- United States

- /

- Oil and Gas

- /

- NasdaqGS:CLNE

Here's Why Clean Energy Fuels (NASDAQ:CLNE) Might Be Better Off Without Debt

Howard Marks put it nicely when he said that, rather than worrying about share price volatility, 'The possibility of permanent loss is the risk I worry about... and every practical investor I know worries about.' So it seems the smart money knows that debt - which is usually involved in bankruptcies - is a very important factor, when you assess how risky a company is. We can see that Clean Energy Fuels Corp. (NASDAQ:CLNE) does use debt in its business. But should shareholders be worried about its use of debt?

When Is Debt Dangerous?

Generally speaking, debt only becomes a real problem when a company can't easily pay it off, either by raising capital or with its own cash flow. Part and parcel of capitalism is the process of 'creative destruction' where failed businesses are mercilessly liquidated by their bankers. While that is not too common, we often do see indebted companies permanently diluting shareholders because lenders force them to raise capital at a distressed price. Having said that, the most common situation is where a company manages its debt reasonably well - and to its own advantage. When we think about a company's use of debt, we first look at cash and debt together.

View our latest analysis for Clean Energy Fuels

How Much Debt Does Clean Energy Fuels Carry?

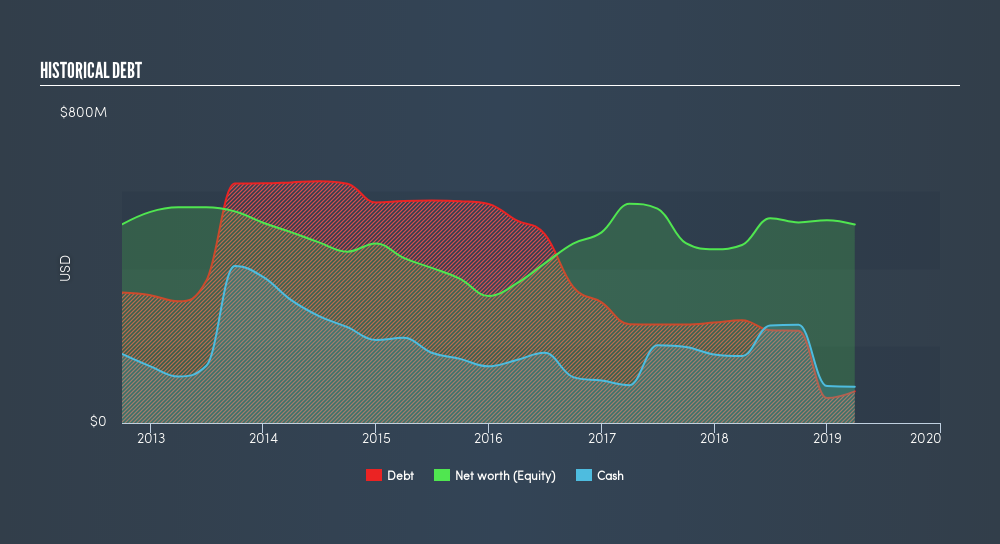

The image below, which you can click on for greater detail, shows that Clean Energy Fuels had debt of US$86.3m at the end of March 2019, a reduction from US$266.2m over a year. However, its balance sheet shows it holds US$94.1m in cash, so it actually has US$7.89m net cash.

A Look At Clean Energy Fuels's Liabilities

Zooming in on the latest balance sheet data, we can see that Clean Energy Fuels had liabilities of US$68.6m due within 12 months and liabilities of US$114.6m due beyond that. Offsetting this, it had US$94.1m in cash and US$80.4m in receivables that were due within 12 months. So its liabilities outweigh the sum of its cash and (near-term) receivables by US$8.65m.

Having regard to Clean Energy Fuels's size, it seems that its liquid assets are well balanced with its total liabilities. So it's very unlikely that the US$560.8m company is short on cash, but still worth keeping an eye on the balance sheet. Given that Clean Energy Fuels has more cash than debt, we're pretty confident it can manage its debt safely. There's no doubt that we learn most about debt from the balance sheet. But ultimately the future profitability of the business will decide if Clean Energy Fuels can strengthen its balance sheet over time. So if you want to see what the professionals think, you might find this free report on analyst profit forecasts to be interesting.

In the last year Clean Energy Fuels actually shrunk its revenue by 9.3%, to US$322m. We would much prefer see growth.

So How Risky Is Clean Energy Fuels?

While Clean Energy Fuels lost money on an earnings before interest and tax (EBIT) level, it actually generated positive free cash flow US$9.7m. So taking that on face value, and considering the net cash situation, we don't think that the stock is too risky in the near term. Until we see some positive EBIT, we're a bit cautious of the stock, not least because of the rather modest revenue growth. For riskier companies like Clean Energy Fuels I always like to keep an eye on the long term profit and revenue trends. Fortunately, you can click to see our interactive graph of its profit, revenue, and operating cashflow.

Of course, if you're the type of investor who prefers buying stocks without the burden of debt, then don't hesitate to discover our exclusive list of net cash growth stocks, today.

We aim to bring you long-term focused research analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material.

If you spot an error that warrants correction, please contact the editor at editorial-team@simplywallst.com. This article by Simply Wall St is general in nature. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. Simply Wall St has no position in the stocks mentioned. Thank you for reading.

About NasdaqGS:CLNE

Clean Energy Fuels

Offers natural gas as alternative fuels for vehicle fleets and related fueling solutions in the United States and Canada.

Excellent balance sheet and fair value.

Similar Companies

Market Insights

Weekly Picks

THE KINGDOM OF BROWN GOODS: WHY MGPI IS BEING CRUSHED BY INVENTORY & PRIMED FOR RESURRECTION

Why Vertical Aerospace (NYSE: EVTL) is Worth Possibly Over 13x its Current Price

The Quiet Giant That Became AI’s Power Grid

Recently Updated Narratives

Butler National (Buks) outperforms.

A tech powerhouse quietly powering the world’s AI infrastructure.

Keppel DC REIT (SGX: AJBU) is a resilient gem in the data center space.

Popular Narratives

MicroVision will explode future revenue by 380.37% with a vision towards success

Crazy Undervalued 42 Baggers Silver Play (Active & Running Mine)