- United States

- /

- Machinery

- /

- NYSE:JBTM

John Bean Technologies Corporation Full-Year Results Just Came Out: Here's What Analysts Are Forecasting For Next Year

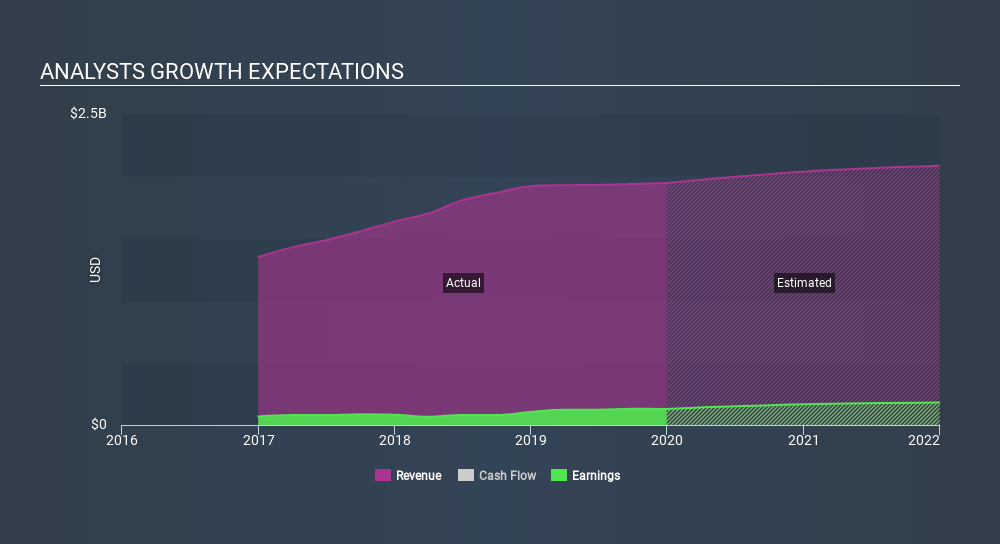

John Bean Technologies Corporation (NYSE:JBT) came out with its full-year results last week, and we wanted to see how the business is performing and what top analysts think of the company following this report. It looks like the results were a bit of a negative overall. While revenues of US$1.9b were in line with analyst predictions, statutory earnings were less than expected, missing estimates by 2.8% to hit US$4.02 per share. Following the result, analysts have updated their earnings model, and it would be good to know whether they think there's been a strong change in the company's prospects, or if it's business as usual. With this in mind, we've gathered the latest statutory forecasts to see what analysts are expecting for next year.

View our latest analysis for John Bean Technologies

Taking into account the latest results, the latest consensus from John Bean Technologies's seven analysts is for revenues of US$2.04b in 2020, which would reflect a modest 4.7% improvement in sales compared to the last 12 months. Statutory earnings per share are expected to surge 27% to US$5.14. Yet prior to the latest earnings, analysts had been forecasting revenues of US$2.04b and earnings per share (EPS) of US$5.14 in 2020. So it's pretty clear that, although analysts have updated their estimates, there's been no major change in expectations for the business following the latest results.

It will come as no surprise then, to learn that the consensus price target is largely unchanged at US$117. It could also be instructive to look at the range of analyst estimates, to evaluate how different the outlier opinions are from the mean. Currently, the most bullish analyst values John Bean Technologies at US$140 per share, while the most bearish prices it at US$96.00. These price targets show that analysts do have some differing views on the business, but the estimates do not vary enough to suggest to us that some are betting on wild success or utter failure.

Further, we can compare these estimates to past performance, and see how John Bean Technologies forecasts compare to the wider market's forecast performance. It's pretty clear that analysts expect John Bean Technologies's revenue growth will slow down substantially, with revenues next year expected to grow 4.7%, compared to a historical growth rate of 15% over the past five years. By way of comparison, other companies in this market with analyst coverage, are forecast to grow their revenue at 1.5% next year. Even after the forecast slowdown in growth, it seems obvious that analysts still thinkJohn Bean Technologies will grow faster than the wider market.

The Bottom Line

The most important thing to take away is that there's been no major change in sentiment, with analysts reconfirming that earnings per share are expected to continue performing in line with their prior expectations. Fortunately, analysts also reconfirmed their revenue estimates, suggesting sales are tracking in line with expectations - and our data does suggest that John Bean Technologies's revenues are expected to grow faster than the wider market. The consensus price target held steady at US$117, with the latest estimates not enough to have an impact on analysts' estimated valuations.

With that said, the long-term trajectory of the company's earnings is a lot more important than next year. We have estimates - from multiple John Bean Technologies analysts - going out to 2021, and you can see them free on our platform here.

You can also see whether John Bean Technologies is carrying too much debt, and whether its balance sheet is healthy, for free on our platform here.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:JBTM

JBT Marel

Provides technology solutions to food and beverage industry in North America, Europe, the Middle East, Africa, the Asia Pacific, and Central and South America.

Fair value with moderate growth potential.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

A case for USD $14.81 per share based on book value. Be warned, this is a micro-cap dependent on a single mine.

Occidental Petroleum to Become Fairly Priced at $68.29 According to Future Projections

Agfa-Gevaert is a digital and materials turnaround opportunity, with growth potential in ZIRFON, but carrying legacy risks.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)