- Japan

- /

- Entertainment

- /

- TSE:5032

Global's September 2025 Stock Picks That May Be Priced Below Fair Value

Reviewed by Simply Wall St

As global markets navigate a period marked by expectations of interest rate cuts and the ongoing enthusiasm for artificial intelligence, major U.S. stock indexes have reached new record highs, buoyed by optimistic economic indicators. Amid this landscape of fluctuating inflation rates and evolving monetary policies, identifying stocks that may be priced below their fair value can be a strategic approach for investors looking to capitalize on potential market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Truecaller (OM:TRUE B) | SEK43.04 | SEK85.80 | 49.8% |

| Suzhou Alton Electrical & Mechanical Industry (SZSE:301187) | CN¥29.37 | CN¥58.18 | 49.5% |

| Nanjing COSMOS Chemical (SZSE:300856) | CN¥14.23 | CN¥28.38 | 49.9% |

| Kolmar Korea (KOSE:A161890) | ₩78400.00 | ₩154923.17 | 49.4% |

| HL Holdings (KOSE:A060980) | ₩41500.00 | ₩82434.95 | 49.7% |

| FP Partner (TSE:7388) | ¥2228.00 | ¥4425.25 | 49.7% |

| Faraday Technology (TWSE:3035) | NT$150.50 | NT$300.04 | 49.8% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.82 | 50% |

| Atea (OB:ATEA) | NOK142.00 | NOK280.67 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.18 | CN¥97.17 | 49.4% |

We're going to check out a few of the best picks from our screener tool.

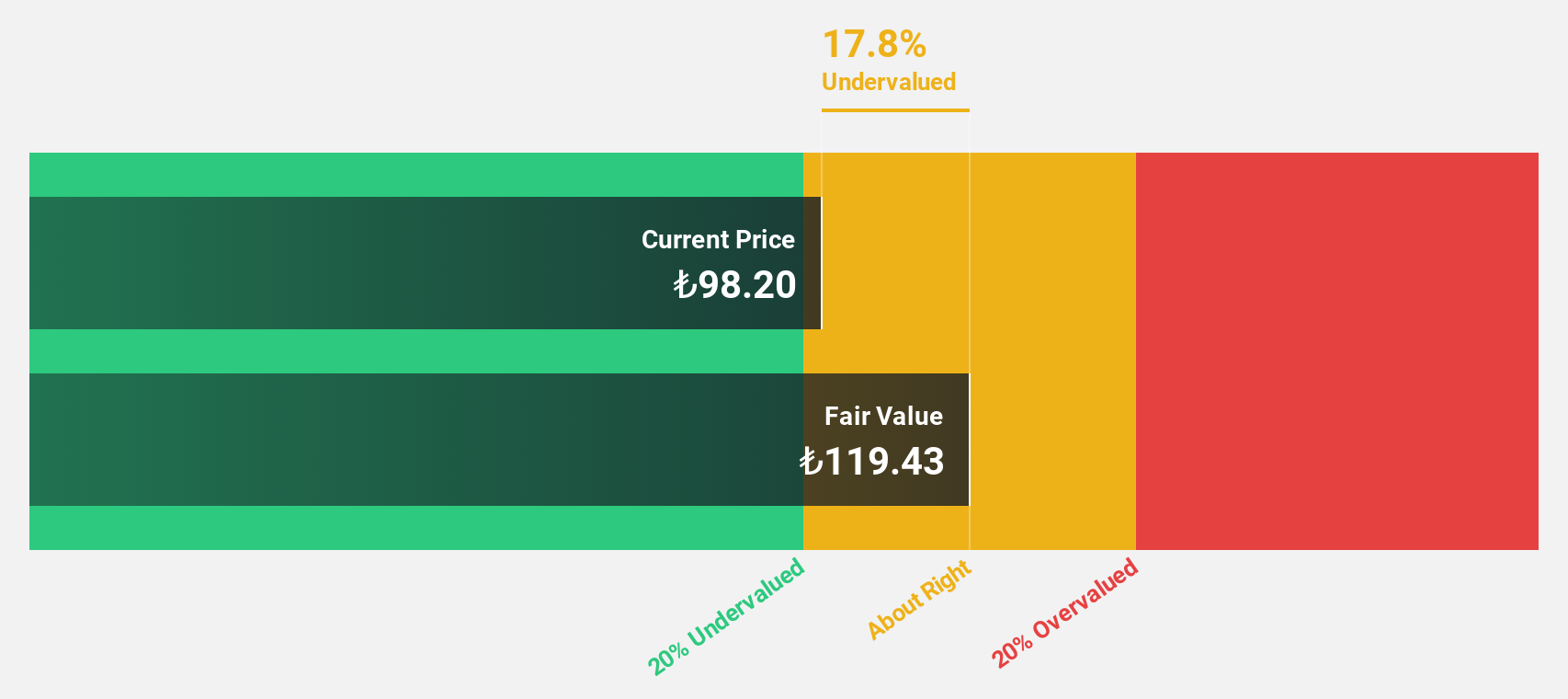

Turkcell Iletisim Hizmetleri (IBSE:TCELL)

Overview: Turkcell Iletisim Hizmetleri A.S., along with its subsidiaries, offers converged telecommunication and technology services in Turkey, Belarus, the Turkish Republic of Northern Cyprus, and the Netherlands, with a market cap of TRY204.02 billion.

Operations: The company's revenue is primarily derived from its Turkcell Turkey segment, which accounts for TRY153.66 billion, and its Techfin segment, contributing TRY9.88 billion.

Estimated Discount To Fair Value: 20.6%

Turkcell Iletisim Hizmetleri appears undervalued, trading at TRY 93.65, below its estimated fair value of TRY 117.88. Despite a drop in profit margins from 13.7% to 7%, the company's revenue and earnings are forecast to grow significantly above market rates, at 27.2% and over 52% annually, respectively. Recent earnings showed robust sales growth but a slight dip in six-month net income year-over-year, reflecting mixed financial health amidst strong cash flow potential.

- Our comprehensive growth report raises the possibility that Turkcell Iletisim Hizmetleri is poised for substantial financial growth.

- Click here to discover the nuances of Turkcell Iletisim Hizmetleri with our detailed financial health report.

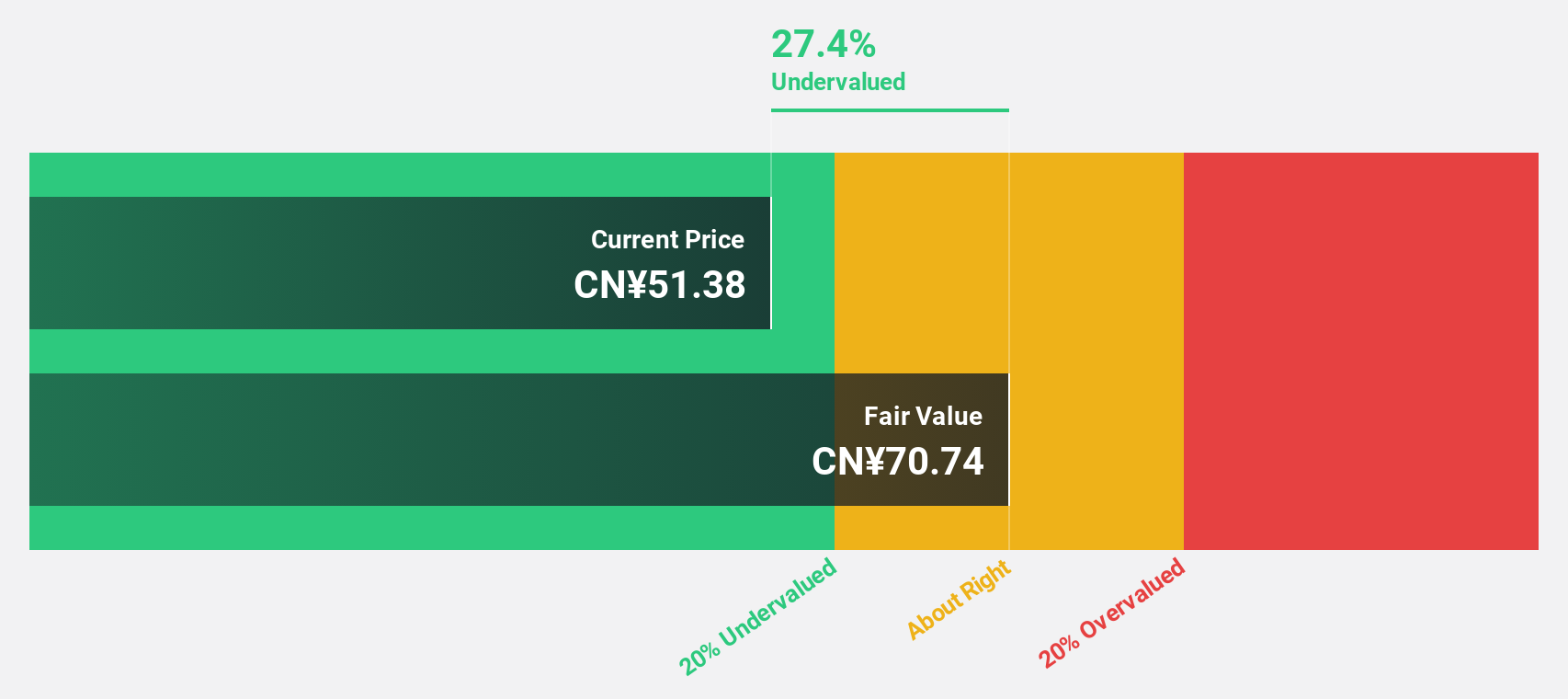

AcrobiosystemsLtd (SZSE:301080)

Overview: Acrobiosystems Co., Ltd. develops and manufactures recombinant proteins, antibodies, and other biological reagents for pharmaceutical and biotechnology companies as well as scientific research institutions, with a market cap of CN¥9.71 billion.

Operations: The company's revenue primarily comes from Research and Experimental Development, amounting to CN¥720.90 million.

Estimated Discount To Fair Value: 14.1%

Acrobiosystems Ltd. is trading at CN¥61.25, 14.1% below its estimated fair value of CN¥71.27, indicating potential undervaluation based on cash flows. Despite high non-cash earnings and a low forecasted return on equity of 9.2%, the company's revenue and earnings are expected to grow significantly above market rates at 21.2% and 27.7% annually, respectively. Recent earnings reports show strong growth in both sales (CN¥387 million) and net income (CN¥83 million) year-over-year amidst ongoing share buybacks totaling CN¥29.85 million.

- According our earnings growth report, there's an indication that AcrobiosystemsLtd might be ready to expand.

- Unlock comprehensive insights into our analysis of AcrobiosystemsLtd stock in this financial health report.

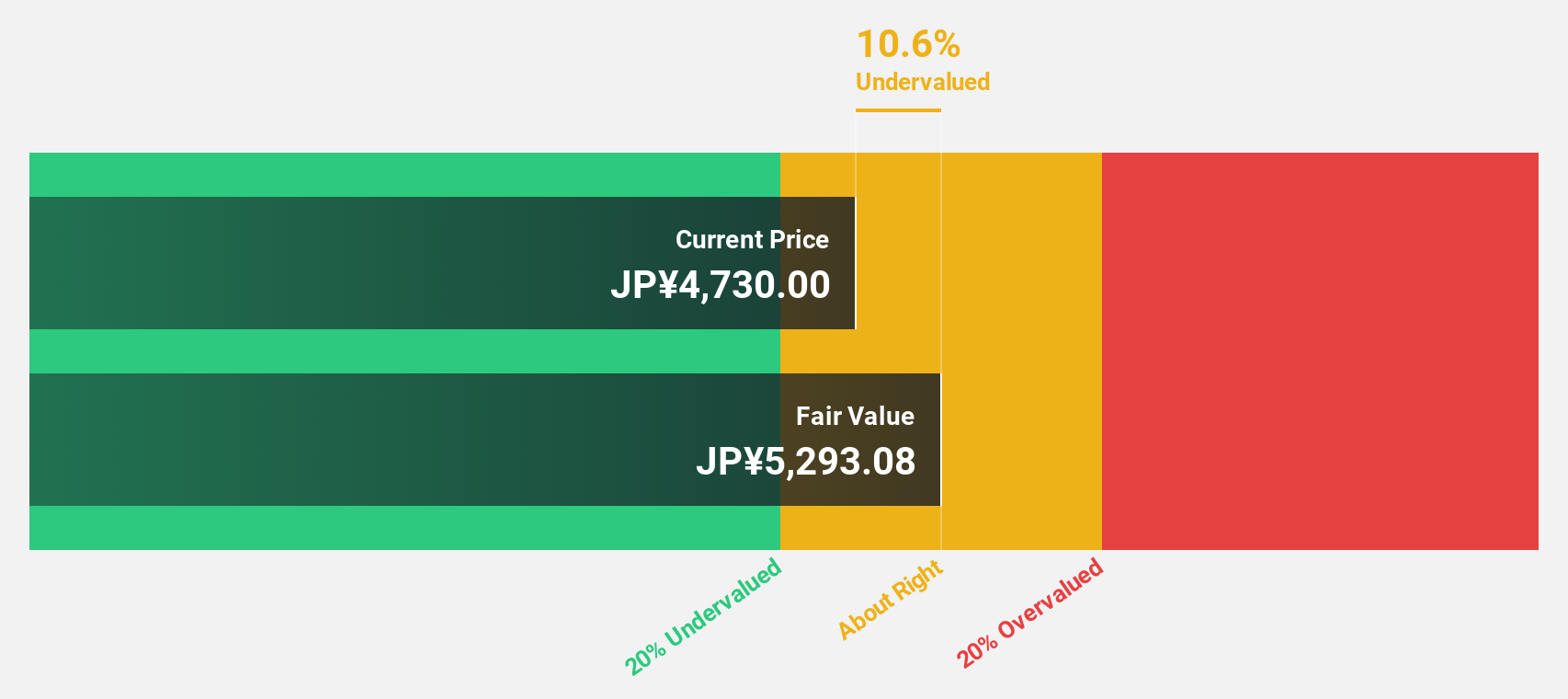

ANYCOLOR (TSE:5032)

Overview: ANYCOLOR Inc. is an entertainment company operating in Japan and internationally, with a market cap of ¥382.45 billion.

Operations: ANYCOLOR Inc.'s revenue is primarily derived from its entertainment operations both domestically and abroad.

Estimated Discount To Fair Value: 11.6%

ANYCOLOR Inc. trades at ¥5560, slightly below its fair value of ¥6290.99, with earnings projected to grow 11.07% annually and revenue expected to increase by 12.2%, outpacing the JP market's growth rate of 4.4%. Recent upward revisions in earnings guidance highlight strong performance from VTuber initiatives and event revenues, supported by effective cost management, suggesting potential undervaluation based on cash flows despite recent share price volatility.

- In light of our recent growth report, it seems possible that ANYCOLOR's financial performance will exceed current levels.

- Dive into the specifics of ANYCOLOR here with our thorough financial health report.

Next Steps

- Delve into our full catalog of 523 Undervalued Global Stocks Based On Cash Flows here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Discover a world of investment opportunities with Simply Wall St's free app and access unparalleled stock analysis across all markets.

Looking For Alternative Opportunities?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About TSE:5032

ANYCOLOR

Operates as an entertainment company in Japan and internationally.

Outstanding track record with flawless balance sheet.

Similar Companies

Market Insights

Community Narratives