Here's Why We're Wary Of Buying Sutlej Textiles and Industries' (NSE:SUTLEJTEX) For Its Upcoming Dividend

Sutlej Textiles and Industries Limited (NSE:SUTLEJTEX) is about to trade ex-dividend in the next three days. Investors can purchase shares before the 14th of September in order to be eligible for this dividend, which will be paid on the 16th of October.

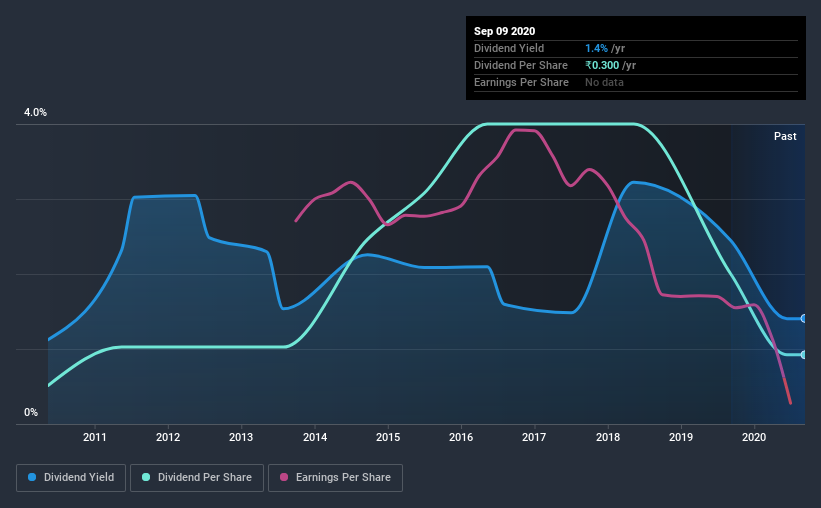

Sutlej Textiles and Industries's next dividend payment will be ₹0.30 per share, on the back of last year when the company paid a total of ₹0.30 to shareholders. Calculating the last year's worth of payments shows that Sutlej Textiles and Industries has a trailing yield of 1.4% on the current share price of ₹21.45. If you buy this business for its dividend, you should have an idea of whether Sutlej Textiles and Industries's dividend is reliable and sustainable. As a result, readers should always check whether Sutlej Textiles and Industries has been able to grow its dividends, or if the dividend might be cut.

See our latest analysis for Sutlej Textiles and Industries

If a company pays out more in dividends than it earned, then the dividend might become unsustainable - hardly an ideal situation. Sutlej Textiles and Industries lost money last year, so the fact that it's paying a dividend is certainly disconcerting. There might be a good reason for this, but we'd want to look into it further before getting comfortable. With the recent loss, it's important to check if the business generated enough cash to pay its dividend. If Sutlej Textiles and Industries didn't generate enough cash to pay the dividend, then it must have either paid from cash in the bank or by borrowing money, neither of which is sustainable in the long term. It paid out 14% of its free cash flow as dividends last year, which is conservatively low.

Click here to see how much of its profit Sutlej Textiles and Industries paid out over the last 12 months.

Have Earnings And Dividends Been Growing?

Businesses with shrinking earnings are tricky from a dividend perspective. If business enters a downturn and the dividend is cut, the company could see its value fall precipitously. Sutlej Textiles and Industries reported a loss last year, and the general trend suggests its earnings have also been declining in recent years, making us wonder if the dividend is at risk.

Another key way to measure a company's dividend prospects is by measuring its historical rate of dividend growth. Since the start of our data, 10 years ago, Sutlej Textiles and Industries has lifted its dividend by approximately 6.1% a year on average.

Remember, you can always get a snapshot of Sutlej Textiles and Industries's financial health, by checking our visualisation of its financial health, here.

Final Takeaway

From a dividend perspective, should investors buy or avoid Sutlej Textiles and Industries? First, it's not great to see the company paying a dividend despite being loss-making over the last year. On the plus side, the dividend was covered by free cash flow." With the way things are shaping up from a dividend perspective, we'd be inclined to steer clear of Sutlej Textiles and Industries.

With that being said, if you're still considering Sutlej Textiles and Industries as an investment, you'll find it beneficial to know what risks this stock is facing. To that end, you should learn about the 4 warning signs we've spotted with Sutlej Textiles and Industries (including 2 which are potentially serious).

If you're in the market for dividend stocks, we recommend checking our list of top dividend stocks with a greater than 2% yield and an upcoming dividend.

When trading Sutlej Textiles and Industries or any other investment, use the platform considered by many to be the Professional's Gateway to the Worlds Market, Interactive Brokers. You get the lowest-cost* trading on stocks, options, futures, forex, bonds and funds worldwide from a single integrated account. Promoted

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

*Interactive Brokers Rated Lowest Cost Broker by StockBrokers.com Annual Online Review 2020

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com.

About NSEI:SUTLEJTEX

Sutlej Textiles and Industries

Designs, manufactures, and distributes textiles to wholesalers, manufacturers, and retailers for the home furnishing industry in India, Turkey, Bangladesh, the United States of America, Hong Kong, Singapore, and internationally.

Low and slightly overvalued.

Similar Companies

Market Insights

Community Narratives