In 2016 John Elliott was appointed CEO of Gencor Industries, Inc. (NASDAQ:GENC). This analysis aims first to contrast CEO compensation with other companies that have similar market capitalization. Next, we'll consider growth that the business demonstrates. Third, we'll reflect on the total return to shareholders over three years, as a second measure of business performance. This process should give us an idea about how appropriately the CEO is paid.

Check out our latest analysis for Gencor Industries

How Does John Elliott's Compensation Compare With Similar Sized Companies?

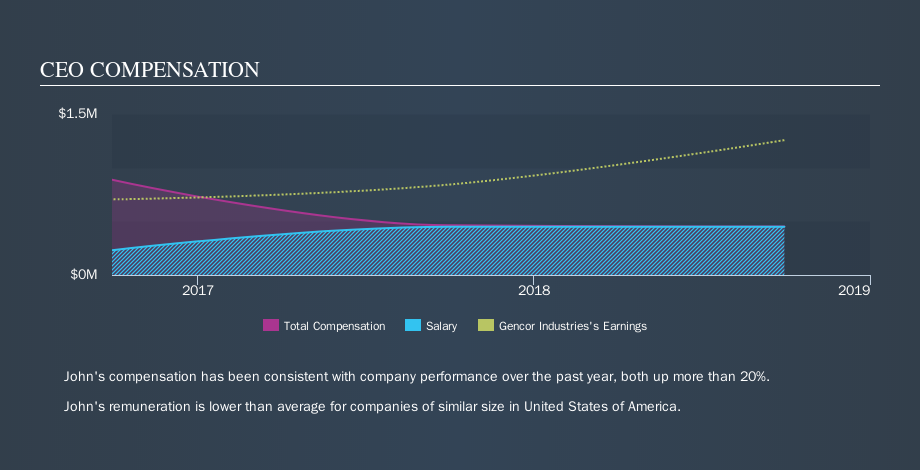

According to our data, Gencor Industries, Inc. has a market capitalization of US$178m, and paid its CEO total annual compensation worth US$451k over the year to September 2018. Notably, the salary of US$450k is the vast majority of the CEO compensation. When we examined a selection of companies with market caps ranging from US$100m to US$400m, we found the median CEO total compensation was US$1.2m.

This would give shareholders a good impression of the company, since most similar size companies have to pay more, leaving less for shareholders. However, before we heap on the praise, we should delve deeper to understand business performance.

The graphic below shows how CEO compensation at Gencor Industries has changed from year to year.

Is Gencor Industries, Inc. Growing?

Gencor Industries, Inc. has increased its earnings per share (EPS) by an average of 30% a year, over the last three years (using a line of best fit). In the last year, its revenue is down -9.6%.

This shows that the company has improved itself over the last few years. Good news for shareholders. The lack of revenue growth isn't ideal, but it is the bottom line that counts most in business.

Has Gencor Industries, Inc. Been A Good Investment?

With a total shareholder return of 13% over three years, Gencor Industries, Inc. shareholders would, in general, be reasonably content. But they would probably prefer not to see CEO compensation far in excess of the median.

In Summary...

It appears that Gencor Industries, Inc. remunerates its CEO below most similar sized companies.

Many would consider this to indicate that the pay is modest since the business is growing. The total shareholder return might not be amazing, but that doesn't mean that John Elliott is paid too much. It's good to see reasonable payment of the CEO, even while the business improves. It would be an additional positive if insiders are buying shares. So you may want to check if insiders are buying Gencor Industries shares with their own money (free access).

Of course, you might find a fantastic investment by looking elsewhere. So take a peek at this free list of interesting companies.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NYSEAM:GENC

Gencor Industries

Engages in the design, manufacture, and sale of heavy machinery used in the production of highway construction materials and environmental control equipment.

Flawless balance sheet with high growth potential.

Similar Companies

Market Insights

Weekly Picks

Ferrari's Intrinsic and Historical Valuation

Investment Thesis: Costco Wholesale (COST)

Undervalued Key Player in Magnets/Rare Earth

Recently Updated Narratives

Salesforce's Market Dominance and AI Pivot Will Drive Earnings Re-acceleration

IREN's Trump Card: How Federal Policy Could Unlock Massive Value in AI Infrastructure

ESPN’s NFL Power Play: How Disney’s Sports Engine Could Drive the Next Leg of Stock Growth

Popular Narratives

The "Sleeping Giant" Stumbles, Then Wakes Up

NVDA: Expanding AI Demand Will Drive Major Data Center Investments Through 2026

Undervalued Key Player in Magnets/Rare Earth

Trending Discussion

I'm exiting the positions at great return! WRLG got great competent management. But, 100k oz gold too small in today environment. They might looking for M/A opportunity in the future, or they might get take over by Aris Mining, I don't know. But, Frank Giustra stated he's believed in multi-assets, so that's my speculation. Anyhow, I want to be aggressive in today's gold price. I'm buying Lahontan Gold LG with this as exchange. Higher upside, more leverage. WRLG CEO is BOD's of LG, that's something. This will be my last update on WRLG, good luck!