- Australia

- /

- Professional Services

- /

- ASX:LNK

Is Link Administration Holdings Limited's (ASX:LNK) CEO Overpaid Relative To Its Peers?

In 2002 John McMurtrie was appointed CEO of Link Administration Holdings Limited (ASX:LNK). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Then we'll look at a snap shot of the business growth. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. The aim of all this is to consider the appropriateness of CEO pay levels.

See our latest analysis for Link Administration Holdings

How Does John McMurtrie's Compensation Compare With Similar Sized Companies?

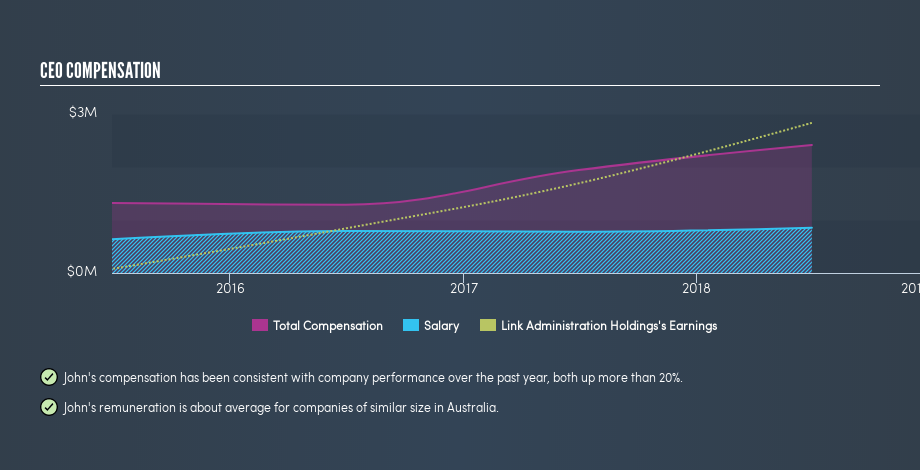

Our data indicates that Link Administration Holdings Limited is worth AU$2.7b, and total annual CEO compensation is AU$2.4m. (This number is for the twelve months until June 2018). We think total compensation is more important but we note that the CEO salary is lower, at AU$855k. We examined companies with market caps from AU$1.4b to AU$4.6b, and discovered that the median CEO total compensation of that group was AU$2.4m.

So John McMurtrie is paid around the average of the companies we looked at. This doesn't tell us a whole lot on its own, but looking at the performance of the actual business will give us useful context.

You can see, below, how CEO compensation at Link Administration Holdings has changed over time.

Is Link Administration Holdings Limited Growing?

On average over the last three years, Link Administration Holdings Limited has grown earnings per share (EPS) by 53% each year (using a line of best fit). In the last year, its revenue is up 59%.

Overall this is a positive result for shareholders, showing that the company has improved in recent years. Most shareholders would be pleased to see strong revenue growth combined with EPS growth. This combo suggests a fast growing business.

Has Link Administration Holdings Limited Been A Good Investment?

With a three year total loss of 34%, Link Administration Holdings Limited would certainly have some dissatisfied shareholders. So shareholders would probably think the company shouldn't be too generous with CEO compensation.

In Summary...

John McMurtrie is paid around what is normal the leaders of comparable size companies.

We'd say the company can boast of its EPS growth, but it's disappointing to see negative shareholder returns over three years. We'd be surprised if shareholders want to see a pay rise for the CEO, but we'd stop short of calling their pay too generous. Shareholders may want to check for free if Link Administration Holdings insiders are buying or selling shares.

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About ASX:LNK

Link Administration Holdings

Provides technology-enabled administration solutions for companies, large asset owners, and trustees worldwide.

Undervalued with concerning outlook.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Jackson Financial Stock: When Insurance Math Meets a Shifting Claims Landscape

Stride Stock: Online Education Finds Its Second Act

CS Disco Stock: Legal AI Is Moving From Efficiency Tool to Competitive Necessity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)