Global's September 2025 Stocks Estimated Below Intrinsic Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by interest rate expectations and AI-driven optimism, major indices like the Dow Jones, S&P 500, and Nasdaq have reached new highs despite ongoing inflation concerns. In this environment, identifying stocks estimated to be below their intrinsic value can offer potential opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Rheinmetall (XTRA:RHM) | €1919.50 | €3817.79 | 49.7% |

| Pansoft (SZSE:300996) | CN¥17.14 | CN¥33.83 | 49.3% |

| Lingotes Especiales (BME:LGT) | €5.70 | €11.17 | 49% |

| Guangdong Marubi Biotechnology (SHSE:603983) | CN¥39.45 | CN¥77.48 | 49.1% |

| Gofore Oyj (HLSE:GOFORE) | €14.88 | €29.58 | 49.7% |

| FP Partner (TSE:7388) | ¥2240.00 | ¥4425.25 | 49.4% |

| DSV (CPSE:DSV) | DKK1378.00 | DKK2699.19 | 48.9% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.81 | 49.9% |

| cyan (XTRA:CYR) | €2.24 | €4.41 | 49.2% |

| ATON Green Storage (BIT:ATON) | €2.07 | €4.09 | 49.4% |

Here's a peek at a few of the choices from the screener.

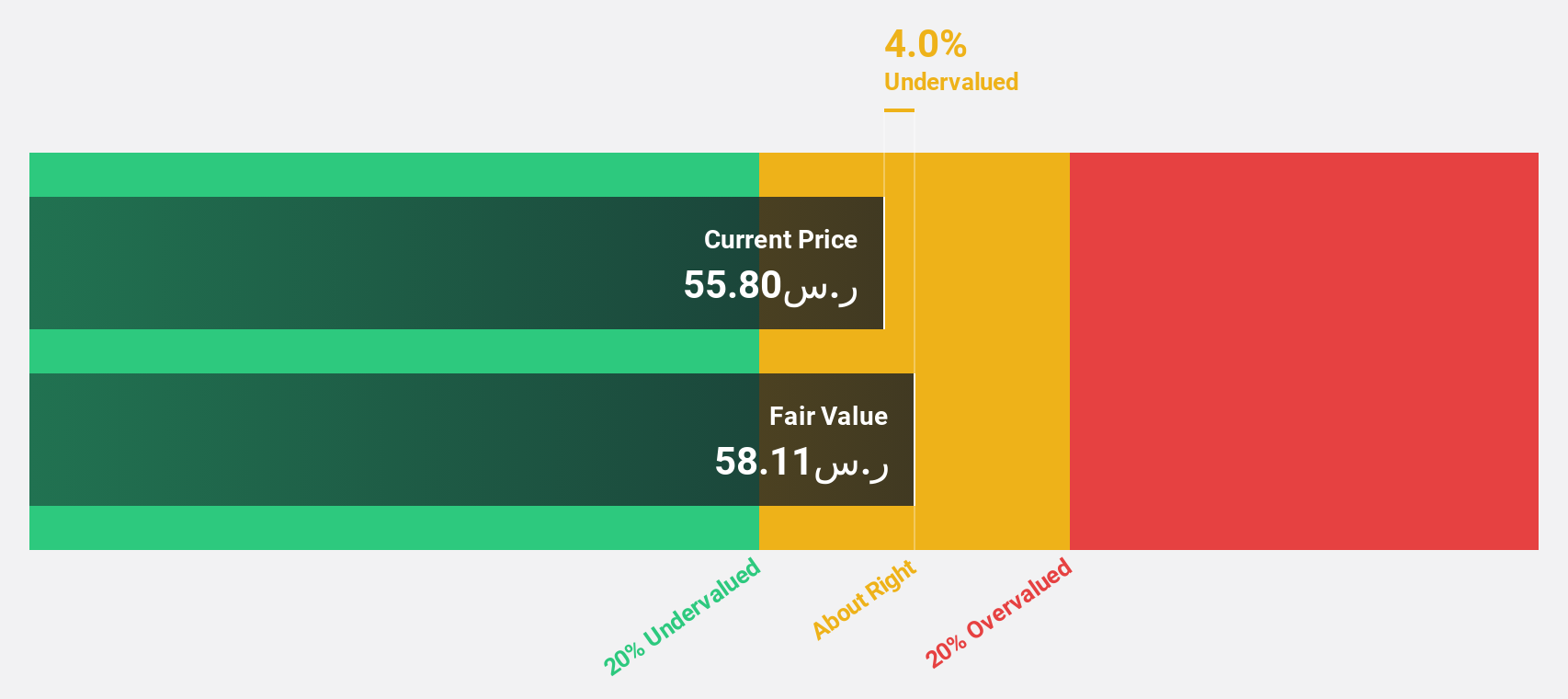

Saudi Basic Industries (SASE:2010)

Overview: Saudi Basic Industries Corporation is a global manufacturer and distributor of chemicals, polymers, plastics, and agri-nutrients with a market cap of SAR181.50 billion.

Operations: The company's revenue is primarily derived from its Petrochemicals & Specialties segment, which accounts for SAR129.64 billion, and its Agri-Nutrients segment, contributing SAR12.09 billion.

Estimated Discount To Fair Value: 28.2%

Saudi Basic Industries is trading at 28.2% below its estimated fair value of SAR 84.6, making it highly undervalued based on discounted cash flow analysis. Despite recent losses, the company is expected to become profitable within three years with earnings projected to grow significantly each year. However, its dividend yield of 5.27% isn't well covered by earnings or free cash flows, and return on equity is forecasted to remain low at 7%.

- The growth report we've compiled suggests that Saudi Basic Industries' future prospects could be on the up.

- Take a closer look at Saudi Basic Industries' balance sheet health here in our report.

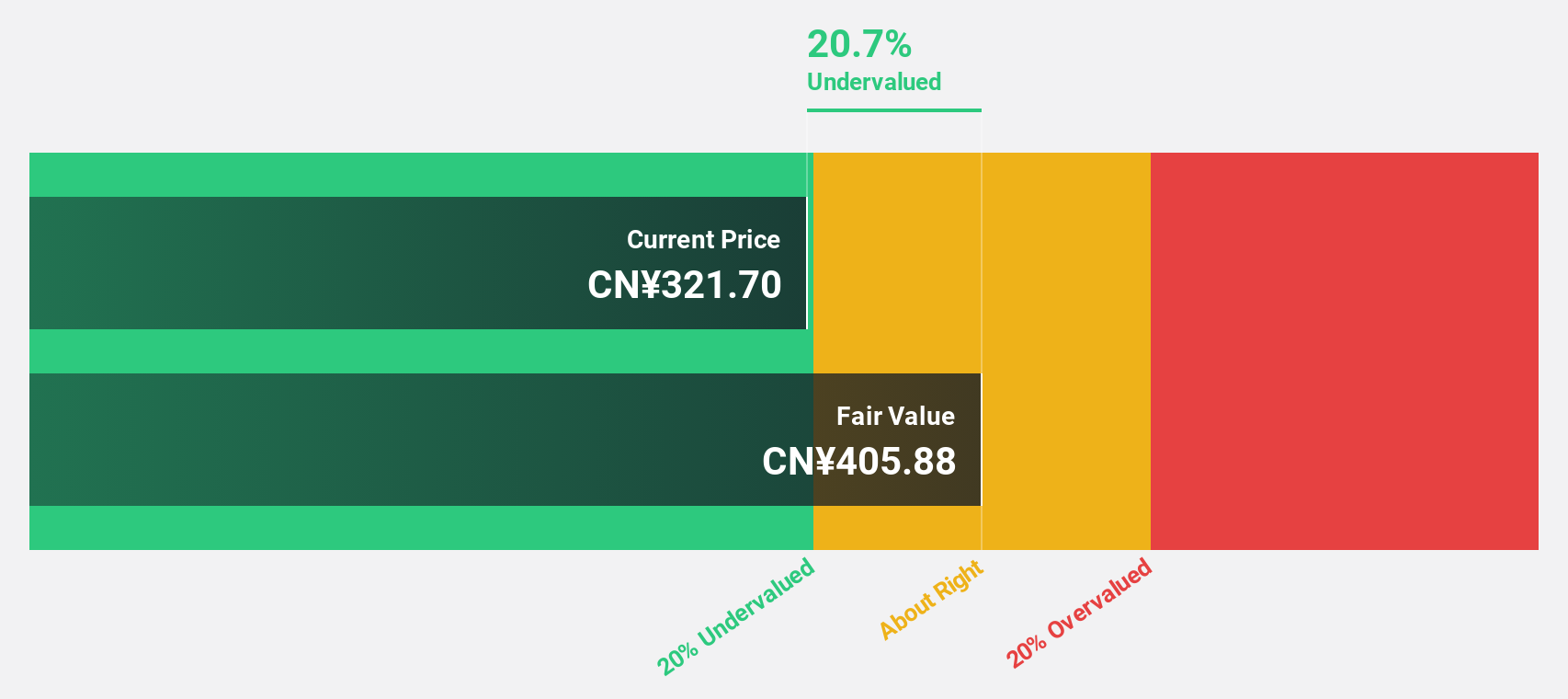

Eastroc Beverage(Group) (SHSE:605499)

Overview: Eastroc Beverage(Group) Co., Ltd. is involved in the research, development, production, and sales of beverages in China with a market cap of CN¥153.73 billion.

Operations: Eastroc Beverage(Group) Co., Ltd. generates revenue primarily through the production, sales, and wholesale of beverages and pre-packaged foods, amounting to CN¥18.70 billion.

Estimated Discount To Fair Value: 26.7%

Eastroc Beverage is trading at 26.7% below its estimated fair value of CNY 408.15, highlighting its undervaluation based on discounted cash flow analysis. The company reported strong earnings growth, with net income reaching CNY 2.37 billion for H1 2025, up from CNY 1.73 billion the previous year. Despite an unstable dividend track record and being removed from an index in June, Eastroc's revenue and earnings are forecast to grow significantly above market rates.

- Insights from our recent growth report point to a promising forecast for Eastroc Beverage(Group)'s business outlook.

- Get an in-depth perspective on Eastroc Beverage(Group)'s balance sheet by reading our health report here.

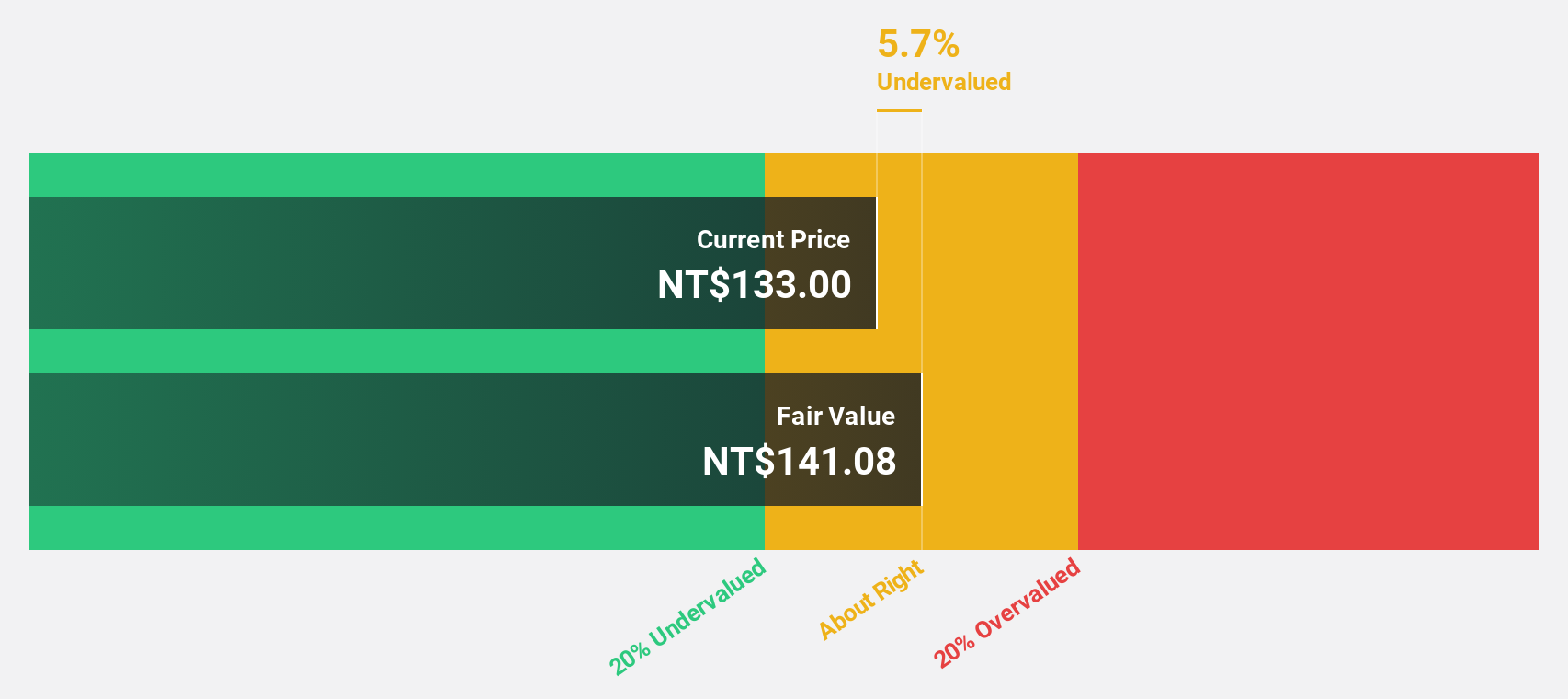

Lite-On Technology (TWSE:2301)

Overview: Lite-On Technology Corporation, with a market cap of NT$373.41 billion, is involved in the research, design, development, manufacture, and sale of modules and system solutions through its subsidiaries.

Operations: The company's revenue is primarily derived from its Information and Consumer Electronics Sector, generating NT$64.06 billion, followed by the Cloud and Internet of Things Department at NT$60.77 billion, and the Optoelectronic Department contributing NT$28.92 billion.

Estimated Discount To Fair Value: 37.7%

Lite-On Technology is trading at 37.7% below its estimated fair value of NT$269.83, reflecting significant undervaluation based on discounted cash flow analysis. The company's earnings are projected to grow significantly, surpassing market rates, despite a dividend not fully covered by free cash flows. Recent strategic alliances in SWIR imaging technology with TriEye aim to expand market applications and enhance product capabilities across multiple industries, potentially strengthening Lite-On's financial performance and addressing market demands efficiently.

- The analysis detailed in our Lite-On Technology growth report hints at robust future financial performance.

- Delve into the full analysis health report here for a deeper understanding of Lite-On Technology.

Summing It All Up

- Investigate our full lineup of 510 Undervalued Global Stocks Based On Cash Flows right here.

- Are any of these part of your asset mix? Tap into the analytical power of Simply Wall St's portfolio to get a 360-degree view on how they're shaping up.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Want To Explore Some Alternatives?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Valuation is complex, but we're here to simplify it.

Discover if Eastroc Beverage(Group) might be undervalued or overvalued with our detailed analysis, featuring fair value estimates, potential risks, dividends, insider trades, and its financial condition.

Access Free AnalysisHave feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SHSE:605499

Eastroc Beverage(Group)

Engages in the research and development, production, and sales of beverages in China.

High growth potential with solid track record.

Market Insights

Community Narratives