In 2016 Doug Dietrich was appointed CEO of Minerals Technologies Inc. (NYSE:MTX). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This method should give us information to assess how appropriately the company pays the CEO.

See our latest analysis for Minerals Technologies

How Does Doug Dietrich's Compensation Compare With Similar Sized Companies?

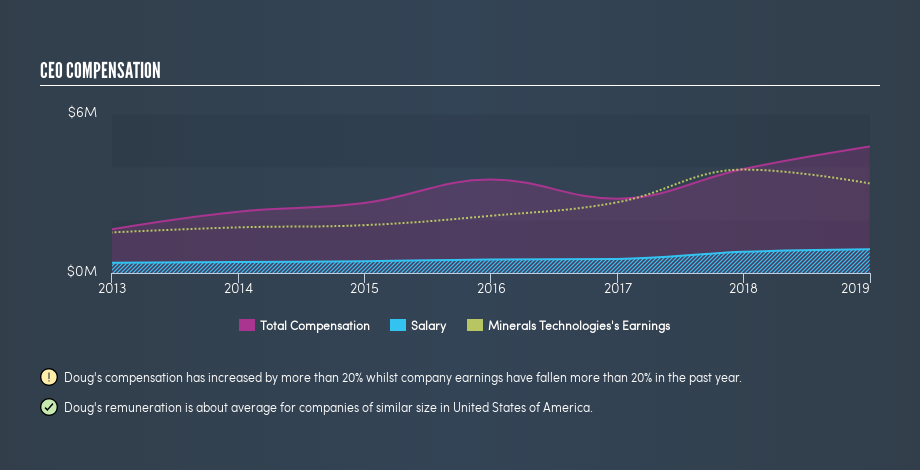

At the time of writing our data says that Minerals Technologies Inc. has a market cap of US$1.7b, and is paying total annual CEO compensation of US$4.8m. (This is based on the year to December 2018). We think total compensation is more important but we note that the CEO salary is lower, at US$898k. As part of our analysis we looked at companies in the same jurisdiction, with market capitalizations of US$1.0b to US$3.2b. The median total CEO compensation was US$4.1m.

That means Doug Dietrich receives fairly typical remuneration for the CEO of a company that size. Although this fact alone doesn't tell us a great deal, it becomes more relevant when considered against the business performance.

You can see a visual representation of the CEO compensation at Minerals Technologies, below.

Is Minerals Technologies Inc. Growing?

Over the last three years Minerals Technologies Inc. has grown its earnings per share (EPS) by an average of 14% per year (using a line of best fit). It achieved revenue growth of 3.5% over the last year.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. It's also good to see modest revenue growth, suggesting the underlying business is healthy.

Has Minerals Technologies Inc. Been A Good Investment?

Since shareholders would have lost about 33% over three years, some Minerals Technologies Inc. shareholders would surely be feeling negative emotions. It therefore might be upsetting for shareholders if the CEO were paid generously.

In Summary...

Doug Dietrich is paid around what is normal the leaders of comparable size companies.

We think that the EPS growth is very pleasing, but we find the returns over the last three years to be lacking. Considering the improvement in earnings per share, one could argue that the CEO pay is appropriate, albeit not too low. CEO compensation is one thing, but it is also interesting to check if the CEO is buying or selling Minerals Technologies (free visualization of insider trades).

Important note: Minerals Technologies may not be the best stock to buy. You might find something better in this list of interesting companies with high ROE and low debt.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSE:MTX

Minerals Technologies

Develops, produces, and markets various mineral, mineral-based, and related systems and services.

Flawless balance sheet and good value.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Investing in the future with RGYAS as fair value hits 228.23

The global leader in cash handling

Wolters Kluwer - A Fundamental and Historical Valuation

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

Undervalued Key Player in Magnets/Rare Earth

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!

Thanks for your post but some of your calculations are wrong. It is only the actual silver that should be priced at 100/oz, not the zink and lead. The actual silver is about 5 million ounces and the rest is biproducts which cannot be calculated as 100/oz per silver equivalent. Since it would now require alot more zink and lead to create 1 AgEq with the current silver price which means their AgEq would become lower even if the production remains the same. I am still very bullish on the stock and I own it.