- United States

- /

- Luxury

- /

- NYSE:CPRI

Inter & Co And 2 Other Stocks That May Be Trading Below Estimated Value

Reviewed by Simply Wall St

As the U.S. stock market navigates a period of mixed performance, with major indices like the S&P 500 and Nasdaq experiencing slight declines after recent highs, investors are keenly observing economic indicators and trade negotiations that could influence future trends. In such a fluctuating environment, identifying stocks that may be trading below their estimated value can offer potential opportunities for investors looking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows In The United States

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| WesBanco (WSBC) | $31.63 | $62.22 | 49.2% |

| TXO Partners (TXO) | $15.04 | $29.91 | 49.7% |

| Symbotic (SYM) | $38.85 | $77.61 | 49.9% |

| SharkNinja (SN) | $98.99 | $196.48 | 49.6% |

| Rocket Lab (RKLB) | $35.77 | $71.52 | 50% |

| PodcastOne (PODC) | $2.4227 | $4.77 | 49.2% |

| Ligand Pharmaceuticals (LGND) | $113.68 | $225.70 | 49.6% |

| Bridgewater Bancshares (BWB) | $15.91 | $31.14 | 48.9% |

| ATRenew (RERE) | $3.31 | $6.46 | 48.8% |

| ACNB (ACNB) | $42.84 | $84.90 | 49.5% |

Below we spotlight a couple of our favorites from our exclusive screener.

Inter & Co (INTR)

Overview: Inter & Co, Inc. operates through its subsidiaries in banking and spending, investments, and insurance brokerage businesses, with a market cap of $3.35 billion.

Operations: The company's revenue segments include Banking & Spending at R$4.10 billion, Inter Shop at R$353.50 million, Investments at R$261.13 million, and Insurance Brokerage at R$196.98 million.

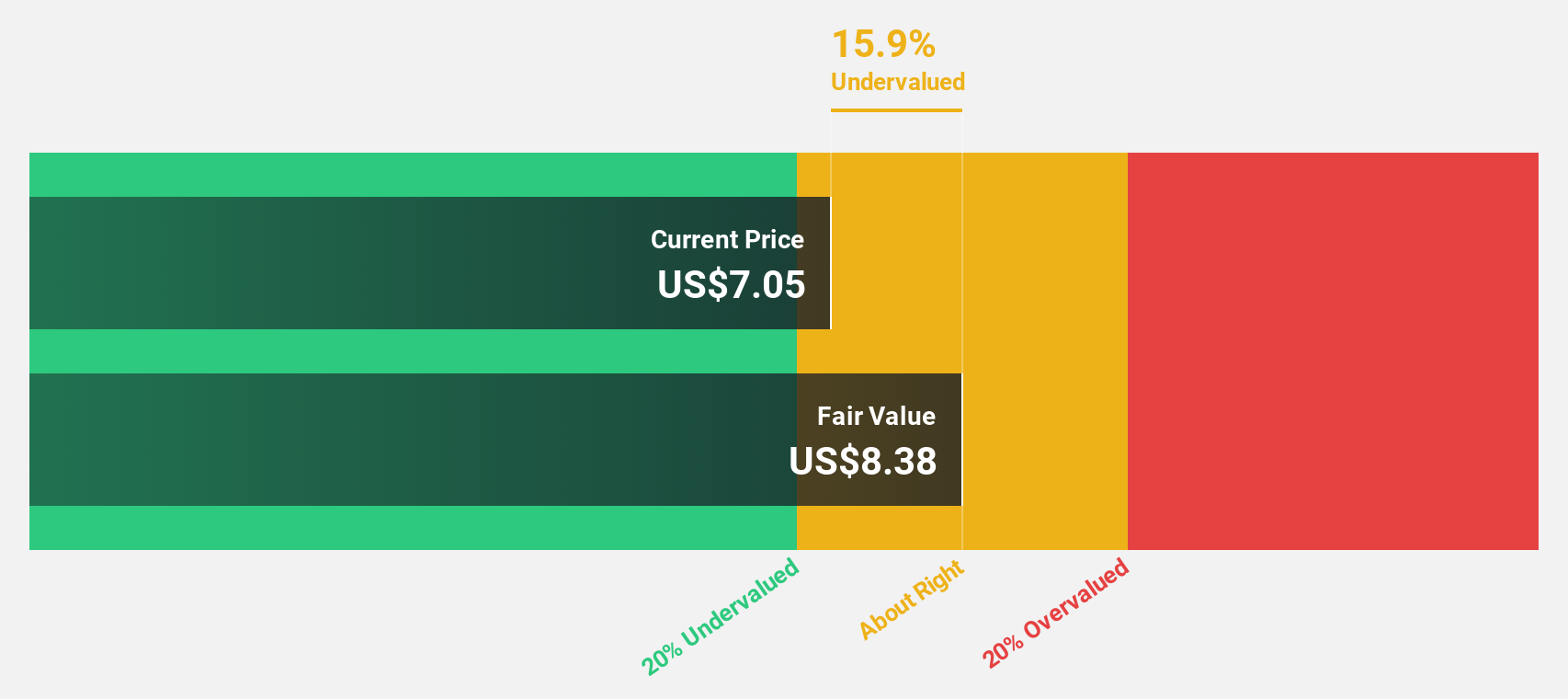

Estimated Discount To Fair Value: 11.8%

Inter & Co is trading at US$7.43, below its fair value estimate of US$8.42, indicating potential undervaluation based on cash flows. Despite a high level of bad loans (9.3%), the company forecasts significant earnings growth at 30.6% annually over the next three years, outpacing the market average. Recent Q1 2025 results show strong performance with net income rising to BRL 286.59 million from BRL 182.79 million year-over-year, reflecting robust financial health amidst organizational changes.

- Our growth report here indicates Inter & Co may be poised for an improving outlook.

- Take a closer look at Inter & Co's balance sheet health here in our report.

Capri Holdings (CPRI)

Overview: Capri Holdings Limited operates in the design, marketing, distribution, and retail of branded apparel, footwear, and accessories across multiple regions globally with a market cap of approximately $2.07 billion.

Operations: The company's revenue is derived from three main segments: Versace at $821 million, Jimmy Choo at $605 million, and Michael Kors at $3.02 billion.

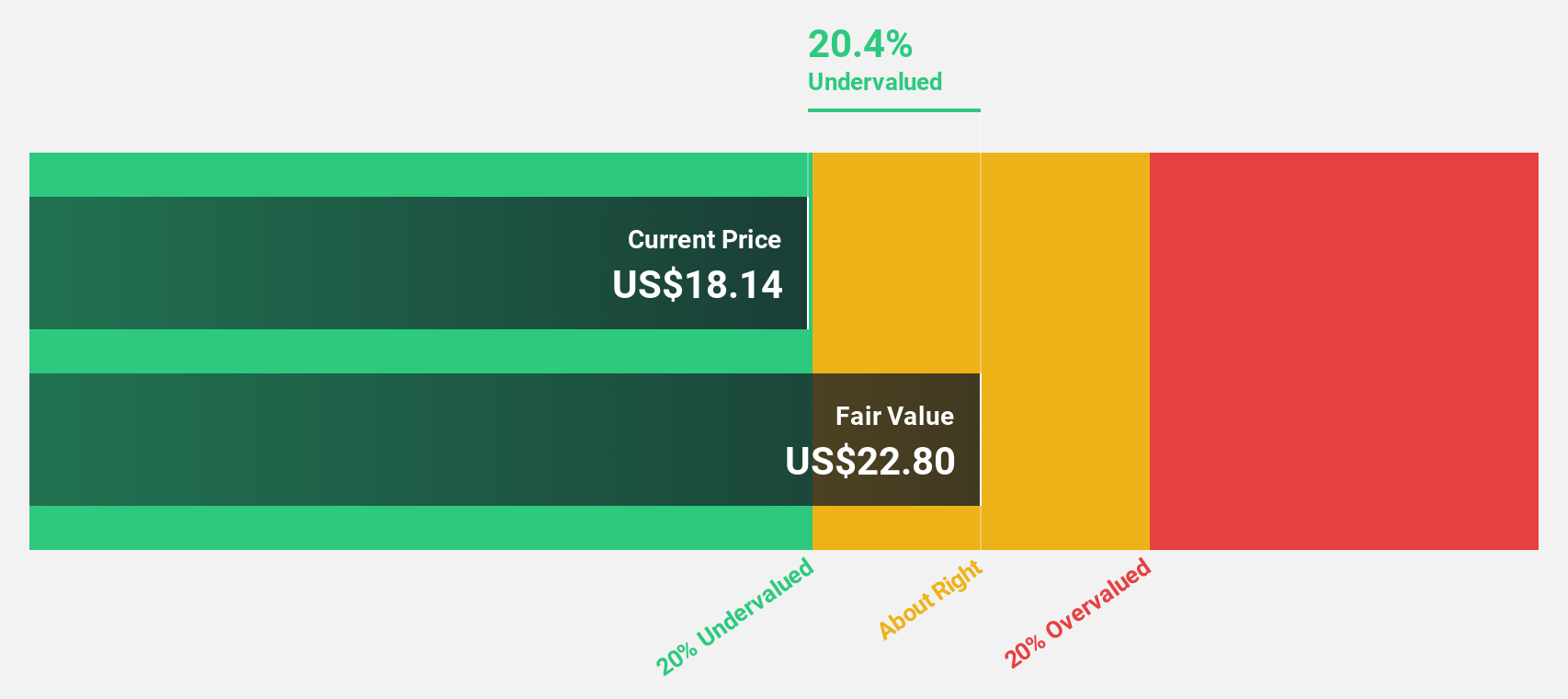

Estimated Discount To Fair Value: 20.9%

Capri Holdings is trading at US$17.70, below its estimated fair value of US$22.36, suggesting undervaluation based on cash flows despite recent index exclusions. The company faces challenges with debt coverage by operating cash flow and a forecasted revenue decline of 4.9% annually over three years. However, earnings are expected to grow significantly at 78.92% per year, with profitability anticipated within the same period, indicating potential for future financial improvement amidst restructuring efforts like Versace's sale to Prada for $1.4 billion.

- The growth report we've compiled suggests that Capri Holdings' future prospects could be on the up.

- Click to explore a detailed breakdown of our findings in Capri Holdings' balance sheet health report.

Grindr (GRND)

Overview: Grindr Inc. operates a social networking and dating application catering to LGBTQ communities globally, with a market cap of $4.35 billion.

Operations: The company generates revenue of $363.23 million from its Internet Information Providers segment.

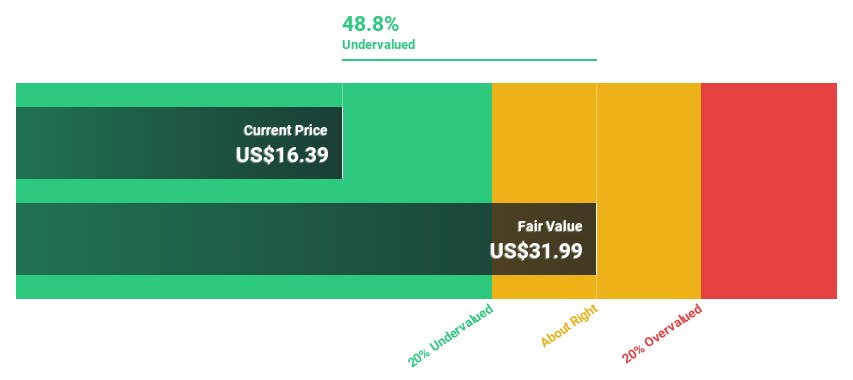

Estimated Discount To Fair Value: 34.1%

Grindr's stock is trading at US$22.70, significantly below its estimated fair value of US$34.44, highlighting potential undervaluation based on cash flows. The company forecasts robust revenue growth of 17.1% annually, surpassing the broader market expectation of 8.8%. Despite recent insider selling and a lack of return on equity data, Grindr's transition to profitability within three years is promising. Recent strategic initiatives include Chad Cohen's board appointment and the global launch of the "Right Now" feature.

- Upon reviewing our latest growth report, Grindr's projected financial performance appears quite optimistic.

- Unlock comprehensive insights into our analysis of Grindr stock in this financial health report.

Taking Advantage

- Click this link to deep-dive into the 173 companies within our Undervalued US Stocks Based On Cash Flows screener.

- Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Interested In Other Possibilities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: AI Stock Screener & Alerts

Our new AI Stock Screener scans the market every day to uncover opportunities.

• Dividend Powerhouses (3%+ Yield)

• Undervalued Small Caps with Insider Buying

• High growth Tech and AI Companies

Or build your own from over 50 metrics.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About NYSE:CPRI

Capri Holdings

Engages in the design, marketing, distribution, and retail of branded women’s and men’s apparel, footwear, and accessories in the United States, Canada, Latin America, Europe, the Middle East, Africa, Asia, and the Oceania.

Undervalued with reasonable growth potential.

Similar Companies

Market Insights

Community Narratives