- United States

- /

- Luxury

- /

- NYSE:WWW

Inter & Co Leads 3 Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

In a market where the S&P 500 is nearing record highs and the Nasdaq Composite continues to climb, investors are keenly observing shifts influenced by tariffs and economic outlooks. Amid this environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for those looking to capitalize on market fluctuations.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| StoneCo (STNE) | $13.41 | $26.38 | 49.2% |

| Similarweb (SMWB) | $7.57 | $14.92 | 49.2% |

| Rhythm Pharmaceuticals (RYTM) | $90.01 | $178.91 | 49.7% |

| Old National Bancorp (ONB) | $20.72 | $40.13 | 48.4% |

| Gogo (GOGO) | $15.31 | $30.29 | 49.5% |

| First Commonwealth Financial (FCF) | $16.54 | $32.97 | 49.8% |

| Duolingo (DUOL) | $343.61 | $677.05 | 49.2% |

| Berkshire Hills Bancorp (BHLB) | $24.23 | $46.67 | 48.1% |

| Atlantic Union Bankshares (AUB) | $31.69 | $62.54 | 49.3% |

| ACNB (ACNB) | $41.75 | $80.99 | 48.5% |

Here's a peek at a few of the choices from the screener.

Inter & Co (INTR)

Overview: Inter & Co, Inc. operates through its subsidiaries in banking, spending, investments, insurance brokerage, and inter shop businesses across Brazil and the United States with a market cap of $2.98 billion.

Operations: Inter & Co generates revenue through its operations in banking and spending, investments, insurance brokerage, and inter shop businesses across Brazil and the United States.

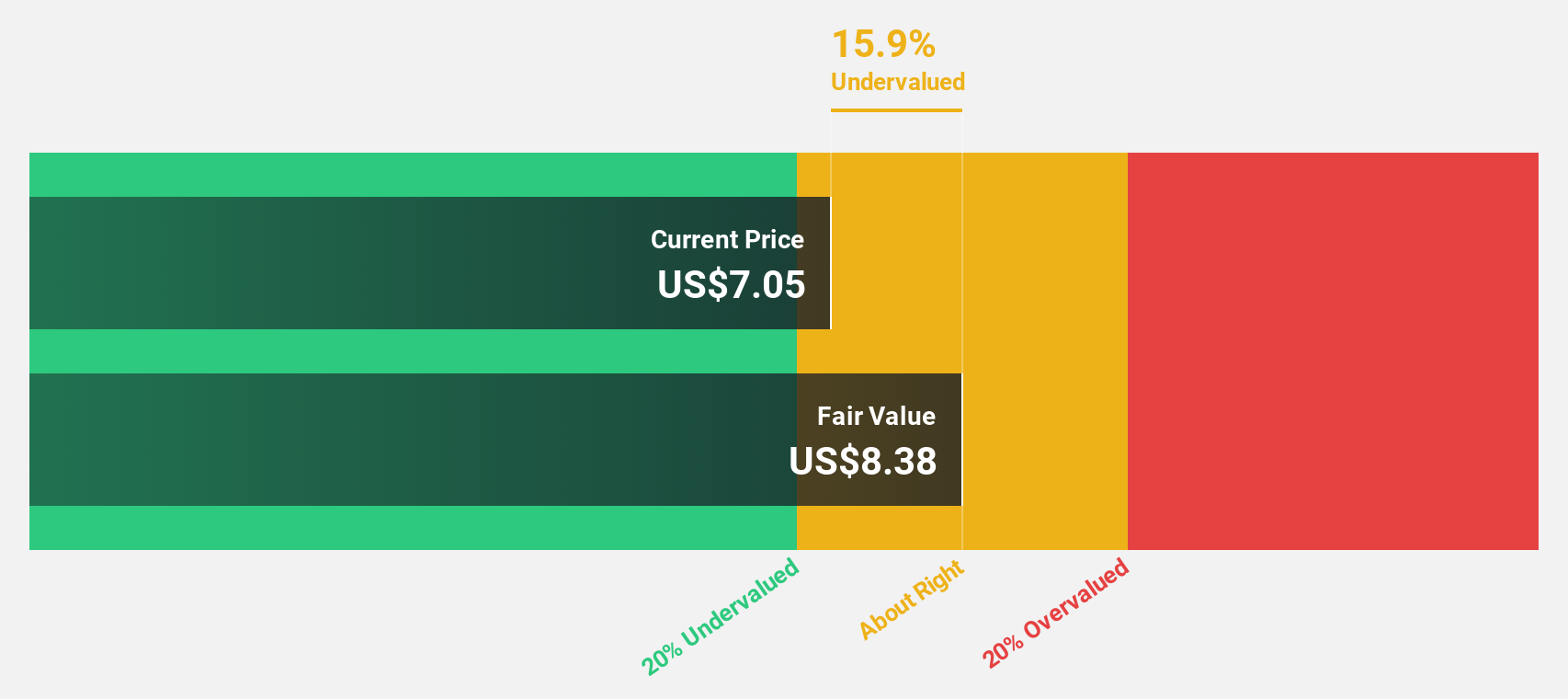

Estimated Discount To Fair Value: 11.1%

Inter & Co. reported strong financial performance with net interest income and net income rising significantly year-over-year for the first half of 2025. Despite trading slightly below its estimated fair value at $7.46 compared to $8.39, it faces challenges with a high level of bad loans at 9.3%. However, its earnings and revenue are expected to grow significantly above market averages, indicating potential long-term growth prospects amidst current undervaluation concerns based on cash flows.

- The analysis detailed in our Inter & Co growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Inter & Co.

Grindr (GRND)

Overview: Grindr Inc. operates a social networking and dating application catering to the LGBTQ community globally, with a market cap of approximately $3.49 billion.

Operations: The company generates revenue primarily from its Internet Information Providers segment, totaling $363.23 million.

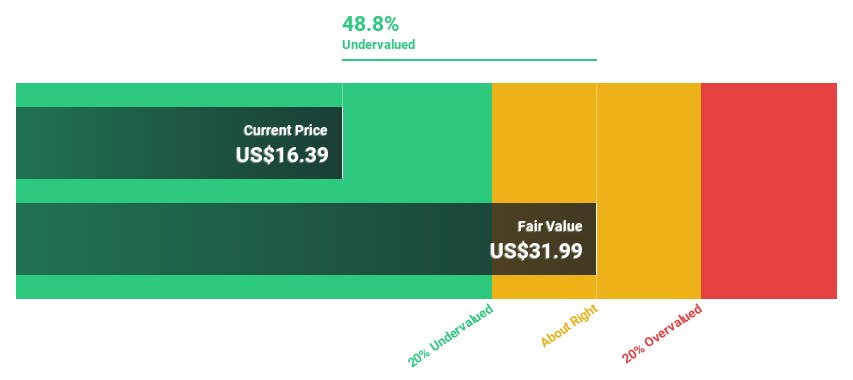

Estimated Discount To Fair Value: 44.5%

Grindr is trading at a significant discount, with its price below the estimated fair value of US$33.59, currently at US$18.64. Despite recent insider selling and slower projected revenue growth of 17% per year compared to its peers, the company is expected to achieve profitability within three years. The reaffirmed guidance for a 26% or greater revenue increase in 2025 supports its potential as an undervalued opportunity based on cash flows amidst executive transitions.

- Upon reviewing our latest growth report, Grindr's projected financial performance appears quite optimistic.

- Click here to discover the nuances of Grindr with our detailed financial health report.

Wolverine World Wide (WWW)

Overview: Wolverine World Wide, Inc. is involved in designing, manufacturing, sourcing, marketing, licensing, and distributing footwear, apparel, and accessories across various regions including the United States and international markets with a market cap of $1.90 billion.

Operations: Wolverine World Wide generates revenue through its diverse operations in footwear, apparel, and accessories across regions such as the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

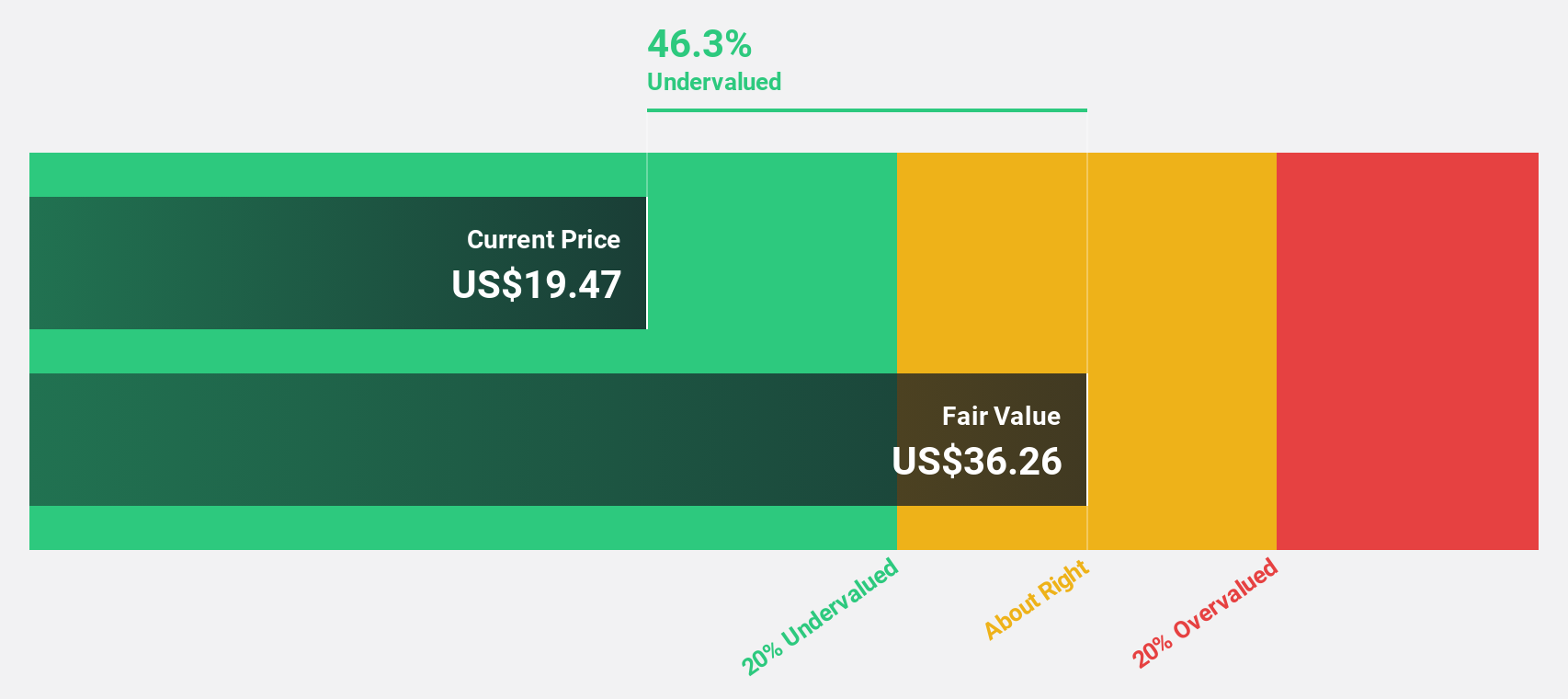

Estimated Discount To Fair Value: 29.8%

Wolverine World Wide trades at a discount, with its current price of US$26.98 below the estimated fair value of US$38.41. Despite high debt levels, its recent profitability and forecasted earnings growth of 24.6% annually over three years highlight potential value based on cash flows. However, revenue growth is expected to lag behind the broader market at 5.7% per year, and recent uncertainty around tariffs has led to a withdrawal of full-year guidance for 2025.

- In light of our recent growth report, it seems possible that Wolverine World Wide's financial performance will exceed current levels.

- Click to explore a detailed breakdown of our findings in Wolverine World Wide's balance sheet health report.

Make It Happen

- Delve into our full catalog of 176 Undervalued US Stocks Based On Cash Flows here.

- Shareholder in one or more of these companies? Ensure you're never caught off-guard by adding your portfolio in Simply Wall St for timely alerts on significant stock developments.

- Maximize your investment potential with Simply Wall St, the comprehensive app that offers global market insights for free.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Wolverine World Wide might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:WWW

Wolverine World Wide

Designs, manufactures, sources, markets, licenses, and distributes footwear, apparel, and accessories in the United States, Europe, the Middle East, Africa, the Asia Pacific, Canada and Latin America.

Reasonable growth potential average dividend payer.

Similar Companies

Market Insights

Community Narratives