Is Weakness In Royal Unibrew A/S (CPH:RBREW) Stock A Sign That The Market Could be Wrong Given Its Strong Financial Prospects?

With its stock down 21% over the past three months, it is easy to disregard Royal Unibrew (CPH:RBREW). But if you pay close attention, you might gather that its strong financials could mean that the stock could potentially see an increase in value in the long-term, given how markets usually reward companies with good financial health. In this article, we decided to focus on Royal Unibrew's ROE.

Return on equity or ROE is a key measure used to assess how efficiently a company's management is utilizing the company's capital. In simpler terms, it measures the profitability of a company in relation to shareholder's equity.

See our latest analysis for Royal Unibrew

How To Calculate Return On Equity?

The formula for ROE is:

Return on Equity = Net Profit (from continuing operations) ÷ Shareholders' Equity

So, based on the above formula, the ROE for Royal Unibrew is:

37% = ø1.1b ÷ ø3.1b (Based on the trailing twelve months to December 2019).

The 'return' refers to a company's earnings over the last year. So, this means that for every DKK1 of its shareholder's investments, the company generates a profit of DKK0.37.

Why Is ROE Important For Earnings Growth?

So far, we've learnt that ROE is a measure of a company's profitability. Based on how much of its profits the company chooses to reinvest or "retain", we are then able to evaluate a company's future ability to generate profits. Assuming everything else remains unchanged, the higher the ROE and profit retention, the higher the growth rate of a company compared to companies that don't necessarily bear these characteristics.

Royal Unibrew's Earnings Growth And 37% ROE

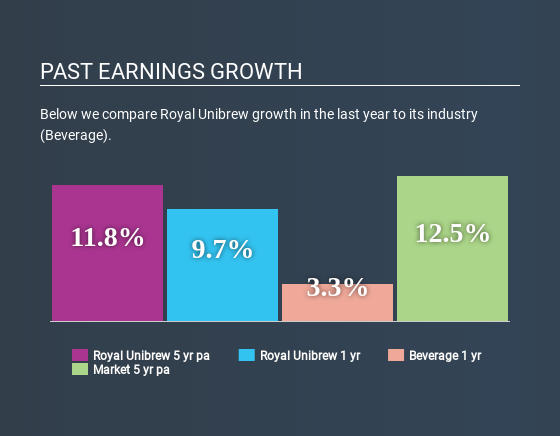

First thing first, we like that Royal Unibrew has an impressive ROE. Secondly, even when compared to the industry average of 11% the company's ROE is quite impressive. This probably laid the groundwork for Royal Unibrew's moderate 12% net income growth seen over the past five years.

We then performed a comparison between Royal Unibrew's net income growth with the industry, which revealed that the company's growth is similar to the average industry growth of 9.8% in the same period.

Earnings growth is an important metric to consider when valuing a stock. The investor should try to establish if the expected growth or decline in earnings, whichever the case may be, is priced in. By doing so, they will have an idea if the stock is headed into clear blue waters or if swampy waters await. What is RBREW worth today? The intrinsic value infographic in our free research report helps visualize whether RBREW is currently mispriced by the market.

Is Royal Unibrew Making Efficient Use Of Its Profits?

Royal Unibrew has a significant three-year median payout ratio of 53%, meaning that it is left with only 47% to reinvest into its business. This implies that the company has been able to achieve decent earnings growth despite returning most of its profits to shareholders.

Besides, Royal Unibrew has been paying dividends over a period of nine years. This shows that the company is committed to sharing profits with its shareholders. Upon studying the latest analysts' consensus data, we found that the company is expected to keep paying out approximately 52% of its profits over the next three years. Accordingly, forecasts suggest that Royal Unibrew's future ROE will be 35% which is again, similar to the current ROE.

Conclusion

In total, we are pretty happy with Royal Unibrew's performance. In particular, its high ROE is quite noteworthy and also the probable explanation behind its considerable earnings growth. Yet, the company is retaining a small portion of its profits. Which means that the company has been able to grow its earnings in spite of it, so that's not too bad. Having said that, the company's earnings growth is expected to slow down, as forecasted in the current analyst estimates. Are these analysts expectations based on the broad expectations for the industry, or on the company's fundamentals? Click here to be taken to our analyst's forecasts page for the company.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About CPSE:RBREW

Royal Unibrew

Provides beer, soft drinks, malt beverages, energy drinks, cider/ready to drink, juice, water, and wine and spirits.

Solid track record average dividend payer.

Similar Companies

Market Insights

Community Narratives