- United States

- /

- Tech Hardware

- /

- NYSE:IONQ

IonQ (IONQ) Announces New Revenue Guidance For Q3 And FY2025

Reviewed by Simply Wall St

IonQ (IONQ) recently announced key corporate developments, including a significant collaboration with Oak Ridge National Laboratory and the U.S. Department of Energy, as well as a new revenue guidance for Q3 and FY2025. With a price movement of 14% over the last quarter, the company's shares responded to these announcements. The strategic alliances and executive shifts perhaps added weight to its market performance, aligning with the broader market's positive trajectory. Additionally, IonQ's financial disclosures showed an increase in sales, although this was marked by widening net losses, reflecting mixed sentiments that might have countered the broader upward moves.

Over the last three years, IonQ has experienced a very large total return of 526.64%, a notable performance considering its volatile share price activity. This performance stands out against the more conservative 16.1% return of the broader US market over the past year. Compared to the US Tech industry, IonQ's shares also exceeded the 2.5% industry return in the same annual context.

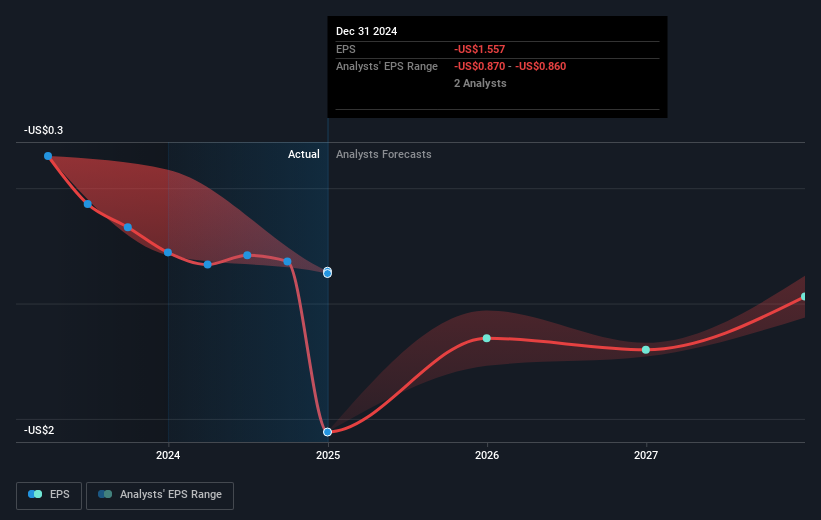

The recent developments mentioned in the introduction, such as partnerships with key organizations and executive changes, potentially influence IonQ's revenue and earnings forecasts. These collaborations, particularly in the quantum computing space, might bolster revenue growth at an anticipated 41.4% annually. However, the company's widening net losses, increasing to US$176.84 million last quarter, might temper their impact on profitability.

In terms of price movement, IonQ's current share price of US$40.23 presents a discount when compared to the consensus analyst price target of approximately US$49.57, a difference of about 23.2%. This discrepancy reflects market sentiment and analysts’ outlook, despite IonQ's ongoing operational and financial challenges.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:IONQ

Flawless balance sheet with slight risk.

Similar Companies

Market Insights

Community Narratives