Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it might be obvious that you need to consider debt, when you think about how risky any given stock is, because too much debt can sink a company. We note that GOME Retail Holdings Limited (HKG:493) does have debt on its balance sheet. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Debt is a tool to help businesses grow, but if a business is incapable of paying off its lenders, then it exists at their mercy. If things get really bad, the lenders can take control of the business. However, a more frequent (but still costly) occurrence is where a company must issue shares at bargain-basement prices, permanently diluting shareholders, just to shore up its balance sheet. By replacing dilution, though, debt can be an extremely good tool for businesses that need capital to invest in growth at high rates of return. When we think about a company's use of debt, we first look at cash and debt together.

See our latest analysis for GOME Retail Holdings

How Much Debt Does GOME Retail Holdings Carry?

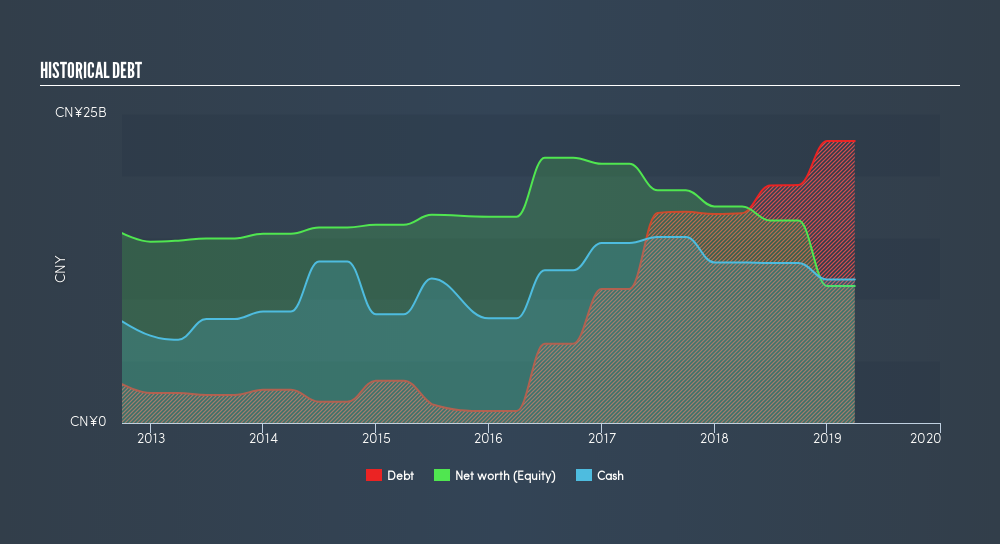

You can click the graphic below for the historical numbers, but it shows that as of December 2018 GOME Retail Holdings had CN¥22.8b of debt, an increase on CN¥17.0b, over one year. On the flip side, it has CN¥11.6b in cash leading to net debt of about CN¥11.2b.

How Strong Is GOME Retail Holdings's Balance Sheet?

Zooming in on the latest balance sheet data, we can see that GOME Retail Holdings had liabilities of CN¥40.6b due within 12 months and liabilities of CN¥9.05b due beyond that. Offsetting these obligations, it had cash of CN¥11.6b as well as receivables valued at CN¥1.00b due within 12 months. So it has liabilities totalling CN¥37.1b more than its cash and near-term receivables, combined.

The deficiency here weighs heavily on the CN¥15.0b company itself, as if a child were struggling under the weight of an enormous back-pack full of books, his sports gear, and a trumpet. So we definitely think shareholders need to watch this one closely. After all, GOME Retail Holdings would likely require a major re-capitalisation if it had to pay its creditors today. There's no doubt that we learn most about debt from the balance sheet. But it is future earnings, more than anything, that will determine GOME Retail Holdings's ability to maintain a healthy balance sheet going forward. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

Over 12 months, GOME Retail Holdings saw its revenue drop to CN¥65b, which is a fall of 9.9%. That's not what we would hope to see.

Caveat Emptor

Over the last twelve months GOME Retail Holdings produced an earnings before interest and tax (EBIT) loss. Its EBIT loss was a whopping CN¥3.6b. When we look at that alongside the significant liabilities, we're not particularly confident about the company. It would need to improve its operations quickly for us to be interested in it. Not least because it burned through CN¥2.0b in negative free cash flow over the last year. So suffice it to say we consider the stock to be risky. For riskier companies like GOME Retail Holdings I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

If you're interested in investing in businesses that can grow profits without the burden of debt, then check out this free list of growing businesses that have net cash on the balance sheet.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About SEHK:493

GOME Retail Holdings

Operates and manages retail stores in the People’s Republic of China.

Low risk with imperfect balance sheet.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

Deep Value Multi Bagger Opportunity

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)