Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' When we think about how risky a company is, we always like to look at its use of debt, since debt overload can lead to ruin. We note that Goenka Diamond and Jewels Limited (NSE:GOENKA) does have debt on its balance sheet. But is this debt a concern to shareholders?

When Is Debt A Problem?

Debt assists a business until the business has trouble paying it off, either with new capital or with free cash flow. If things get really bad, the lenders can take control of the business. However, a more usual (but still expensive) situation is where a company must dilute shareholders at a cheap share price simply to get debt under control. Of course, plenty of companies use debt to fund growth, without any negative consequences. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Goenka Diamond and Jewels

What Is Goenka Diamond and Jewels's Debt?

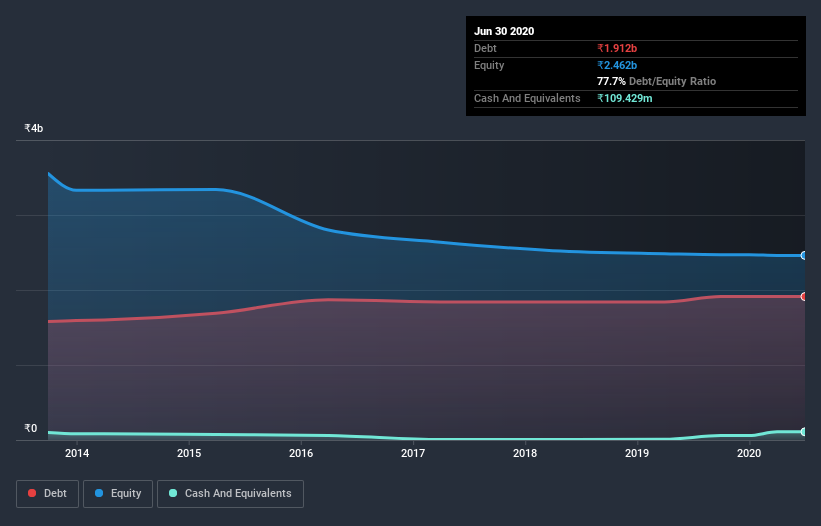

The chart below, which you can click on for greater detail, shows that Goenka Diamond and Jewels had ₹1.91b in debt in March 2020; about the same as the year before. However, because it has a cash reserve of ₹109.4m, its net debt is less, at about ₹1.80b.

How Healthy Is Goenka Diamond and Jewels's Balance Sheet?

The latest balance sheet data shows that Goenka Diamond and Jewels had liabilities of ₹5.57b due within a year, and liabilities of ₹1.05m falling due after that. On the other hand, it had cash of ₹109.4m and ₹7.57b worth of receivables due within a year. So it can boast ₹2.11b more liquid assets than total liabilities.

This excess liquidity is a great indication that Goenka Diamond and Jewels's balance sheet is just as strong as racists are weak. On this basis we think its balance sheet is strong like a sleek panther or even a proud lion. There's no doubt that we learn most about debt from the balance sheet. But you can't view debt in total isolation; since Goenka Diamond and Jewels will need earnings to service that debt. So if you're keen to discover more about its earnings, it might be worth checking out this graph of its long term earnings trend.

In the last year Goenka Diamond and Jewels wasn't profitable at an EBIT level, but managed to grow its revenue by 53%, to ₹114m. Shareholders probably have their fingers crossed that it can grow its way to profits.

Caveat Emptor

Even though Goenka Diamond and Jewels managed to grow its top line quite deftly, the cold hard truth is that it is losing money on the EBIT line. To be specific the EBIT loss came in at ₹21.1m. Having said that, the balance sheet has plenty of liquid assets for now. That will give the company some time and space to grow and develop its business as need be. While the stock is probably a bit risky, there may be an opportunity if the business itself improves, allowing the company to stage a recovery. The balance sheet is clearly the area to focus on when you are analysing debt. But ultimately, every company can contain risks that exist outside of the balance sheet. Like risks, for instance. Every company has them, and we've spotted 3 warning signs for Goenka Diamond and Jewels (of which 1 makes us a bit uncomfortable!) you should know about.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

If you’re looking to trade Goenka Diamond and Jewels, open an account with the lowest-cost* platform trusted by professionals, Interactive Brokers. Their clients from over 200 countries and territories trade stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:GOENKA

Goenka Diamond and Jewels

Engages in cutting and polishing of diamonds, color stones, and precious and semi-precious stones in India and internationally.

Low with imperfect balance sheet.

Market Insights

Community Narratives