Suzanne Sitherwood has been the CEO of Spire Inc. (NYSE:SR) since 2012. This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. And finally we will reflect on how common stockholders have fared in the last few years, as a secondary measure of performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Spire

How Does Suzanne Sitherwood's Compensation Compare With Similar Sized Companies?

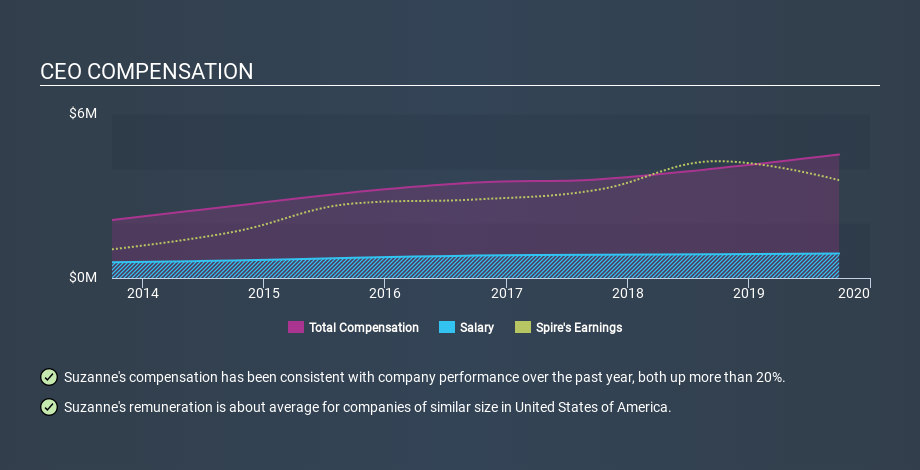

According to our data, Spire Inc. has a market capitalization of US$4.1b, and paid its CEO total annual compensation worth US$4.5m over the year to September 2019. That's a notable increase of 12% on last year. While this analysis focuses on total compensation, it's worth noting the salary is lower, valued at US$900k. We further remind readers that the CEO may face performance requirements to receive the non-salary part of the total compensation. We looked at a group of companies with market capitalizations from US$2.0b to US$6.4b, and the median CEO total compensation was US$5.0m.

So Suzanne Sitherwood receives a similar amount to the median CEO pay, amongst the companies we looked at. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see, below, how CEO compensation at Spire has changed over time.

Is Spire Inc. Growing?

On average over the last three years, Spire Inc. has grown earnings per share (EPS) by 5.8% each year (using a line of best fit). The trailing twelve months of revenue was pretty much the same as the prior period.

I would argue that the lack of revenue growth in the last year is less than ideal, but the improvement in EPS is good. It's hard to reach a conclusion about business performance right now. This may be one to watch. Shareholders might be interested in this free visualization of analyst forecasts.

Has Spire Inc. Been A Good Investment?

Most shareholders would probably be pleased with Spire Inc. for providing a total return of 38% over three years. As a result, some may believe the CEO should be paid more than is normal for companies of similar size.

In Summary...

Remuneration for Suzanne Sitherwood is close enough to the median pay for a CEO of a similar sized company .

While the growth could be better, the shareholder returns are clearly good. So considering most shareholders would be happy, we'd say the CEO pay is appropriate. Shareholders may want to check for free if Spire insiders are buying or selling shares.

If you want to buy a stock that is better than Spire, this free list of high return, low debt companies is a great place to look.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Thank you for reading.

About NYSE:SR

Spire

Engages in the purchase, retail distribution, and sale of natural gas to residential, commercial, industrial, and other end-users of natural gas in the United States.

Average dividend payer with acceptable track record.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

MINISO's fair value is projected at 26.69 with an anticipated PE ratio shift of 20x

Fiverr International will transform the freelance industry with AI-powered growth

Stride Stock: Online Education Finds Its Second Act

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)