- United Kingdom

- /

- IT

- /

- LSE:NCC

IntegraFin Holdings Leads This Trio Of UK Penny Stocks

Reviewed by Simply Wall St

The UK market has recently faced challenges, with the FTSE 100 and FTSE 250 indices closing lower amid weak trade data from China, highlighting ongoing global economic uncertainties. In such a climate, investors might consider exploring penny stocks—companies that are smaller or newer but can offer unique growth opportunities when backed by strong financial health. While the term "penny stocks" may seem outdated, these investments remain relevant for those seeking potential value and growth beyond the major market players.

Top 10 Penny Stocks In The United Kingdom

| Name | Share Price | Market Cap | Rewards & Risks |

| FRP Advisory Group (AIM:FRP) | £1.24 | £307.58M | ✅ 5 ⚠️ 0 View Analysis > |

| Warpaint London (AIM:W7L) | £4.275 | £345.37M | ✅ 4 ⚠️ 2 View Analysis > |

| Van Elle Holdings (AIM:VANL) | £0.415 | £44.9M | ✅ 5 ⚠️ 2 View Analysis > |

| RWS Holdings (AIM:RWS) | £0.835 | £308.76M | ✅ 4 ⚠️ 3 View Analysis > |

| LSL Property Services (LSE:LSL) | £3.11 | £320.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Alumasc Group (AIM:ALU) | £3.315 | £119.22M | ✅ 4 ⚠️ 2 View Analysis > |

| Begbies Traynor Group (AIM:BEG) | £1.18 | £188.25M | ✅ 4 ⚠️ 1 View Analysis > |

| Croma Security Solutions Group (AIM:CSSG) | £0.805 | £11.08M | ✅ 3 ⚠️ 4 View Analysis > |

| Braemar (LSE:BMS) | £2.17 | £67.11M | ✅ 3 ⚠️ 4 View Analysis > |

| ME Group International (LSE:MEGP) | £2.235 | £843.76M | ✅ 4 ⚠️ 1 View Analysis > |

Click here to see the full list of 298 stocks from our UK Penny Stocks screener.

Here we highlight a subset of our preferred stocks from the screener.

IntegraFin Holdings (LSE:IHP)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: IntegraFin Holdings plc, with a market cap of £1.06 billion, offers software and services to clients and financial advisers in the UK and Isle of Man through its subsidiaries.

Operations: IntegraFin Holdings generates revenue from three main segments: Adviser Back-Office Technology (£5 million), Investment Administration Services (£74.7 million), and Insurance and Life Assurance Business (£72 million).

Market Cap: £1.06B

IntegraFin Holdings, with a market cap of £1.06 billion, generates significant revenue from its investment administration and insurance segments. Despite recent negative earnings growth and declining profit margins, the company remains debt-free with strong short-term asset coverage over liabilities. Its seasoned management team and board provide stability, while high return on equity indicates efficient use of capital. The company reported a net income decrease to £21.2 million for H1 2025 but increased its interim dividend slightly to 3.3 pence per share, reflecting a commitment to shareholder returns amidst fluctuating earnings performance and stable weekly volatility.

- Click here and access our complete financial health analysis report to understand the dynamics of IntegraFin Holdings.

- Learn about IntegraFin Holdings' future growth trajectory here.

NCC Group (LSE:NCC)

Simply Wall St Financial Health Rating: ★★★★☆☆

Overview: NCC Group plc operates in the cyber and software resilience sector across the United Kingdom, Asia-Pacific, North America, and Europe, with a market cap of £440.30 million.

Operations: The company's revenue is divided into two segments: Cyber Security, generating £246.18 million, and Escode, contributing £65.95 million.

Market Cap: £440.3M

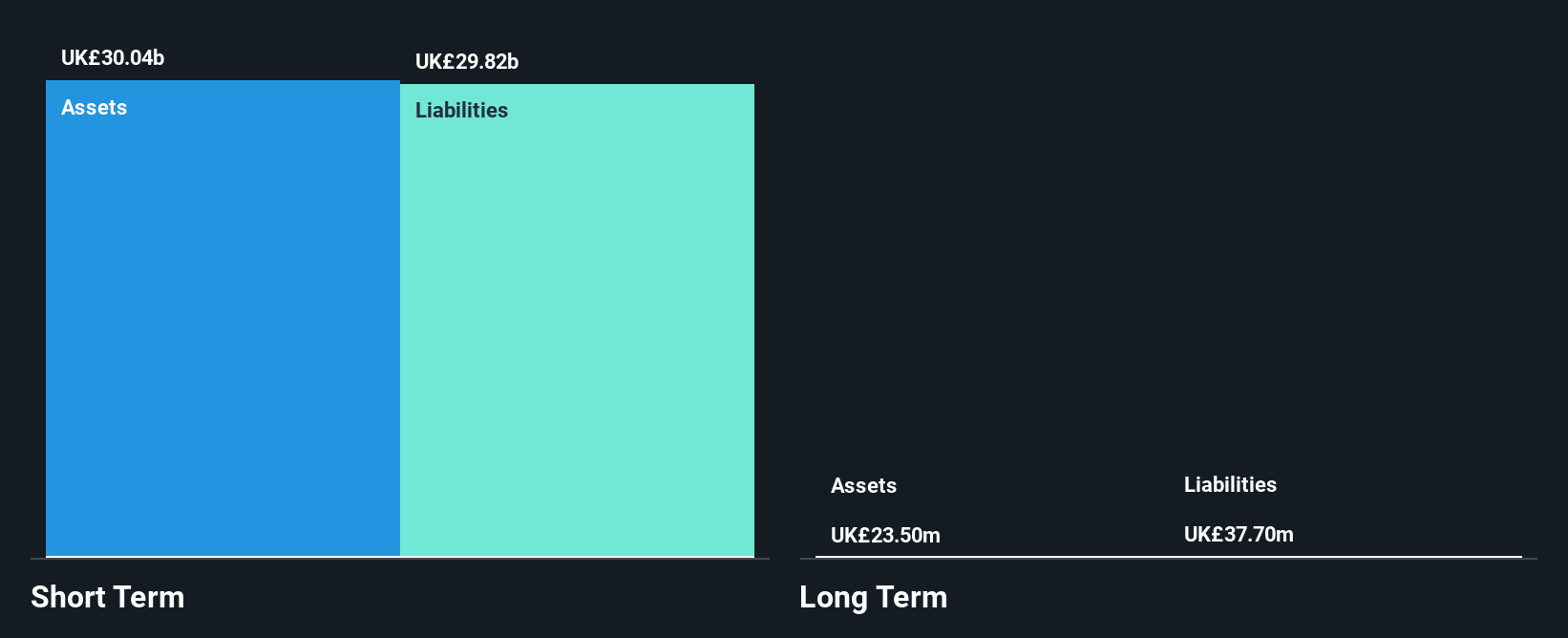

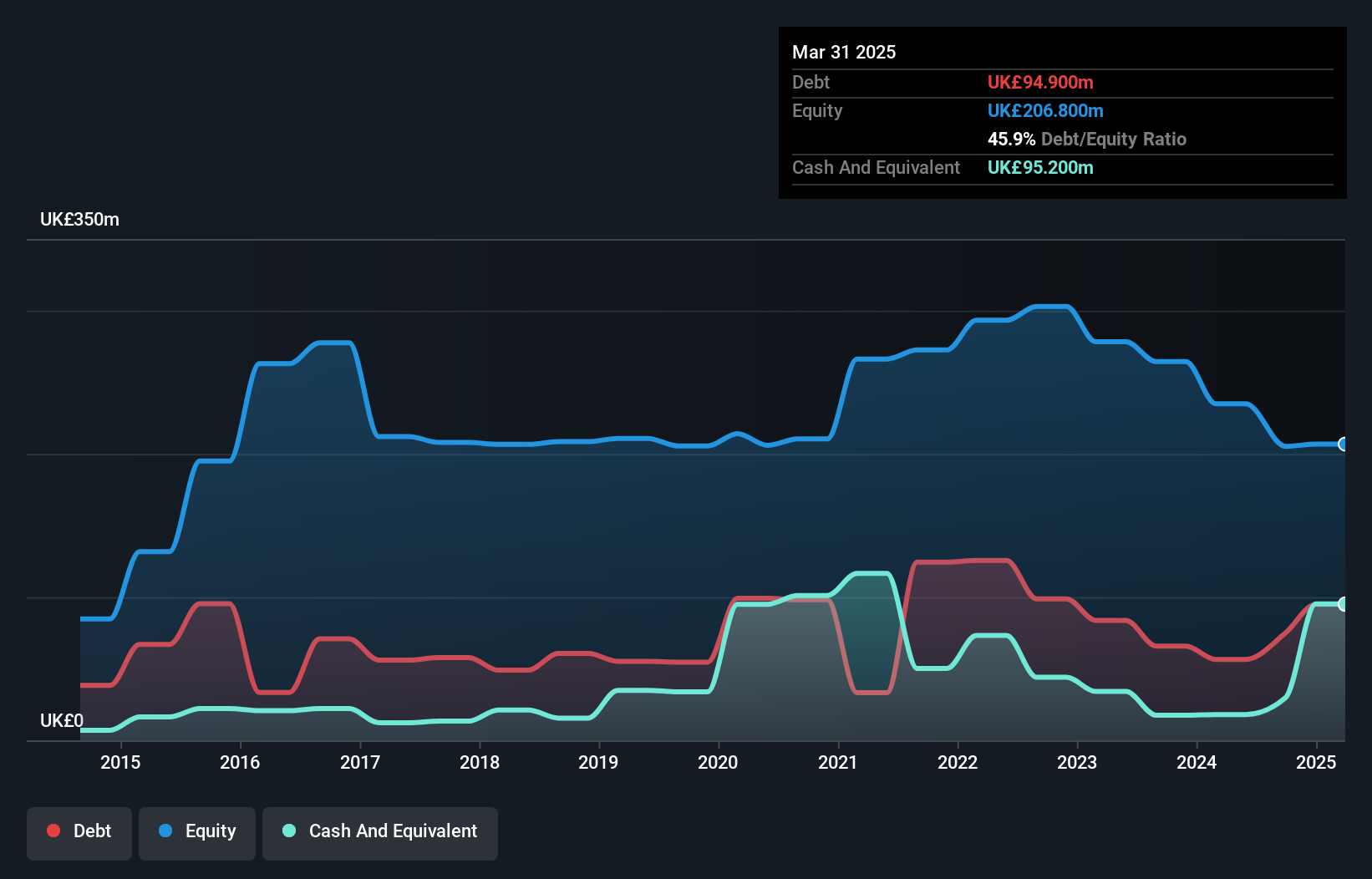

NCC Group, with a market cap of £440.30 million, operates in the cyber and software resilience sector and reported half-year sales of £156.8 million. Despite an increase in net income to £16 million, the company remains unprofitable with a negative return on equity of -7.05%. It has more cash than total debt but struggles with interest coverage from EBIT at 2.1x. The firm maintains stable short-term asset coverage over liabilities and declared an interim dividend of 1.50 pence per share, although this is not well covered by earnings or free cash flows as it pivots its Cyber Security division strategy.

- Take a closer look at NCC Group's potential here in our financial health report.

- Understand NCC Group's earnings outlook by examining our growth report.

Coinsilium Group (OFEX:COIN)

Simply Wall St Financial Health Rating: ★★★★★★

Overview: Coinsilium Group Limited is a venture capital firm that focuses on early-stage startups and seed-stage investments, with a market cap of £53.58 million.

Operations: The firm's revenue is primarily derived from its advisory services, amounting to £0.006 million.

Market Cap: £53.58M

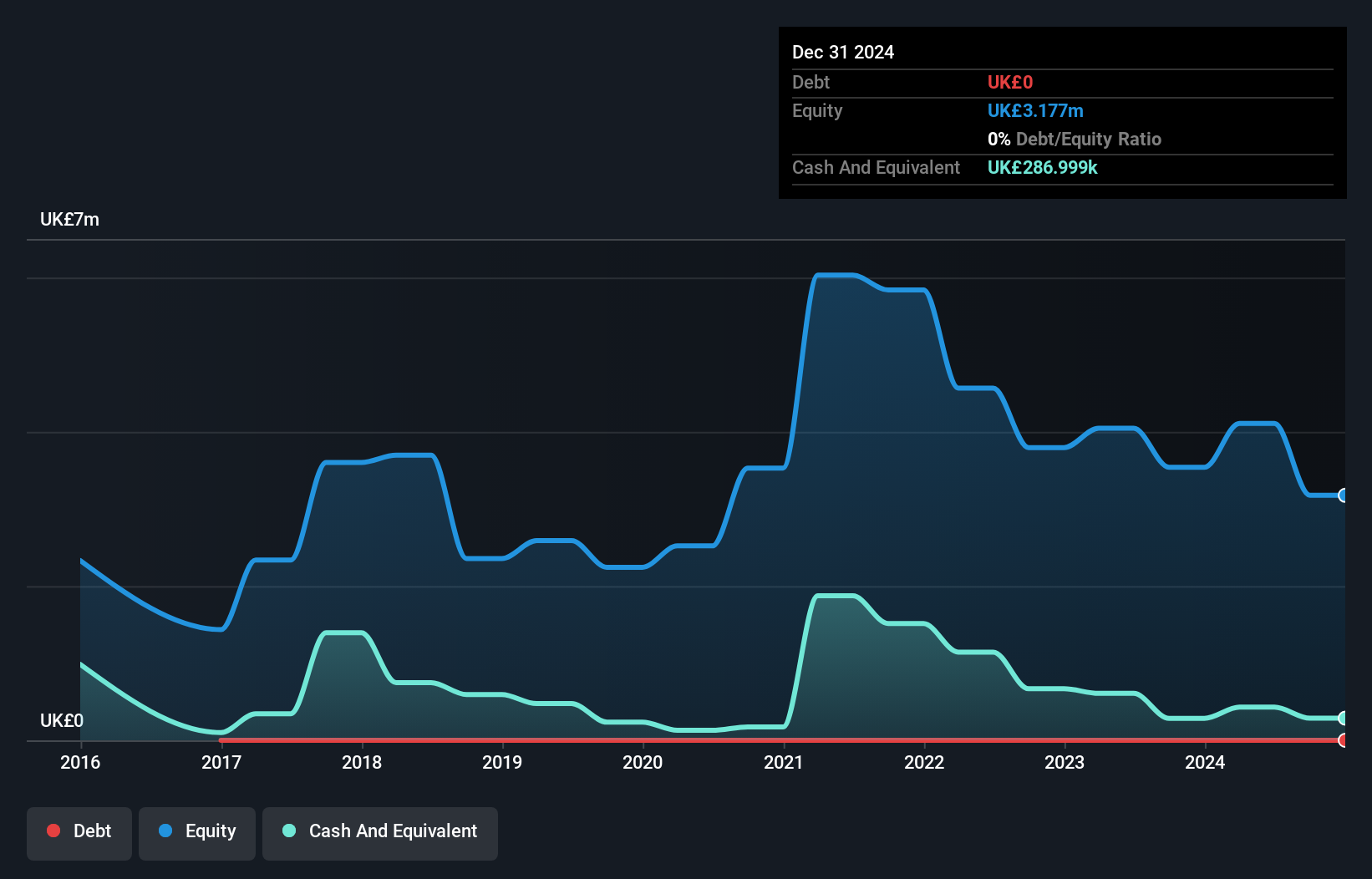

Coinsilium Group, with a market cap of £53.58 million, remains pre-revenue with minimal sales of £0.006 million and has experienced increasing losses over the past five years. The company is debt-free and has no long-term liabilities, but its cash runway is limited to five months without additional capital inflows. Recently, Coinsilium completed several follow-on equity offerings totaling over £10 million to bolster its financial position amid high share price volatility. Despite an experienced board with an average tenure of 4.1 years, the firm faces challenges in achieving profitability and sustaining growth in a competitive venture capital landscape.

- Jump into the full analysis health report here for a deeper understanding of Coinsilium Group.

- Review our historical performance report to gain insights into Coinsilium Group's track record.

Turning Ideas Into Actions

- Navigate through the entire inventory of 298 UK Penny Stocks here.

- Searching for a Fresh Perspective? The end of cancer? These 24 emerging AI stocks are developing tech that will allow early idenification of life changing disesaes like cancer and Alzheimer's.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if NCC Group might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About LSE:NCC

NCC Group

Engages in the cyber and software resilience business in the United Kingdom, the Asian-Pacific, North America, and Europe.

Adequate balance sheet with moderate growth potential.

Similar Companies

Market Insights

Community Narratives