, is undervalued compared to its estimated fair value of US$71.23. Despite a drop in sales to US$1.08 billion for Q1 2025 from the previous year, net income rose significantly to US$41.35 million, highlighting improved profitability. However, its dividend yield of 2.76% is not well supported by earnings or free cash flows, and it faces challenges with low projected return on equity and being dropped from the FTSE All-World Index.

- Our expertly prepared growth report on Albemarle implies its future financial outlook may be stronger than recent results.

- Click here to discover the nuances of Albemarle with our detailed financial health report.

Sociedad Química y Minera de Chile (SQM)

Overview: Sociedad Química y Minera de Chile S.A. is a global mining company with a market cap of approximately $9.15 billion.

Operations: The company's revenue segments include Potassium ($249.68 million), Industrial Chemicals ($75.14 million), Iodine and Derivatives ($983.18 million), Lithium and Derivatives ($2.20 billion), and Specialty Plant Nutrition ($946.42 million).

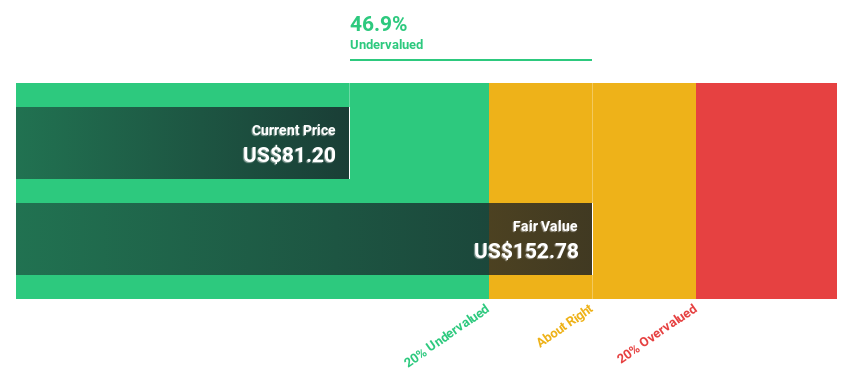

Estimated Discount To Fair Value: 24.1%

Sociedad Química y Minera de Chile is trading at US$32.30, significantly below its estimated fair value of US$42.53, indicating it is undervalued by over 20%. Despite a slight decline in Q1 2025 sales to US$1.04 billion, net income improved substantially to US$137.53 million from a loss last year. While earnings are expected to grow at a robust rate of 26.12% annually, the dividend yield of 6.54% lacks sufficient coverage from earnings or free cash flows and the company maintains a high debt level.

- Our earnings growth report unveils the potential for significant increases in Sociedad Química y Minera de Chile's future results.

- Dive into the specifics of Sociedad Química y Minera de Chile here with our thorough financial health report.

Next Steps

- Click through to start exploring the rest of the 153 Undervalued US Stocks Based On Cash Flows now.

- Have a stake in these businesses? Integrate your holdings into Simply Wall St's portfolio for notifications and detailed stock reports.

- Simply Wall St is your key to unlocking global market trends, a free user-friendly app for forward-thinking investors.

Searching for a Fresh Perspective?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:SQM

Sociedad Química y Minera de Chile

Operates as a mining company worldwide.

High growth potential with solid track record.

Similar Companies

Market Insights

Community Narratives