- Saudi Arabia

- /

- Electric Utilities

- /

- SASE:5110

Global Stocks That May Be Priced Below Their Estimated Value

Reviewed by Simply Wall St

As global markets navigate a landscape marked by expectations of interest rate cuts and AI-driven optimism, major indices such as the S&P 500 and Nasdaq Composite have recently reached record highs. Amidst this buoyant environment, identifying stocks that may be priced below their estimated value can present intriguing opportunities for investors seeking to capitalize on market inefficiencies.

Top 10 Undervalued Stocks Based On Cash Flows

| Name | Current Price | Fair Value (Est) | Discount (Est) |

| Talenom Oyj (HLSE:TNOM) | €3.605 | €7.18 | 49.8% |

| Pansoft (SZSE:300996) | CN¥17.09 | CN¥33.96 | 49.7% |

| Micro Systemation (OM:MSAB B) | SEK62.00 | SEK122.46 | 49.4% |

| Jiangxi Rimag Group (SEHK:2522) | HK$17.25 | HK$34.45 | 49.9% |

| Inspur Digital Enterprise Technology (SEHK:596) | HK$9.69 | HK$19.31 | 49.8% |

| Gofore Oyj (HLSE:GOFORE) | €14.72 | €29.38 | 49.9% |

| Food Empire Holdings (SGX:F03) | SGD2.59 | SGD5.13 | 49.5% |

| Digital Workforce Services Oyj (HLSE:DWF) | €3.41 | €6.77 | 49.6% |

| CGN Mining (SEHK:1164) | HK$2.95 | HK$5.83 | 49.4% |

| Anhui Ronds Science & Technology (SHSE:688768) | CN¥49.09 | CN¥97.22 | 49.5% |

Let's dive into some prime choices out of the screener.

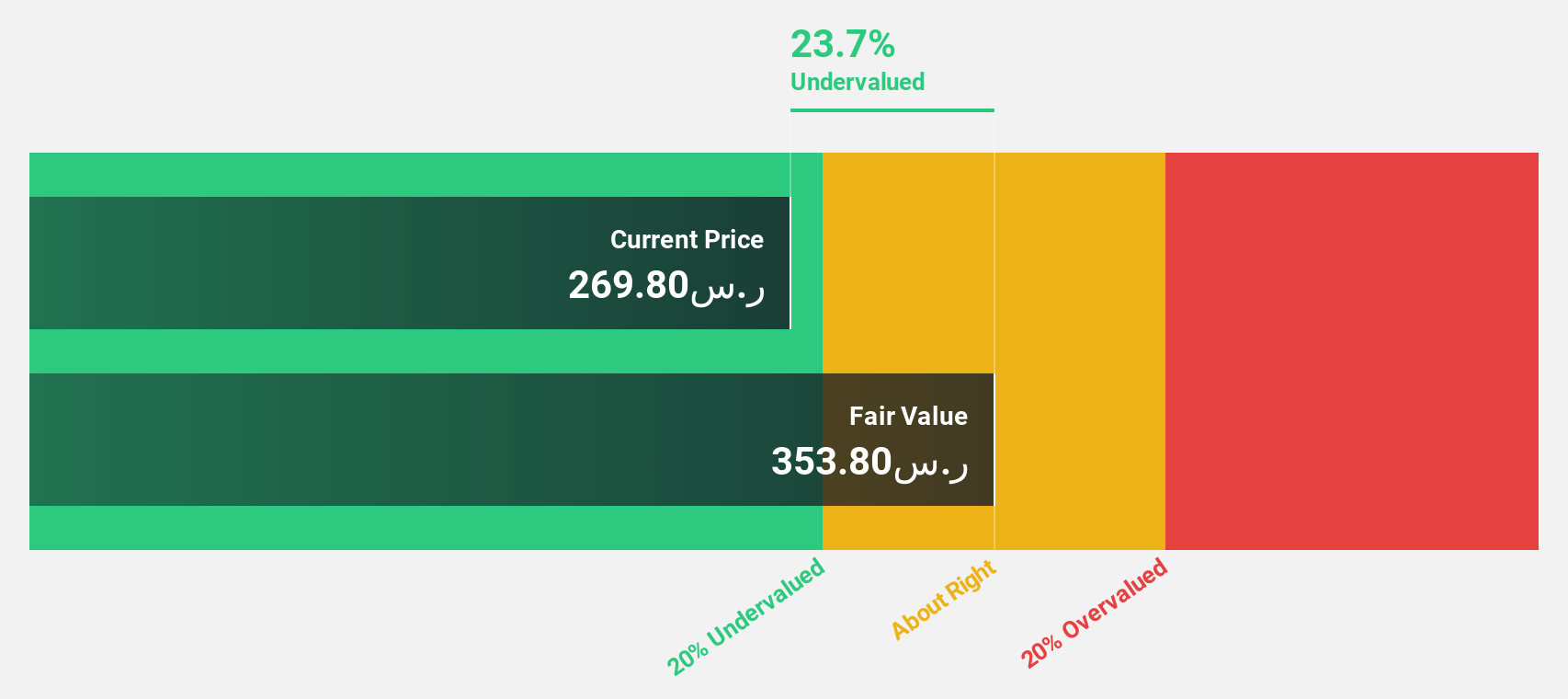

ACWA Power (SASE:2082)

Overview: ACWA Power Company, along with its subsidiaries, focuses on the investment, development, operation, and maintenance of power generation, water desalination, and green hydrogen production plants across Saudi Arabia and various regions including the Middle East, Asia, and Africa; it has a market cap of SAR160.14 billion.

Operations: ACWA Power's revenue segments include SAR1.90 billion from renewables and SAR5.29 billion from thermal and water desalination operations.

Estimated Discount To Fair Value: 45.7%

ACWA Power is trading at SAR 208.9, significantly below its estimated fair value of SAR 384.53, indicating potential undervaluation based on cash flows. Despite debt coverage concerns by operating cash flow, earnings are forecast to grow significantly at 25% annually, outpacing the Saudi market's growth rate. Recent expansions in renewable projects and strategic alliances enhance future revenue prospects but may require careful monitoring of financial impacts and operational execution in the near term.

- Our expertly prepared growth report on ACWA Power implies its future financial outlook may be stronger than recent results.

- Navigate through the intricacies of ACWA Power with our comprehensive financial health report here.

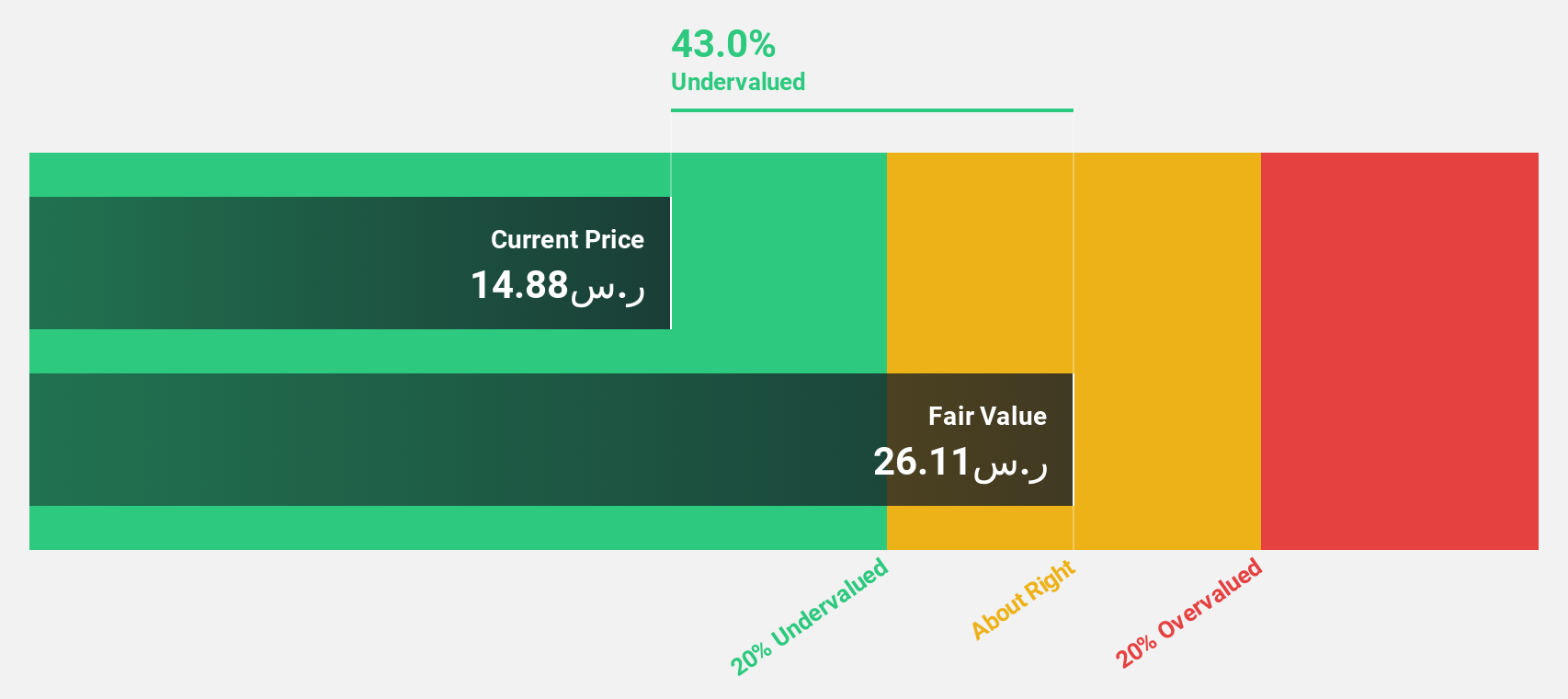

Saudi Electricity (SASE:5110)

Overview: Saudi Electricity Company, along with its subsidiaries, is involved in the generation, transmission, and distribution of electricity across the Kingdom of Saudi Arabia, with a market cap of SAR59.58 billion.

Operations: The company's revenue segments include the National Grid Company at SAR28.94 billion, Generation at SAR17.81 billion, and Distribution and Subscribers Services at SAR90.06 billion.

Estimated Discount To Fair Value: 30.6%

Saudi Electricity is trading at SAR 14.37, significantly below its estimated fair value of SAR 20.72, highlighting potential undervaluation based on cash flows. Despite a high debt level and a dividend not fully covered by earnings or free cash flows, revenue growth is expected to outpace the Saudi market. Recent earnings show improved sales and net income compared to last year, supporting its growth trajectory amidst profitability expectations in the next three years.

- Insights from our recent growth report point to a promising forecast for Saudi Electricity's business outlook.

- Unlock comprehensive insights into our analysis of Saudi Electricity stock in this financial health report.

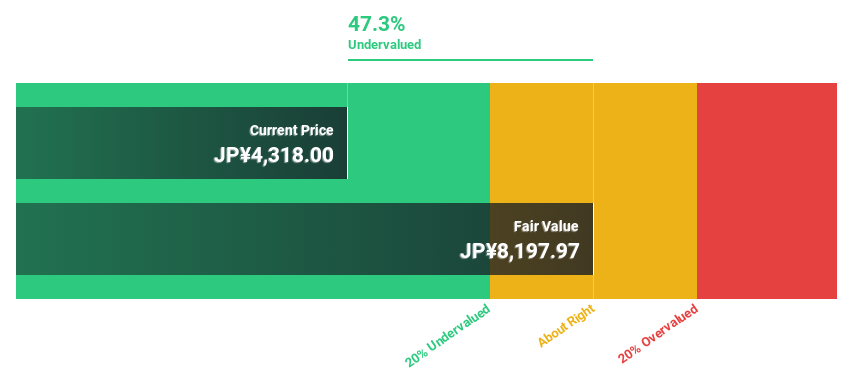

Food & Life Companies (TSE:3563)

Overview: Food & Life Companies Ltd. operates a chain of sushi restaurants and has a market cap of ¥857.45 billion.

Operations: The company's revenue is primarily derived from its Japan Sushiro Business at ¥258.59 billion and Overseas Sushiro Business at ¥119.29 billion, with additional contributions from the Kyotaru Business totaling ¥23.72 billion and other businesses generating ¥7.21 billion.

Estimated Discount To Fair Value: 39.2%

Food & Life Companies is trading at ¥7,892, considerably below its estimated fair value of ¥12,975.65, indicating potential undervaluation based on cash flows. Recent guidance revisions show increased revenue and operating profit expectations due to strong performance in both domestic and international markets. Despite high share price volatility recently and anticipated rising costs in raw materials like rice and labor, the company's earnings are projected to grow faster than the Japanese market average.

- Upon reviewing our latest growth report, Food & Life Companies' projected financial performance appears quite optimistic.

- Click to explore a detailed breakdown of our findings in Food & Life Companies' balance sheet health report.

Turning Ideas Into Actions

- Discover the full array of 516 Undervalued Global Stocks Based On Cash Flows right here.

- Already own these companies? Link your portfolio to Simply Wall St and get alerts on any new warning signs to your stocks.

- Enhance your investing ability with the Simply Wall St app and enjoy free access to essential market intelligence spanning every continent.

Seeking Other Investments?

- Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

- Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

- Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

New: Manage All Your Stock Portfolios in One Place

We've created the ultimate portfolio companion for stock investors, and it's free.

• Connect an unlimited number of Portfolios and see your total in one currency

• Be alerted to new Warning Signs or Risks via email or mobile

• Track the Fair Value of your stocks

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

About SASE:5110

Saudi Electricity

Generates, transmits, and distributes electricity in the Kingdom of Saudi Arabia.

Undervalued with reasonable growth potential.

Market Insights

Community Narratives