- United States

- /

- Medical Equipment

- /

- NasdaqGS:ISRG

Intuitive Surgical (ISRG) Reports Strong Q2 Earnings With Revenue Up To US$2,440 Million

Reviewed by Simply Wall St

Intuitive Surgical (ISRG) recently showcased strong performance in its second-quarter earnings report, with revenue growing significantly to USD 2,440 million and net income increasing to USD 658 million. The 4.73% rise in the company's share price over the last quarter aligns with the broader market trend, supported by optimism surrounding corporate earnings. Additionally, the announcement of David J. Rosa as CEO and advancements in product capabilities might have added to the positive market sentiment. These developments occurred amidst a bullish market environment where the S&P 500 reached new highs, further supporting the overall price movement of ISRG.

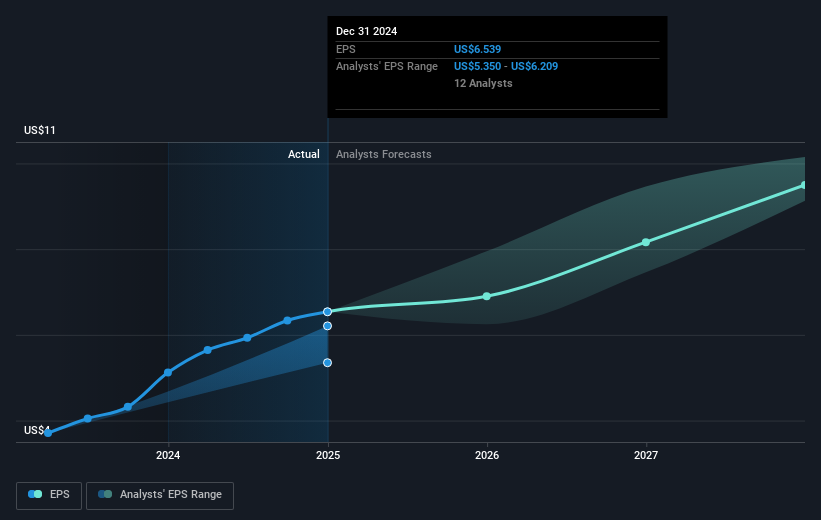

The recent developments within Intuitive Surgical, specifically the appointment of David J. Rosa as CEO and the launch of new product capabilities, are anticipated to support the continued adoption of innovative surgical technologies like the da Vinci 5. These advancements align well with the company's revenue growth strategy through increased global adoption and cost optimization, potentially boosting revenue and earnings over time. Analysts project a revenue growth rate of 14.6% annually, positioning Intuitive Surgical for significant earnings expansion, albeit with some expected margin contraction from 28.4% to 26.5%. The introduction of da Vinci 5, in particular, is likely to enhance surgical outcomes globally, which could further uplift sales and market penetration.

Over the past three years, Intuitive Surgical's total shareholder return, combining both share price appreciation and dividends, was 135.71%, a figure that underscores the company's strong performance trajectory. Over the more recent detailed period, Intuitive Surgical outperformed the US Medical Equipment industry that returned 5.8% over the past year but underperformed the US market, which returned 14.6%. This long-term growth, coupled with short-term gains such as the 4.73% increase in share price last quarter, reflects well on the investor sentiment surrounding the firm.

Despite the positive growth and new innovations, the company's current share price of US$511.00 presents a discount to the consensus price target of US$581.45, indicating a potential upside of about 13.79%. However, the projected Price-To-Earnings Ratio of 75.4x suggests that investors should carefully consider growth assumptions and potential risks, including macroeconomic and competitive pressures, that could affect overall profitability. As Intuitive Surgical further expands its manufacturing and product offerings, stakeholders are watching closely to see how these strategies will translate into sustained financial performance and shareholder value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NasdaqGS:ISRG

Intuitive Surgical

Develops, manufactures, and markets products that enable physicians and healthcare providers to enhance the quality of and access to minimally invasive care in the United States and internationally.

Flawless balance sheet with solid track record.

Similar Companies

Market Insights

Community Narratives